- The Growing Debate: Excel vs. Google Sheets for Financial Modeling

- Key Advantages of Excel for Financial Modeling

- Limitations of Google Sheets for Financial Modeling

- Performance with Large Datasets

- Lack of Automation and Advanced Tools

- Collaboration Benefits with Limited Processing Power

- Is It Ever Acceptable to Use Google Sheets for Financial Modeling?

- When to Use Excel

- Conclusion: Why Excel is Better for Financial Modeling

Excel vs. Google Sheets for Financial Modeling

The Growing Debate: Excel vs. Google Sheets for Financial Modeling

Choosing between Excel and Google Sheets for financial modeling can significantly impact efficiency and accuracy. While both tools can handle basic modeling tasks, Excel is the preferred choice due to its advanced features and ability to process larger datasets. As financial models grow in complexity, Excel’s specialized tools become essential for financial analysts who need precision and scalability.

Although Google Sheets is great for collaboration, allowing multiple users to work together in real-time, it lacks the advanced functionality needed for more intricate financial modeling. For professionals focused on building detailed models, Excel remains the go-to tool, offering the depth and automation required for rigorous financial analysis.

Key Highlights

- Excel is the top choice for financial modeling due to its ability to handle complex models, large datasets, and advanced automation features like Power Query and VBA.

- Google Sheets is useful for simpler tasks such as basic budgeting and real-time collaboration but lacks the power needed for detailed financial analysis.

- Finance professionals should choose Excel when working with intricate models or large data, as it offers advanced tools that Google Sheets cannot match.

Key Advantages of Excel for Financial Modeling

Excel and Google Sheets both offer powerful features, but Excel stands out when it comes to handling large datasets, automation, and more complex financial modeling tasks. Here’s why Excel is often the preferred tool for financial analysts.

Features for Complex Models

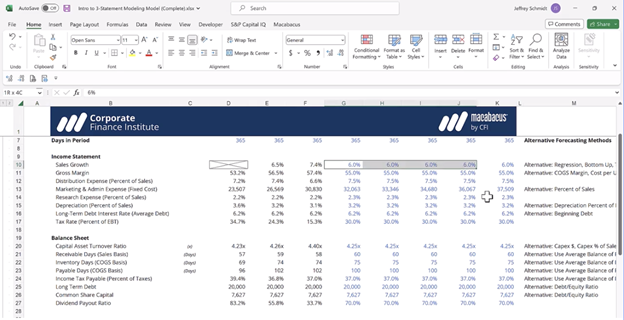

Excel works seamlessly with Power Query and Power Pivot, which are essential tools for data transformation, management, and analysis — especially for large volumes of data. These tools enable financial analysts to build and manage complex models efficiently with capabilities that aren’t found in Google Sheets.

Automation with VBA for Efficiency

VBA (Visual Basic for Applications) is a programming language integrated into Microsoft Office applications like Excel. With VBA, analysts can streamline repetitive tasks and run complex macros, saving time and reducing manual effort. While Google Sheets provides basic scripting with Google Apps Script, it doesn’t offer the same level of functionality or flexibility, making Excel more suitable for models that require extensive automation.

Handling Large Datasets with Ease

Although Google Sheets can handle smaller datasets and support advanced formulas, it struggles with large datasets. Excel performs better in these cases, ensuring smooth operation even with large amounts of data. This makes it the more reliable choice for financial analysts working on forecasting, sensitivity analysis, and other tasks that involve significant data processing.

Limitations of Google Sheets for Financial Modeling

Although Google Sheets is user-friendly and offers strong collaboration features, it faces limitations when handling more complex financial models. These limitations primarily affect data processing and automation, both essential for financial analysts working on detailed models.

Performance with Large Datasets

One of Google Sheets’ major weaknesses is its inability to handle large datasets efficiently. For financial analysts working with thousands of rows of data or multiple data sources, Google Sheets often struggles with performance issues, such as lagging and freezing. These issues can severely impact productivity when working on financial forecasting or data modeling, where extensive datasets are involved.

Lack of Automation and Advanced Tools

While Google Sheets supports many common formulas, it lacks more advanced tools available in Excel like Power Query, Power Pivot, and VBA. These tools are invaluable for analysts who need to streamline tasks and integrate data from multiple sources without manual input.

Collaboration Benefits with Limited Processing Power

Though Google Sheets excels in real-time collaboration, it can’t handle the heavy processing requirements of intricate financial models. For simpler, collaborative tasks, Google Sheets works well, but when deeper analysis or more advanced modeling is required, its limited data handling becomes a significant drawback.

Is It Ever Acceptable to Use Google Sheets for Financial Modeling?

In general, we recommend using Excel for all model building and analysis.

That said, Google Sheets can be a viable option for simpler tasks, such as smaller datasets and basic financial models. Tasks like basic budgeting, expense tracking, or simple cash flow analysis are well-suited to Google Sheets. It allows multiple users to collaborate simultaneously, making it ideal for group projects or situations where real-time feedback is needed.

In addition, Google Sheets can handle some advanced formulas like dynamic arrays, LOOKUP functions, and error handling. It also offers interactive charts and graphs, with slicer tools that allow users to filter data dynamically, much like Excel. For tasks that require visual clarity but not extensive automation or data handling, Google Sheets can be a useful alternative.

Excel vs. Google Sheets

Microsoft Excel is the tool of choice for financial analysis. Is it ever acceptable to use Google Sheets?

| Advanced Formulas such as dynamic arrays, lookups, and error handling. | ||

| Advanced Charts & Graphs with interactive slicers. | ||

| Keyboard Shortcuts to improve speed and productivity. | ||

| Dataset Size that can be stored or calculated. | ||

| Power Query for automating data imports and transformations. | ||

| Power Pivot for advanced analysis using a data model. | ||

| Security considerations, including the location of saved files. | ||

| Collaboration, including synchronous editing. |

Source: CFI’s Workflow Best Practices for Analysts course

When to Use Excel

As the complexity of a model increases, the need for advanced tools like Power Query, Power Pivot, or VBA becomes apparent. When analysts encounter large datasets or require automation to streamline processes, Excel is best. For financial forecasting, sensitivity analysis, and models that require integrating data from various sources, Excel remains the superior tool.

Conclusion: Why Excel is Better for Financial Modeling

Excel is the top choice for financial modeling due to its ability to handle complex models, large datasets, and advanced automation. With features like Power Query, Power Pivot, and VBA, it equips analysts to manage tasks like forecasting, sensitivity analysis, and data integration, making it the best spreadsheet for financial analysts.

While Google Sheets is useful for smaller tasks and collaboration, it lacks the power needed for detailed financial analysis. It handles basic budgeting and smaller datasets but struggles with large data and automation.

For finance professionals working on complex models, Excel is the clear choice for serious financial work, offering advanced features that Google Sheets cannot match.

Additional Resources

Thank you for reading CFI’s guide to Excel vs. Google Sheets for financial modeling. To keep advancing your career and skills, the following CFI resources will be useful:

Free Financial Modeling Guidelines

Create a free account to unlock this Template

Access and download collection of free Templates to help power your productivity and performance.

Already have an account? Log in

Supercharge your skills with Premium Templates

Take your learning and productivity to the next level with our Premium Templates.

Upgrading to a paid membership gives you access to our extensive collection of plug-and-play Templates designed to power your performance—as well as CFI's full course catalog and accredited Certification Programs.

Already have a Self-Study or Full-Immersion membership? Log in

Access Exclusive Templates

Gain unlimited access to more than 250 productivity Templates, CFI's full course catalog and accredited Certification Programs, hundreds of resources, expert reviews and support, the chance to work with real-world finance and research tools, and more.

Already have a Full-Immersion membership? Log in