- What is FP&A?

- Why is Risk and Opportunity Management Crucial in FP&A?

- Identifying and Assessing Risks and Opportunities

- Risk and Opportunity Assessment Techniques

- Leveraging FP&A for Effective Risk and Opportunity Management

- The Benefits of FP&A Risk and Opportunity Management

- Role of FP&A Professionals in a Dynamic Business Environment

- Conclusion

FP&A Risk and Opportunity

FP&A's critical role in managing risks and capturing opportunities

What is FP&A?

Financial Planning and Analysis (FP&A) is a crucial business function that involves budgeting, forecasting, and analyzing a company’s financial and operating performance. FP&A professionals play a pivotal role in supporting corporate decisions by conducting financial modeling and providing strategic advice to a company’s CEO, CFO, and Board of Directors. The FP&A team monitors key performance indicators (KPIs) to guide business operations and strategic planning, ensuring the company is on track to meet its financial goals.

Why is Risk and Opportunity Management Crucial in FP&A?

One of the key aspects of FP&A is managing risks and identifying opportunities. In a dynamic business environment, companies must navigate uncertainties and capture potential opportunities to maintain competitive advantage and ensure sustainable success.

Establishing an effective risk management process helps identify potential risks to company health, as well as developing risk-mitigation strategies. Similarly, recognizing and seizing growth opportunities allows businesses the ability to prudently allocate capital and maximize returns on investment.

Key Highlights

- FP&A is a crucial role that can help companies navigate uncertainties and recommend potential opportunities to ensure sustainable business success.

- Benefits of effective monitoring of potential risks and opportunities include improved decision making, enhanced resiliency, and maximizing strategic prospects.

- A risk and opportunity (R&O) matrix can be used to identify, assess, and manage potential risks and opportunities associated with strategic decision making.

Identifying and Assessing Risks and Opportunities

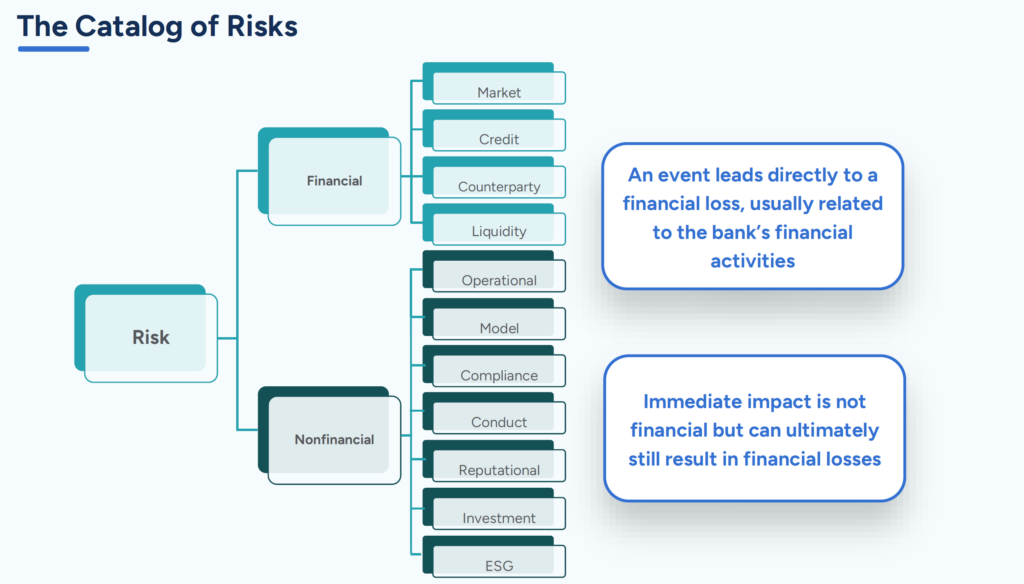

Types of Risks

There are many risks an organization faces. In general, risks can be divided into financial risks and nonfinancial risks. Some examples of financial risks include:

- Market Risk: Market risks involve fluctuations in market prices, foreign exchange rates, and interest rates. These can directly impact a company’s financial performance.

- Credit Risk: This risk is related to a company’s credit profile, which can be negatively impacted by poor financial performance, resulting in increased borrowing costs and the potential inability to meet its obligations.

- Counterparty Risk: This risk is somewhat similar in nature to credit risk, but it reflects the potential financial loss if the company’s customers do not pay the company.

Examples of nonfinancial risks include:

- Strategic Risk: Strategic risk is the risk a company’s key business initiatives and decisions end up underperforming, which can not only cause a financial loss but also a loss in customer and supplier confidence.

- Operational Risk: Operational risks arise from business operations, such as supply-chain disruptions, data breaches, or human errors.

- Compliance Risk: These risks are related to maintaining legal and regulatory compliance. Lack of compliance can lead to penalties and reputational damage.

Identifying Opportunities

The FP&A team should also proactively monitor for potential opportunities that can potentially impact the company’s financial and operating performance. These can include:

- Cost Reduction: As part of the ongoing monitoring of key metrics and a company’s financial health, FP&A teams can likely suggest areas where a company can reduce its costs without compromising quality.

- Market Expansion: FP&A teams are often called upon to assess the potential of entering a new market or analyzing ways to increase market share in existing markets or products. As part of this, FP&A may analyze whether it’s better to acquire companies or invest in research and development to achieve market expansion.

Risk and Opportunity Assessment Techniques

Financial analysts use various techniques to assess risks and opportunities, including:

- Scenario Planning: Developing multiple scenarios to better understand how potential future events impact the company’s financial health.

- Sensitivity Analysis: Evaluating how changes in key financial metrics affect the company’s overall financial performance.

- SWOT Analysis: SWOT analysis is used to gain insights on a company’s strengths, weaknesses, opportunities, and threats. SWOT analysis can help design a comprehensive risk and opportunity profile.

- PESTEL Analysis: PESTEL is an abbreviation for Political, Economic, Social, Technological, Environmental, and Legal. PESTEL analysis is used to evaluate the business environment in which a firm operates.

- Financial Modeling: Financial analysts create detailed financial models to forecast future performance and assess the impact of different variables and outcomes.

Risk and Opportunity (R&O) Matrix

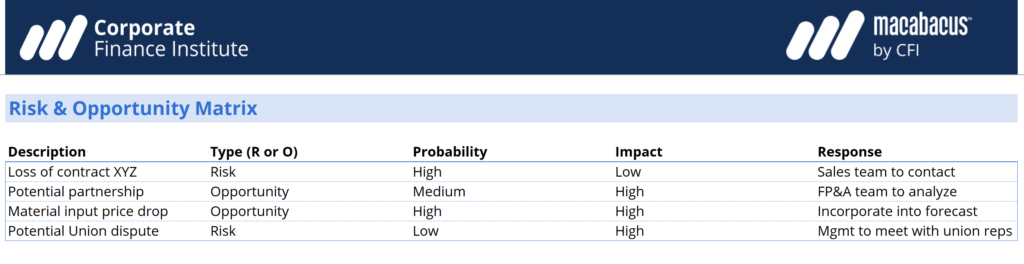

An R&O matrix is a tool used in project management and strategic financial planning to identify, assess, and manage potential risks and opportunities associated with strategic decision making.

Below are the typical components of an R&O matrix:

Risks

- Identification: Management will need to identify and list any materially significant risks that could negatively impact the company or project.

- Assessment: After identifying potential risks, it’s up to management to determine the likelihood and impact of each risk. If feasible, management should assign probabilities to the risks.

- Mitigation: At this point, management can potentially decide to avoid a specific risk, develop a strategy to minimize a risk, or simply accept the risk.

Opportunities

- Identification: Similar to risks, management should identify all potential opportunities that could positively impact the company or project.

- Assessment: Management then needs to evaluate the likelihood and benefit of each potential opportunity.

- Exploitation: Assuming the opportunity is meaningful and can be seized, management will then need to develop a strategy to capitalize on the opportunity.

Structure of an R&O Matrix

An R&O matrix can be quickly created in any type of office software. For example, if the R&O matrix is created using Microsoft Excel, it may consist of several columns, including the following items:

- Description: A brief description of the risk or opportunity.

- Probability: The likelihood of the risk or opportunity actually occurring.

- Impact: The potential impact if the risk or opportunity occurs. If possible, this should be expressed numerically. For example, a 20% drop in input prices will increase EBITDA by $11 million.

- Response: Based on the probability and the impact, the company can then craft a response to the risk or opportunity.

Using the R&O matrix, management can then communicate the priority for the listed risks and opportunities.

The R&O matrix helps determine and quantify strategic goals and requires dealing with how various uncertainties — both positive and negative — can impact performance.

Understanding the risks and opportunities allows a company to identify areas that impact the business and plan corrective actions to mitigate risks or seize opportunities.

Leveraging FP&A for Effective Risk and Opportunity Management

Financial planning and analysis professionals are in a unique spot to use both their problem-solving skills and communication skills to help management teams implement effective investment opportunities while monitoring the potential impacts of risks. Financial planning plays a key role in identifying risks and opportunities and recommending proactive measures, potentially leading to improved financial performance.

The Benefits of FP&A Risk and Opportunity Management

Importance of Risk and Opportunity Management in Corporate Finance

The financial management team is critical for effective risk and opportunity management. This function can directly impact investment decisions given its comprehensive view of a company’s strategy as well as its threats. In many ways, FP&A can act as a “first responder” since it can monitor economic trends and other external factors that are important to many organizations.

Improved Decision-Making

By incorporating risk and opportunity management into FP&A, companies can make more informed decisions. FP&A analysts can provide valuable insights into potential risks and opportunities, enabling management to make informed strategic decisions that align with the company’s financial goals and business strategy.

Enhanced Resilience

Proactive risk management helps companies build and maintain resilience against uncertainties. By identifying risks early and developing risk-mitigation strategies, financial analysts can help ensure that the company can withstand adverse conditions and continue operations without significant disruptions.

Maximizing Strategic Opportunities

Identifying and capitalizing on opportunities is essential for driving growth. FP&A can help evaluate the viability of new capital expenditures, potential partnerships, and other investments, ensuring that the company invests in the opportunities that provide the highest returns.

Role of FP&A Professionals in a Dynamic Business Environment

In today’s dynamic business landscape, FP&A professionals play a crucial role in helping navigate uncertainties and drive strategic initiatives. They are responsible for continuously analyzing financial data, monitoring key metrics, and providing advice to key decision-makers. Financial analysts’ expertise in FP&A is vital for identifying risks and opportunities, ensuring that the company remains competitive and financially healthy.

Conclusion

Financial Planning and Analysis (FP&A) is a cornerstone of effective corporate finance and financial management, providing insights and assessing necessary strategies to navigate a dynamic business environment.

Through robust risk and opportunity management, FP&A professionals help companies mitigate potential threats and seize growth opportunities, enabling long-term success. By leveraging their expertise in financial analysis, business operations, scenario planning, and strategic planning, FP&A professionals enable improved decision-making, heightened flexibility, and the maximization of strategic opportunities, solidifying their essential role in business administration.

Additional Resources

Thank you for reading CFI’s guide on FP&A Risks and Opportunities. To keep advancing your career and skills, the following CFI resources will be useful:

Create a free account to unlock this Template

Access and download collection of free Templates to help power your productivity and performance.

Already have an account? Log in

Supercharge your skills with Premium Templates

Take your learning and productivity to the next level with our Premium Templates.

Upgrading to a paid membership gives you access to our extensive collection of plug-and-play Templates designed to power your performance—as well as CFI's full course catalog and accredited Certification Programs.

Already have a Self-Study or Full-Immersion membership? Log in

Access Exclusive Templates

Gain unlimited access to more than 250 productivity Templates, CFI's full course catalog and accredited Certification Programs, hundreds of resources, expert reviews and support, the chance to work with real-world finance and research tools, and more.

Already have a Full-Immersion membership? Log in