- What is a Finance Business Partner?

- The Evolution of the Finance Business Partner Role

- Key Responsibilities of a Finance Business Partner

- Financial Planning & Analysis (FP&A)

- Data-Driven Decision Making

- Collaboration with Internal Stakeholders

- Advisory Role

- Performance Monitoring

- Skills and Qualifications of a Successful Finance Business Partner

- The Impact of a Finance Business Partner on Business Success

- Challenges Faced by Finance Business Partners

- Balancing Objectivity with Advocacy

- Data Overload

- Influencing without Direct Authority

- Rapidly Changing Technology

- Managing Stakeholder Expectations

- Importance of the Finance Business Partner Role

- How to Succeed as a Finance Business Partner

Finance Business Partner

How finance business partnering benefits organizations and helps corporate finance professionals expand their roles

What is a Finance Business Partner?

A finance business partner goes beyond the finance team to work closely with different departments within an organization, like operations, marketing, and sales, to provide financial insights and strategic advice. Good finance business partners use financial data and analysis to help teams make informed decisions that align with the company’s financial goals.

The Evolution of the Finance Business Partner Role

The role of corporate finance professionals has evolved significantly in recent years. Traditionally, finance teams were focused on tasks like budgeting, reporting, and compliance — working behind the scenes to ensure accuracy and control. However, as businesses have become more complex and data-driven, the role of the finance team has expanded, requiring partnership with almost every department.

Today, finance business partners are strategic advisors who provide real-time insights and analysis to help shape business decisions. This shift has been driven by advances in technology, the need for quicker decision-making, and the demand for finance to play a more active role in driving business strategy. As a finance business partner, you work alongside leaders in other departments, helping them navigate financial challenges and drive growth.

Key Highlights

- A finance business partner is a finance professional who connects financial data and insights with business strategy, helping departments make informed decisions that align with the company’s financial goals.

- Strong analytical, communication, and relationship-building skills are essential for success as a finance business partner, along with a deep understanding of both finance and the business as a whole.

- Finance business partnering helps to drive business success by offering real-time insights, optimizing financial performance, and supporting long-term growth through strategic guidance and collaboration.

Key Responsibilities of a Finance Business Partner

Finance business partners are key contributors to aligning financial insights with business strategy. Here are some of their key responsibilities:

Financial Planning & Analysis (FP&A)

Finance business partners are responsible for supporting the company strategy and financial planning process. In addition to budgeting, they use models to create financial forecasts. They ensure that business plans are aligned with financial goals and resources.

Data-Driven Decision Making

By analyzing financial data, finance business partners provide actionable insights to help departments make informed decisions. This analysis could range from evaluating the profitability of a new product line to future performance or optimizing operational costs.

Collaboration with Internal Stakeholders

A finance business partner works closely with the finance department, leaders, and teams to help them understand the financial implications of their decisions. This collaboration ensures that all parts of the business are aligned with overall financial objectives.

Advisory Role

Acting as a trusted advisor, a finance business partner guides business units through financial challenges, offering recommendations on resource allocation, investments, and cost management. This guidance helps ensure that business unit and financial strategies are in sync with broader business objectives.

Performance Monitoring

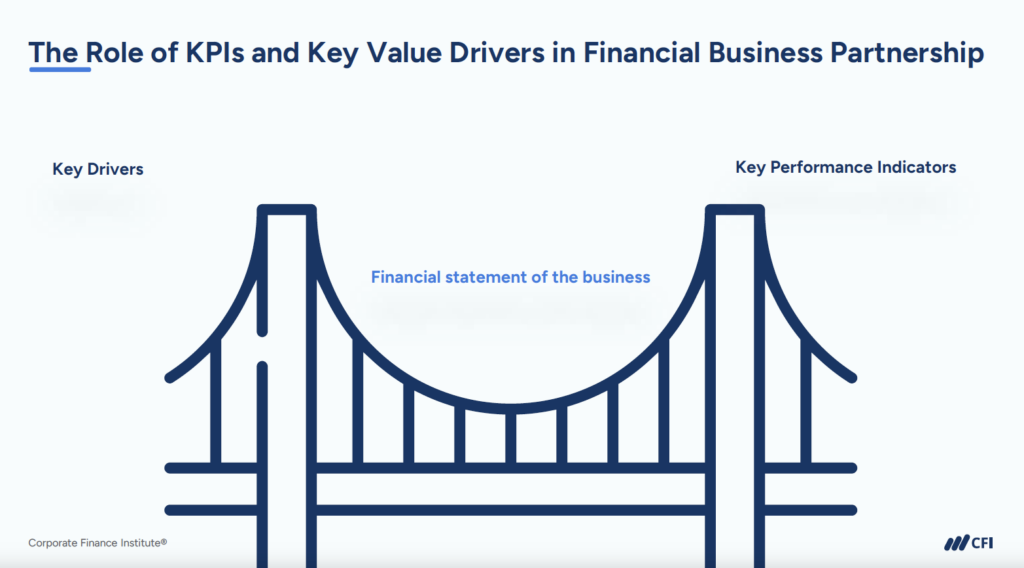

Finance business partners regularly track financial performance against key performance indicators(KPIs) and provide recommendations for improvement, helping the organization stay on track with its financial goals.

Skills and Qualifications of a Successful Finance Business Partner

The skills needed to succeed as a finance business partner include a blend of technical expertise, business acumen, analytical skills, and the ability to build relationships. Relevant education and professional certifications can provide you with a solid foundation of knowledge and skills for success as a finance business partner.

Technical Skills

- Financial Analysis & Modeling: Expertise in creating and interpreting financial models, including budgeting, forecasting, and scenario analysis.

- Data Analytics: Proficiency in using data to perform financial analysis and generate strategic insights, with experience in financial software and tools like Excel, Power BI, and Tableau.

- Accounting Knowledge: Strong understanding of accounting principles, including financial reporting and compliance.

- ERP & Financial Systems: Familiarity with enterprise resource planning (ERP) systems like SAP or Oracle to manage and integrate company financials.

Soft Skills

- Communication Skills: Ability to translate complex financial information into clear, actionable insights for non-finance stakeholders.

- Collaboration & Relationship-Building: Developing strong partnerships with cross-functional teams, acting as a trusted advisor.

- Strategic Thinking: Seeing the bigger picture and aligning financial recommendations with overall business goals.

- Problem-Solving: Proactively identifying challenges and offering practical solutions to drive business performance.

- Emotional Intelligence: Understanding the needs and motivations of business leaders to influence decisions effectively.

Educational Background

- Finance or Accounting Degree: A bachelor’s degree in finance, accounting, economics, or business is typically required.

- Advanced Certifications: Pursuing professional credentials, such as CFI’s Financial Modeling & Valuation Analyst (FMVA®) Certification or FP&A Specialization, enhances credibility and expertise.

The Impact of a Finance Business Partner on Business Success

Finance business partners have a direct and meaningful impact on a company’s success. By providing valuable insights that are closely aligned with the company’s strategic goals, they help drive better decision-making across departments. This can lead to improved resource allocation, cost efficiencies, and better business outcomes.

In addition to influencing day-to-day operations, finance business partners play a role in long-term growth. They assist in evaluating new business opportunities, assessing financial risks, and optimizing investment strategies. Their ability to present data-driven insights enables businesses to develop strategies, adapt to market changes, seize opportunities, and remain competitive.

Ultimately, the presence of a finance business partner ensures that financial and strategic decisions are always made with the company’s broader success in mind.

Challenges Faced by Finance Business Partners

Despite their valuable role, finance business partners face several challenges in their day-to-day responsibilities:

Balancing Objectivity with Advocacy

A finance business partner must remain objective while also advocating for the best interests of the departments they support. This balancing act can be difficult, especially when financial realities clash with business goals.

Data Overload

With access to vast amounts of financial information, it can be overwhelming to identify the most relevant insights. Finance business partners need to sift through data efficiently to provide actionable recommendations.

Influencing without Direct Authority

While finance business partners advise on key decisions, they often do not have direct authority over other business departments. This requires strong persuasion skills to guide teams toward financially sound choices.

Rapidly Changing Technology

As financial tools and systems evolve, staying current with the latest technology is a constant challenge. Finance business partners need to continuously learn and adapt to ensure they are using the best tools for their data analysis and reporting.

Managing Stakeholder Expectations

Different departments may have conflicting priorities, and finance business partners are tasked with finding solutions that balance financial constraints with business objectives. Navigating these dynamics requires both diplomacy and strategic thinking.

Importance of the Finance Business Partner Role

Finance business partnering is increasingly vital to a company’s overall success. By acting as a bridge between the finance function and other departments, finance business partners ensure that financial stewardship and insights are embedded in every aspect of the business. This helps align day-to-day operations with long-term financial goals, promoting better decision-making across the organization.

A finance business partner also plays a key role in identifying risks and opportunities. Their ability to assess financial performance in real time and provide actionable advice allows businesses to adapt quickly to changing market conditions. This agility can be the difference between merely surviving and thriving in competitive environments.

Ultimately, finance business partnering helps create a culture where financial accountability is shared across the organization, fostering collaboration and driving sustainable growth.

How to Succeed as a Finance Business Partner

To succeed as a finance business partner, a combination of technical expertise, strong communication skills, building relationships, and strategic acumen is essential. Here are a few key areas to focus on:

- Continuous Learning: The financial landscape is always evolving, with new tools, technologies, and trends emerging regularly. Staying current with industry developments, as well as improving your knowledge of financial systems and data analytics tools, will keep you competitive and effective in your role.

- Relationship Building: Collaboration is at the heart of finance business partnering. Building trust and strong relationships with stakeholders across departments is key to influencing decisions and driving change. Understanding the needs of your business partners and communicating financial insights in a clear, accessible way is essential for success.

- Developing Business Acumen: It’s not enough to know finance; you must understand the broader business environment. A successful finance business partner sees the big picture and understands how different parts of the organization function and interact. This enables you to offer advice that aligns financial strategy with overall business goals.

- Adaptability: Businesses change rapidly, and a successful finance business partner must be flexible in their approach. Whether it’s responding to shifting market conditions, evolving business strategies, or new technological tools, being adaptable ensures you stay relevant and valuable.

- Emotional Intelligence: Understanding the motivations, concerns, and perspectives of your colleagues helps you better influence decision-making. Emotional intelligence enables finance business partners to navigate complex interpersonal dynamics, resolve conflicts, and foster stronger collaboration.

By focusing on these key areas, you can succeed as a finance business partner, effectively contributing to the financial health and strategic growth of your organization.

Additional Resources

Thank you for reading CFI’s guide to Finance Business Partnering. To keep learning and advancing your career, check out the following resources:

Create a free account to unlock this Template

Access and download collection of free Templates to help power your productivity and performance.

Already have an account? Log in

Supercharge your skills with Premium Templates

Take your learning and productivity to the next level with our Premium Templates.

Upgrading to a paid membership gives you access to our extensive collection of plug-and-play Templates designed to power your performance—as well as CFI's full course catalog and accredited Certification Programs.

Already have a Self-Study or Full-Immersion membership? Log in

Access Exclusive Templates

Gain unlimited access to more than 250 productivity Templates, CFI's full course catalog and accredited Certification Programs, hundreds of resources, expert reviews and support, the chance to work with real-world finance and research tools, and more.

Already have a Full-Immersion membership? Log in