- The Importance of Workflow Efficiency for Financial Analysts

- Power Query: Automate Data Handling and Transformation

- Power Pivot for Building Data Models from Large Datasets

- AI & ChatGPT: Revolutionizing Financial Analysis and Workflow Automation

- Macabacus for Enhanced Productivity in Excel

- Collaborative Tools for Workflow Efficiency

- Google Sheets: Best for Simplicity and Real-Time Collaboration

- Microsoft Excel: Best for Advanced Data Handling and Automation

- Google or Excel?

- How to Select the Best Tools for Workflow Efficiency

- Why Workflow Tools are Essential for Efficiency

Workflow Efficiency for Financial Analysts: Best Automation and Productivity Tools

The Importance of Workflow Efficiency for Financial Analysts

Financial analysts handle large datasets, build complex models, and deliver insights under pressure. Workflow inefficiencies — whether caused by manual tasks or data processing delays — can lead to costly errors and lost time. To stay accurate and productive, analysts need the right tools to streamline tasks and eliminate bottlenecks.

Boost Productivity and Save Time

These tools help financial analysts work more efficiently and free up valuable time by automating repetitive processes. They also help to reduce mistakes, allowing analysts to focus on deeper analysis. As the demand for greater efficiency grows, mastering the right workflow tools becomes increasingly important.

Choose the Right Tools for Your Workflow

In this article, we’ll explore essential tools such as Excel shortcuts, Power Query, Power Pivot, Macabacus, and AI technologies to help analysts optimize their workflows.

Key Highlights

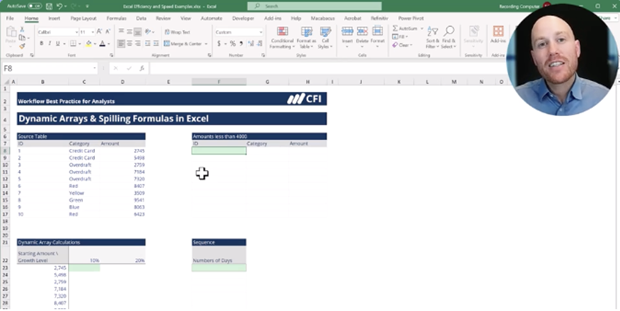

- Use automation and productivity tools to improve day-to-day productivity and strengthen the quality of financial analysis. Learning Excel shortcuts is a quick way to work more efficiently.

- Excel automation tools like Power Query and Power Pivot and AI technologies such as ChatGPT reduce manual work, freeing up time to focus on strategic analysis and uncovering insights.

- Excel add-ins like Macabacus automate key tasks like formatting and formula auditing, helping analysts reduce errors, save time, and maintain consistency across financial models and presentations.

Excel Shortcuts: Boosting Productivity for Financial Analysts

Mastering Excel shortcuts is one of the quickest ways for financial analysts to improve workflow efficiency. Given the heavy reliance on Excel for tasks like building models, analyzing data, and creating reports, knowing the right shortcuts can save hours of manual work and reduce the need for repetitive mouse actions.

Get CFI’s free Excel shortcuts cheat sheet!

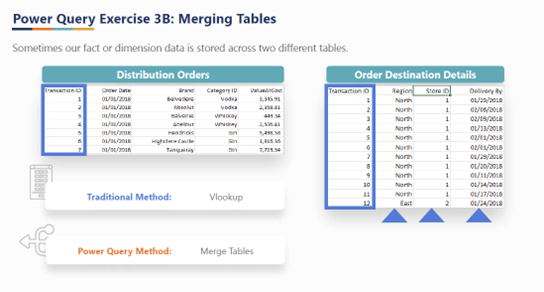

Power Query: Automate Data Handling and Transformation

Power Query is one of Excel’s most powerful tools for automating data tasks such as importing, cleaning, and merging datasets. Instead of manual data updates, Power Query automates this process and cleans data with just a few clicks, saving time and improving accuracy.

Automating Data Imports from Multiple Sources

Analysts use Power Query to pull in data from multiple sources — such as Excel files, databases, or cloud-based systems — and transform it into a consistent format. It automates the data cleaning process, ensuring that all datasets are standardized, whether you’re working with financial model data from spreadsheets or external data from a database.

This functionality is especially useful for recurring tasks like monthly reports, where Power Query automatically updates the data each time, so analysts don’t have to repeat the manual work.

Streamlining Workflows for Deeper Analysis

By automating these repetitive data tasks, Power Query allows analysts to spend less time on manual data management and more time on in-depth analysis. It improves efficiency and reduces the risk of errors that can arise from manual processes. This makes Power Query an essential tool for analysts who need to keep models up to date without spending hours on routine tasks.

Power Query is a valuable tool for analysts, allowing them to simplify data handling and automate time-consuming tasks, which helps them focus on providing insights that drive better decision-making.

Power Pivot for Building Data Models from Large Datasets

Power Pivot is a valuable Excel tool for analyzing large amounts of data efficiently, allowing analysts to:

- Create relationships between different data tables

- Perform advanced data analyses and build integrated data models

- Reduce their reliance on complex formulas or cluttering a spreadsheet with multiple worksheets

- Combine and analyze large amounts of data efficiently

Using Power Pivot with Pivot Tables

One of Power Pivot’s key strengths is its seamless integration with Pivot Tables, which allows you to summarize millions of rows of data quickly. Pivot Tables can also summarize and analyze data points such as sales performance or budget comparisons. For example, you could use Power Pivot to connect multiple data sources — like sales data from different regions — and create a Pivot Table that summarizes the overall performance of each region.

Using Power Pivot with Power Query

When used with Power Query, Power Pivot goes a step further by automating data imports and updates, removing the need for manual data manipulation. This integration ensures that financial models remain up to date without requiring frequent intervention, even when working with very large datasets.

By simplifying data management and analysis for large volumes of data, Power Pivot enables analysts to combine data sources, automate updates, and produce insightful reports with far less manual effort.

AI & ChatGPT: Revolutionizing Financial Analysis and Workflow Automation

Generative AI is reshaping analyst workflows with applications like OpenAI’s ChatGPT and Google’s Gemini offering faster, smarter automation. These AI tools handle many repetitive tasks and assist with real-time problem-solving, freeing analysts to focus on deeper analysis.

Using ChatGPT for Excel Formulas and Automation

AI tools like ChatGPT and Gemini assist with troubleshooting Excel formulas, generating VBA (Visual Basic for Applications) code, and creating report summaries. Instead of manually searching for and resolving formula errors, analysts can use AI tools to quickly provide solutions or generate automation scripts. These features can speed up workflows and increase productivity.

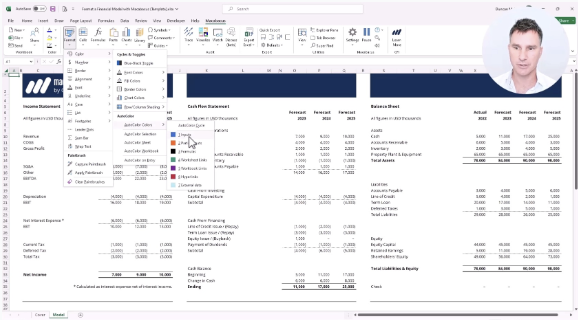

Macabacus for Enhanced Productivity in Excel

Macabacus is a powerful Excel add-in that boosts productivity by automating repetitive tasks like formatting and formula auditing. It reduces errors by automatically identifying inconsistencies and correcting formulas, saving analysts time on manual checks and improving model accuracy.

Key Features of Macabacus

- Automated Formatting and Formula Auditing: Ensures models follow best practices, reducing the chance of unnoticed errors.

- Pre-Built Templates and Quick Insertions: Offers ready-made templates for financial tasks like cash flow statements, enabling faster model building.

- Charting and Presentation Tools: Links data between Excel, PowerPoint, and Word, automatically updating presentations as Excel models change.

- Branding Integration: Applies company branding to reports, ensuring consistency and saving time on manual formatting.

By automating key aspects of financial modeling, Macabacus helps analysts work more efficiently, reduce errors, and maintain consistency across reports.

Collaborative Tools for Workflow Efficiency

Effective collaboration keeps analyst teams aligned and productive. Microsoft Excel and Google Sheets both offer solutions for teamwork and data sharing, each with its own strengths and limitations.

Google Sheets: Best for Simplicity and Real-Time Collaboration

Google Sheets supports real-time collaboration, ideal for basic tasks like budgeting or project tracking. Google’s Workspace cloud-based platform makes real-time collaboration simple and accessible from anywhere.

However, Google Sheets struggles with complex models and large datasets, lacking the advanced data processing and automation features needed for intricate financial analysis.

Microsoft Excel: Best for Advanced Data Handling and Automation

Excel shines at handling large datasets, building complex financial models, and automating tasks with tools like Power Query and VBA. Analysts can collaborate through tools like Teams and OneDrive while retaining full access to Excel’s powerful features.

While Excel offers superior functionality for advanced workflows, it lacks the seamless real-time collaboration capabilities that Google Sheets provides for simpler tasks.

Google or Excel?

For real-time collaboration on simpler tasks, Google Sheets is a convenient option. However, for complex models and advanced automation, Excel remains the superior choice. Using both platforms strategically allows analyst teams to optimize workflows and collaboration.

How to Select the Best Tools for Workflow Efficiency

In competitive environments like finance, leveraging the right tools can give analysts a significant edge by improving speed and accuracy. Selecting the right tools for your financial workflow depends on the complexity of datasets and models, the ability to automate tasks, and platforms or tools that easily connect and work together.

When choosing tools, focus on three key factors:

- Complexity: Excel’s advanced tools are ideal for complex models and large datasets.

- Automation: Automation tools like Power Query, Power Pivot, and even AI tools like ChatGPT, reduce manual errors and save time.

- Collaboration: Google Workspace provides strong collaborative features for real-time teamwork, while Excel is best for working with complex models and large datasets.

By selecting the right combination of tools based on the task at hand, you can significantly improve both individual and team efficiency, ensuring that your workflow remains smooth and productive.

Why Workflow Tools are Essential for Efficiency

Optimizing workflow efficiency goes beyond saving time — it improves accuracy, reduces errors, and allows analysts to focus on meaningful analysis. By using Excel shortcuts and advanced applications, along with add-ins like Macabacus and AI tools like ChatGPT, analysts can automate routine tasks, streamline data management, and deliver more accurate insights.

Investing in the right tools improves day-to-day productivity and strengthens the quality of analysis and insights. Streamlining workflows positions analysts to meet deadlines, handle complexity, and deliver greater value to their organizations.

Additional Resources

Thank you for reading CFI’s guide to Tools to Improve Workflow Efficiency for Financial Analysts. To keep advancing your career and skills, the following CFI resources will be useful:

Excel vs. Google Sheets for Financial Modeling

Excel Shortcuts for Mac and PC

Create a free account to unlock this Template

Access and download collection of free Templates to help power your productivity and performance.

Already have an account? Log in

Supercharge your skills with Premium Templates

Take your learning and productivity to the next level with our Premium Templates.

Upgrading to a paid membership gives you access to our extensive collection of plug-and-play Templates designed to power your performance—as well as CFI's full course catalog and accredited Certification Programs.

Already have a Self-Study or Full-Immersion membership? Log in

Access Exclusive Templates

Gain unlimited access to more than 250 productivity Templates, CFI's full course catalog and accredited Certification Programs, hundreds of resources, expert reviews and support, the chance to work with real-world finance and research tools, and more.

Already have a Full-Immersion membership? Log in