- What is Bottom-Up Budgeting?

- What is Top-Down Budgeting?

- Top-down vs Bottom-up Budgeting

- Choosing the Right Approach for Your Organization

- The Bottom-Up Budgeting Process

- 1. Identify the individual components of the business.

- 2. Get a sum of cost projections of each component.

- 3. Sum up the budgets of all departments.

- 4. Submit for approval.

- Top-Down Budgeting Definition and Process

- 1. Budget allocations to departments

- 2. Department-level budgets

- 3. Alignment of departmental budgets

- Advantages and Disadvantages of Bottom-up and Top-down Budgets

- Bottom-up Budgeting Advantages

- Bottom-up Budgeting Disadvantages

- Top-down Budgeting Advantages

- Top-down Budgeting Disadvantages

- Effective Budget Implementation Tips

Bottom-up vs. Top-down Budgeting: The Difference

What is Bottom-Up Budgeting?

Bottom-up budgeting is a budgeting method that starts at the department level, with each department creating a budget and moving it up to the top, creating a company-level budget. Each department is required to compile a list of the things it needs, hires it plans to make, projects it plans to carry out, as well as cost estimates for all of these.

The estimates of all the departments are then summed up to get the overall company budget. This budgeting process requires the managers of each department to give their input since they are in the best place to know all of the various needs and costs.

What is Top-Down Budgeting?

Top-down budgeting is a budgeting method where top management prepares a high-level budget for the company. This budget is based on overall company objectives and strategies and is then passed down to department-level managers for implementation.

While department-level managers may make suggestions to the company budget, it’s up to senior management as to whether or not to incorporate those suggestions. After the budget is created, senior management makes specific allocations to the different departments, which must then create their own budgets based on their budget allocation and goals.

Key Highlights

- Bottom-up budgeting is a budgeting method that starts at the department level, with each department creating a budget and moving it up to the top, creating a company-level budget. Top-down budgeting is a budgeting method where top management prepares a high-level budget for the company, which is then pushed down to department or business unit.

- Choosing the right approach to budgeting depends on the company’s needs and work culture.

- Bottom-up budgets can be more detailed and result in greater acceptance but are difficult to manage and may not align with company strategy or goals.

- Top-down budgets ensure better alignment with company strategy but often suffer from lower employee buy in and resistance to implementation.

Top-down vs Bottom-up Budgeting

The two different approaches to budgeting are naturally at tension with each other and even with themselves.

On the one hand, an ideal budgeting approach would result in buy-in and acceptance from the entire company. However, this is difficult to achieve regardless of budgeting approach.

For example, a top-down budget is effectively imposed on junior managers and employees who may disagree with the way this budget allocates resources. Therefore, there may be pushback from the employees that must implement and follow the top-down budget.

The bottom-up budget has similar issues. Since each department budget is effectively created in isolation, the budget itself may not be in line with other department heads and overall company goals.

Choosing the Right Approach for Your Organization

Choosing the right approach — whether bottom up or top down — really depends on the company’s needs and culture.

The following are some generalities regarding which approach is better for a certain type of organization:

Better for Top Down

The top-down budgeting process is generally better for companies with a centralized decision-making authority and uniform operations. Examples of this would be a large retail or restaurant chain or a large manufacturing firm.

The top-down approach is also better for companies that need to respond quickly to changes in a dynamic business environment, and management doesn’t have time to get input from many stakeholders.

A situation where the top-down approach is pretty much required would be if a company is in decline and in need of a turnaround. In a turnaround, there are often difficult but necessary changes that must happen in order for the company to mitigate its decline. In this case, the company cannot afford to take the time to use a bottom-up strategy.

Better for Bottom Up

The bottom-up approach is usually better suited for decentralized organizations, where decision-making is spread across various business units. Examples of decentralized organizations might be large multinational corporations or diversified conglomerates. These types of organizations are also likely to have robust systems and processes in place that allow for the additional complexity of bottom-up budgets.

Another situation in which a bottom-up budget might be preferred is for industries that require constant creativity and innovation to thrive. Industries in need of constant innovation will need the input of day-to-day employees and stakeholders to stay on top of trends. This makes bottom-up budgeting a better approach. Examples of industries that are constantly innovating are technology firms or pharmaceutical companies.

The Bottom-Up Budgeting Process

Below are the general steps to creating a bottom-up budget.

1. Identify the individual components of the business.

- The first step when creating a bottom-up budget is to identify the individual components of the business. These components consist of projects, investments, and initiatives the company plans to carry out in the coming fiscal year. As part of this process, costs must be assigned to these components.

- For example, a component may be at the department level and include costs like employee wages, capital expenditures, administrative costs, etc. If the components are individual projects, the budget must first obtain a list of all projects to be carried out in the coming year and then come up with cost estimates for each project.

2. Get a sum of cost projections of each component.

- After departments finish preparing a list of planned projects and initiatives, the costs will then be added up to get the total budget for the department. For example, the cost estimates of the human resources department may include $20,000 for recruiting personnel, $50,000 for employee salaries, and $10,000 for administrative costs, bringing the department’s total budget to $80,000.

- All departmental managers will come up with the totals for their respective departments.

3. Sum up the budgets of all departments.

- After all of the departments/initiatives submit their budgets, these budgets are then summed up to get the overall company budget.

4. Submit for approval.

- The final stage of the bottom-up budgeting process is submitting the budget estimates to senior management for approval. When reviewing the budget, management wants to know if the budgets are aligned with overall company goals and objectives.

If satisfied, senior management will approve the various budgets and will monitor how well different teams’ actual results compare to the budget in a process known as variance analysis. However, if company leadership is not satisfied with the budget, it will ask the departmental managers to make necessary changes before the budget is again submitted for approval.

Top-Down Budgeting Definition and Process

The top-down budgeting process starts with senior management meeting to come up with the objectives for the year. As part of this, management will discuss and determine high-level targets for the company in terms of sales, expenses, profits, etc. Department managers and lower-level staff do not usually participate in these discussions but may put forward suggestions for consideration.

Once management finishes preparing the targets, the objectives are passed on to the finance department for allocation to the different departments and projects. Management deploys resources based on the finalized targets set during the budgeting process.

1. Budget allocations to departments

- The finance department is tasked with making allocations to departments in a top-down approach. The finance team may use the previous year’s results to determine the proper allocations. For example, if the sales department incurred 35% of the overall expenses during the previous year, then the finance department may allocate 35% of budgeted expense to the sales department for the budget year.

- However, the ultimate allocation may be higher or lower depending on what the department managers presented to senior management. As an example, if the company plans to roll-out a new product into the market, the finance department may increase the budget allocation to the marketing department to cover higher promotional costs related to the new product.

2. Department-level budgets

- After the finance department allocates budget targets to the various departments, department-level managers will then take the targets and prepare their own department budget. The department manager will need to develop revenue and cost estimates that align with the allocation and the company-level budget.

- Department-level budgets should include planned expenditures, expenses, and salaries. Additionally, if applicable, department-level budgets will include the number of products the department aims to sell, as well as the expected revenue.

3. Alignment of departmental budgets

- The final step in the top-down approach occurs when each department submits their budgets to the finance team for overall alignment. The finance department reviews these budgets to make sure they are aligned with the overall objectives of the company. If there are departments with insufficient or excess budgets, the finance department may send the budgets back to the department(s) for revision, and the allocations may be adjusted upwards or downwards.

Once all of the budgets are finalized, they are loaded into a financial system to track monthly expenditures and other metrics via variance analysis. The departments receive monthly or periodic reports to show the amount of revenues and expenses compared to the allocated budget. Leaders must monitor any variances and understand how actual results differ from expectations.

Advantages and Disadvantages of Bottom-up and Top-down Budgets

Bottom-up Budgeting Advantages

- Bottom-up budgets can be more realistic: Since this budgeting approach is developed by team members who are closest to day-to-day operations, it may result in a more realistic assessment of a department or project’s needs.

- Greater employee buy in: Bottom-up budgeting seeks input from employees, making them feel more valued and involved in the process. This can improve employee morale and commitment by fostering a more collaborative budgeting process.

- Potential for more flexibility: Bottom-up budgeting potentially allows for more agility and adaptability as business conditions change. Since the budget is developed at a lower level, it can be more quickly adjusted if necessary, avoiding the longer process of seeking approval from upper management.

- More detailed: Since bottom-up budgeting starts at a lower level compared to top-down budgeting, it usually necessitates more information and detail. This additional detail can be used to make sure the budget is realistic and achievable and may also lead to better and more useful variance analysis, ultimately helping to identify specific areas for improvement.

Bottom-up Budgeting Disadvantages

- Bottom-up budgeting is time-consuming: Given the level of detail and the involvement of many different employees, this method can be quite lengthy and requires significant coordination and communication.

- Potential for overestimation: Departments may “pad” or overestimate their needs in order to obtain more funding and resources. This can lead to inflated budget numbers and competition among different departments for a finite amount of resources.

- Lack of strategic alignment: Without guidance from upper management, department budgets may not align with overall company goals. Bottom-up budgeting can lead to unhealthy internal competition with no assurance that these budgets will correspond with company strategy.

- Greater complexity: While an advantage of bottom-up budgeting is the level of detail, this can also lead to greater complexity. Managing and integrating numerous departmental budgets can be difficult, time-consuming, and complex. This budgeting approach requires robust systems and processes to compile, manage, and analyze all of the budget information effectively.

Top-down Budgeting Advantages

- Top-down budgeting allows for better speed and efficiency: Since this budget process is mostly driven by upper management, decisions can usually be made fairly quickly since fewer people are involved in the deliberation.

- Ensures strategic alignment with company goals: Top-down budgeting ensures that the budget aligns with the organization’s strategic goals and priorities. Upper management can maintain a “high-level” view of the business and can therefore allocate resources to the most high-priority areas.

- Enhanced control: Since management retains control of the budget, this can potentially reduce the risk of overspending and internal competition for resources. This helps the company maintain overall financial discipline.

- Heightened consistency: Top-down budgeting allows for greater consistency across departments, as the budget process is guided by management and company strategy.

Top-down Budgeting Disadvantages

- Lack of detail: Upper management may lack detailed and comprehensive knowledge of each department’s various needs. This may result in unrealistic budgets that, while they may align with company strategy, just aren’t achievable by individual departments.

- Potential for lower employee morale: Since the top-down budget is essentially “dictated” to departments, employees may feel excluded from the decision-making process. If there is no well-designed feedback loop for employees, this can result in unrealistic targets, dissatisfaction, and reduced motivation.

- Resistance to implementation: Somewhat related to lower employee morale is the potential to resist implementing a budget. If employees feel their voice is not being actively heard or represented, then they might challenge executing and adhering to the budget.

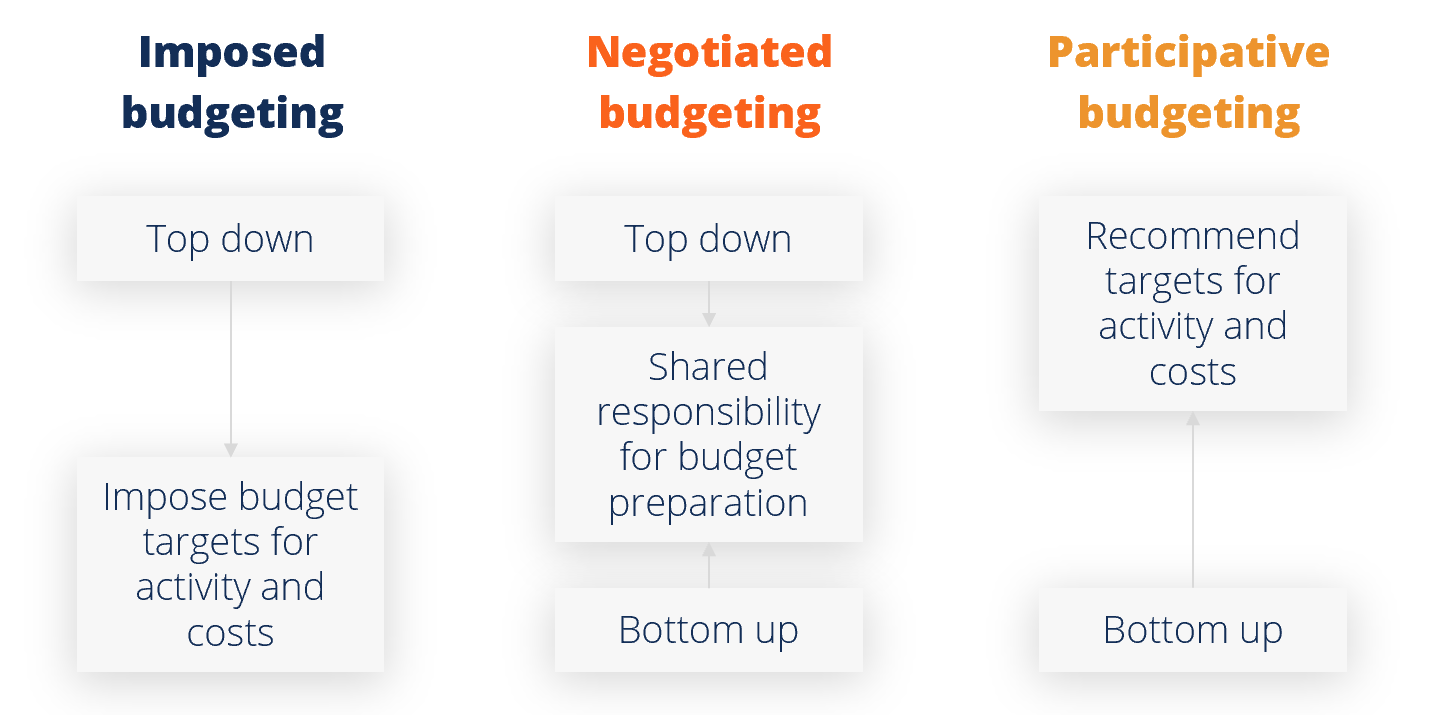

Top-down vs bottom-up budgeting approaches both have their merits and drawbacks. Often, organizations may adopt a hybrid or negotiated approach, with elements of both top-down and bottom-up budgeting.

As an example, upper management may outline some of the most important company targets, while allowing individual departments the potential to develop their own detailed budgets that will contribute to these targets.

Effective Budget Implementation Tips

Regardless of which process a company chooses, there are some crucial tips to consider when implementing a formal budgeting process.

- Clear communication and coordination across the organization is absolutely necessary to ensure employee buy in and create organizational alignment while maintaining employee morale.

- As part of clear communication, it’s important to involve key stakeholders when deciding the best process. Since a budget is owned by multiple parties with different backgrounds (sales, operations, finance, etc) it’s necessary to listen to all stakeholders and not just ones with finance backgrounds. This has the added benefit of fostering collaboration within an organization.

- Continuously review the budget process and adjust the process as needed. Leadership should encourage departments to review their budgets based on feedback from senior management. The departments should solicit feedback from all levels and can then refine the process going forward.

- Whether it’s implementing a budgeting process or any other change, it’s critical to establish clear metrics and definable goals so that the process can be objectively measured and altered as necessary.

- Once a process is in place, an organization must have a system to compare actual results to the budget and identify any material differences between the two. If there are meaningful variances, are they expected to recur and impact future performance or are they “one-off” in nature? If they are expected to recur in the future, then updating the budget may be necessary.

Additional Resources

Thank you for reading CFI’s guide on Bottom-up vs Top-down Budgeting. To keep advancing your career and skills, the following CFI resources will be useful:

Create a free account to unlock this Template

Access and download collection of free Templates to help power your productivity and performance.

Already have an account? Log in

Supercharge your skills with Premium Templates

Take your learning and productivity to the next level with our Premium Templates.

Upgrading to a paid membership gives you access to our extensive collection of plug-and-play Templates designed to power your performance—as well as CFI's full course catalog and accredited Certification Programs.

Already have a Self-Study or Full-Immersion membership? Log in

Access Exclusive Templates

Gain unlimited access to more than 250 productivity Templates, CFI's full course catalog and accredited Certification Programs, hundreds of resources, expert reviews and support, the chance to work with real-world finance and research tools, and more.

Already have a Full-Immersion membership? Log in