Overview

Applied Fixed Income Course Overview

This Applied Fixed Income course builds on the fixed income fundamentals and delves deeper into government & agency-issued debt, zeroes, floaters & linkers, and callables & putables. It provides knowledge on how they are priced with industry-relevant examples of each type of debt. You will work through practice examples of certain types of debt and learn how to identify critical information on Refinitiv Workspace. By the end of this course, you will have an enhanced understanding of fixed-income products, which will prepare you for learning advanced fixed-income courses. We will explore the following:- Government, GSE, and SSA Debt

- Zeroes, Floaters, and Linkers

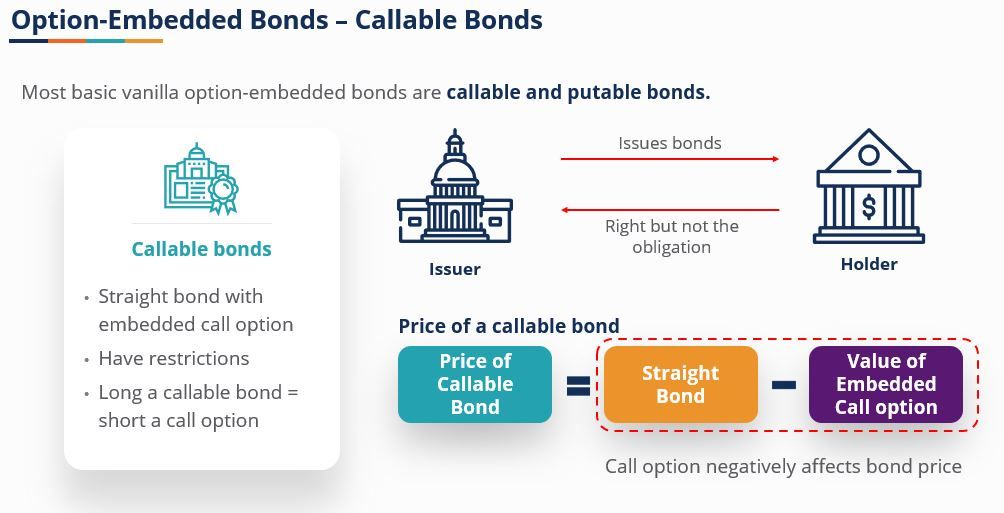

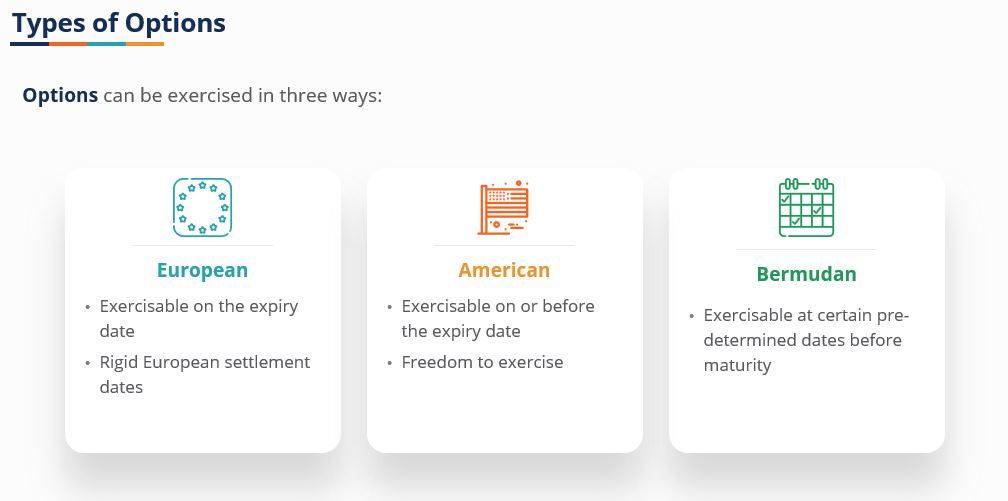

- Callables and Putables

Applied Fixed Income Learning Objectives

Upon completing this course, you will be able to:- Describe the different types of fixed-income products, their issuers, and investors

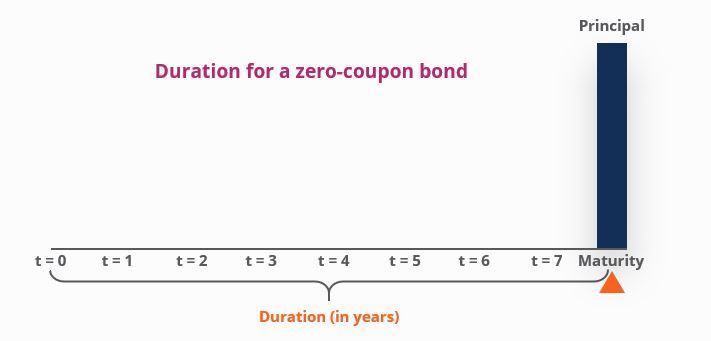

- Understand in-depth their pricing, duration, and convexity

- Understand how to calculate bond yields from Bloomberg

Who should take this course?

This Applied Fixed Income course is perfect for anyone who wants to build up their understanding of fixed-income products. This course is designed to equip anyone who desires to begin a career in the capital markets on the fixed income desk.Applied Fixed Income

Level 4

Approx 7h to complete

100% online and self-paced

Get StartedWhat you'll learn

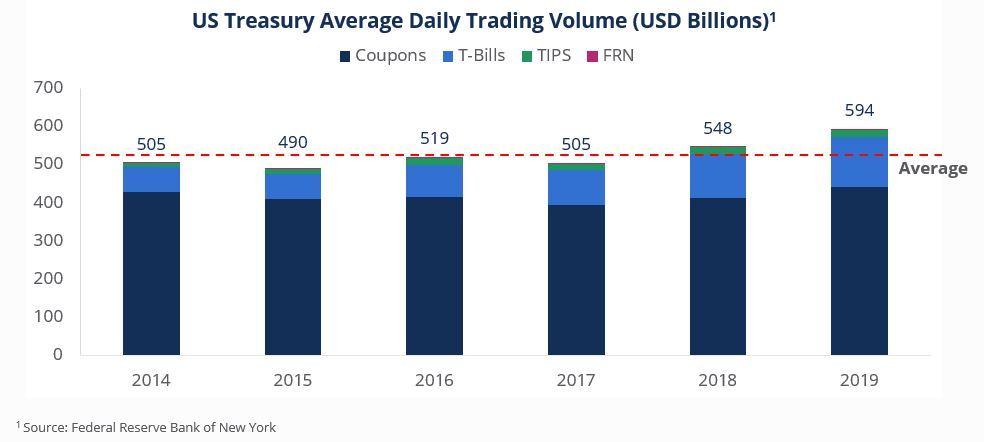

Government, GSE, and SSA Overview

Zeros, Floaters, and Linkers Overview

Callables and Putables

Qualified Assessment

This Course is Part of the Following Programs

Why stop here? Expand your skills and show your expertise with the professional certifications, specializations, and CPE credits you’re already on your way to earning.

Capital Markets & Securities Analyst (CMSA®) Certification

- Skills Learned Trading strategies used in the finance and capital markets

- Career Prep Work in capital markets, whether on the buy-side or the sell-side

We will explore the following:

We will explore the following: