- Evolution of Data Storage: Enabling the AI Revolution

- The Birth of the Digital Era and the World Wide Web

- Evolution of Data Collection and Storage

- The Role of Data in AI and Machine Learning

- Data Quality is Just as Important as Data Quantity

- Training Large Language Models Relies on Data Quality

- Data in Business Analytics

- Types of Business Analytics

- Build a Data-Driven Culture

- Data Maturity: The Key to Unlocking AI's Potential

- Looking Ahead: The Future of Data and AI

Data Foundations: Fueling the AI Revolution in Business

As the volume of globally available digital data continues to grow year over year, businesses are increasingly recognizing the transformative power of harnessing this resource. From optimizing operations and improving decision-making to developing innovative products and services, data has become the lifeblood of modern organizations.

We are now witnessing the explosive growth in the power of artificial intelligence (AI) and machine learning (ML) technologies, which is only further intensifying the need to effectively collect, store, and analyze vast amounts of data for businesses of all sizes.

For finance professionals, the ability to leverage data and AI can lead to significant improvements in financial forecasting, risk management, and fraud detection. By harnessing the power of predictive analytics and machine learning algorithms, finance teams can identify patterns and anomalies in financial data, enabling them to make more accurate predictions and proactively mitigate potential risks.

Evolution of Data Storage: Enabling the AI Revolution

The evolution of data storage has been a crucial enabler of the AI revolution. From early punch cards and magnetic tapes to modern hard disk drives, solid-state drives, and cloud storage, advancements in data storage technology have allowed for the efficient and secure storage of vast amounts of data generated by businesses, social media platforms, and Internet of Things (IoT) devices.

The Birth of the Digital Era and the World Wide Web

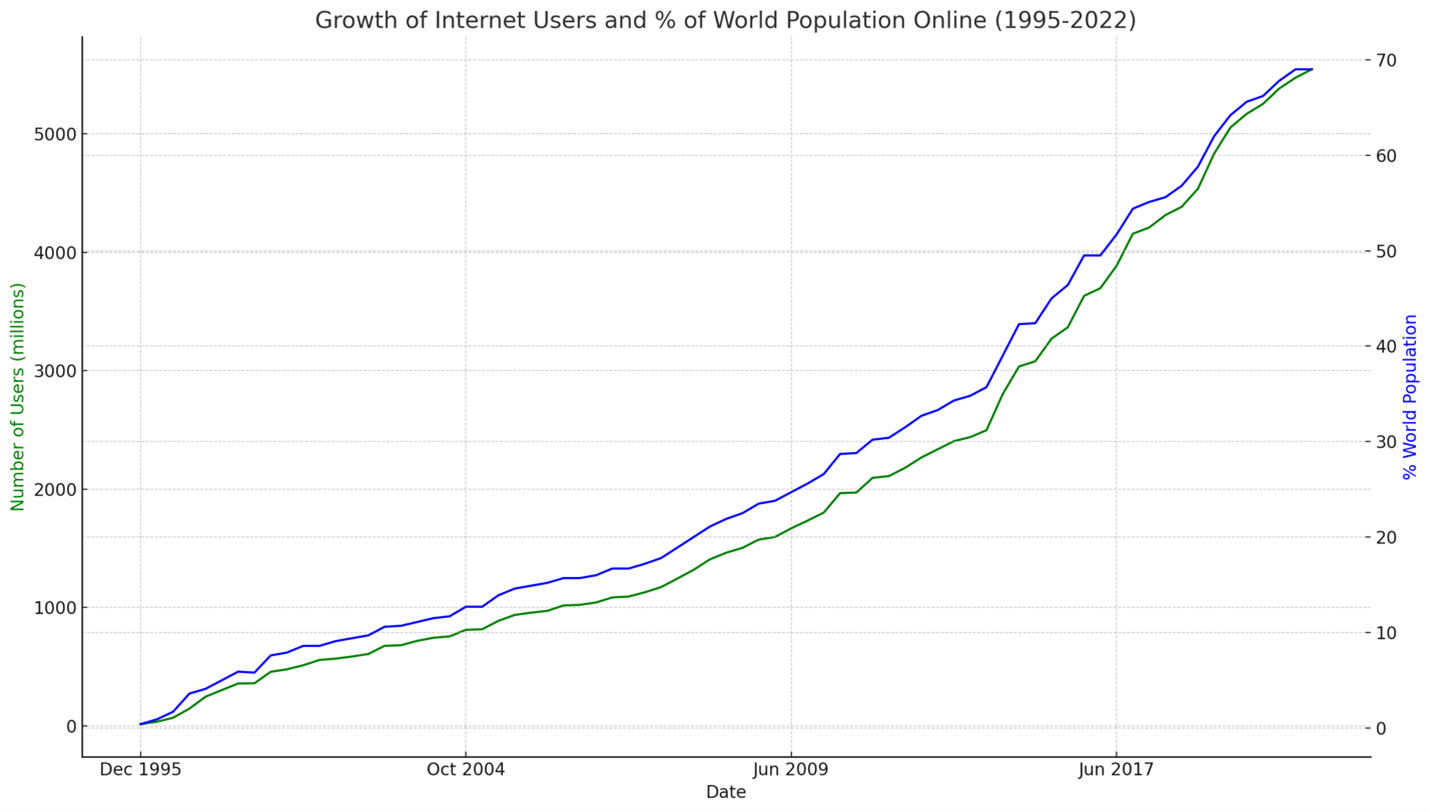

Figure 1. Source

The introduction of the World Wide Web in the early 1990s revolutionized data accessibility and sharing, leading to exponential growth in the amount of available data. As more people gained internet access, the number of websites skyrocketed, and search engines like Google made it easier to find relevant information. Social media platforms emerged, allowing users to generate and share content, further contributing to the data explosion.

Evolution of Data Collection and Storage

As computing power increased and technology advanced, businesses began digitizing their records and processes, leading to more efficient data management. The rise of the internet in the 1990s marked a significant turning point in data collection and accessibility, enabling unprecedented data exchange and collaboration. Cloud computing further revolutionized data management by providing scalable, cost-effective storage solutions.

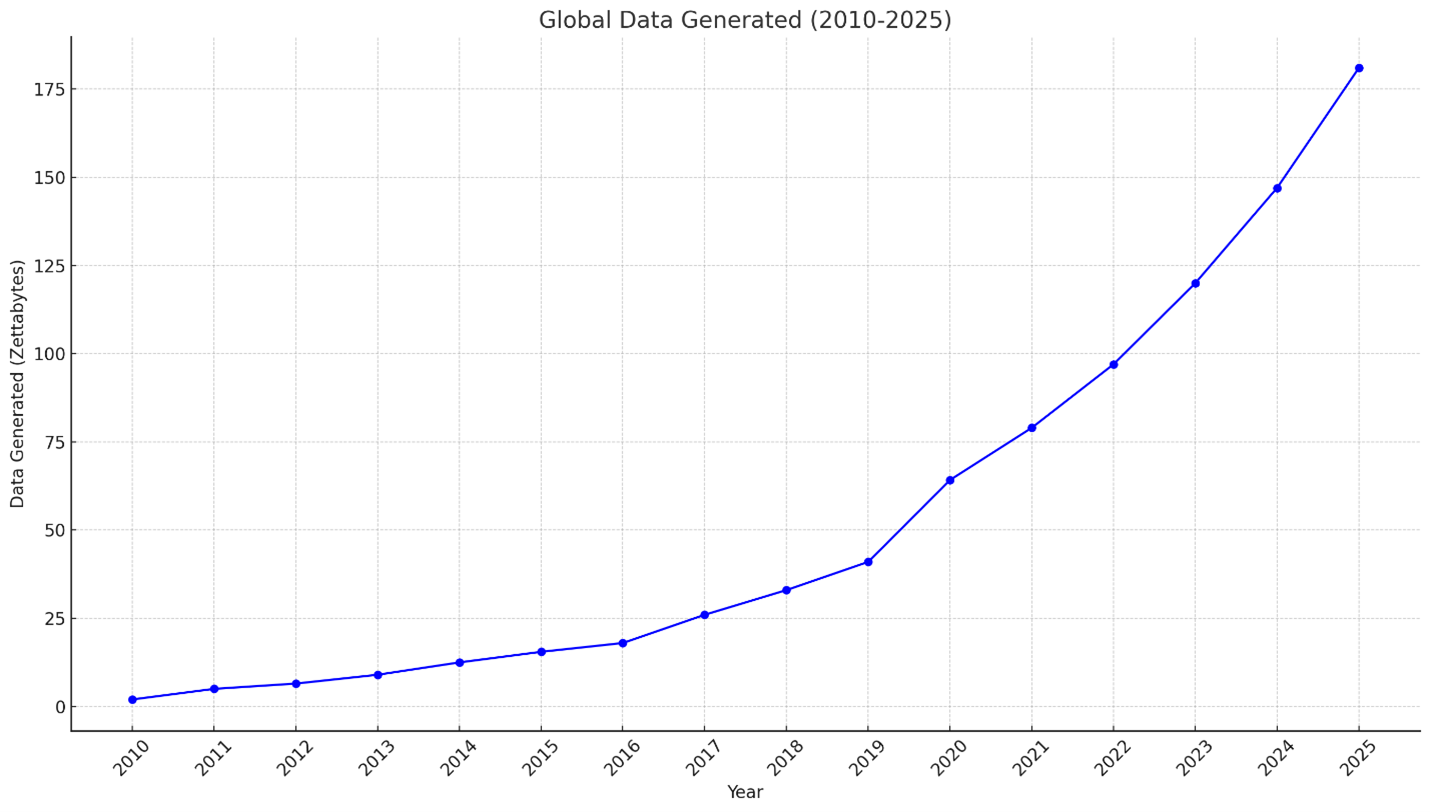

Figure 2. Source

The exponential growth of data in the internet era has been staggering, with global data volume reaching over 120 zettabytes in 2022 (one zettabyte is equal to one billion terabytes).

To effectively harness the power of data, organizations must implement robust data management practices, including regular data audits, secure storage solutions, and compliance with privacy regulations. Raw data must be cleaned, organized, and analyzed to extract meaningful insights that can drive business decisions and innovation. As data continues to grow exponentially, the importance of advanced storage technologies and effective data management practices will only continue to increase, powering the AI revolution and shaping the future of technology.

The Role of Data in AI and Machine Learning

Data is the cornerstone of artificial intelligence (AI) and machine learning. These technologies rely on vast amounts of high-quality data to train models and make accurate predictions. The more data an AI model is exposed to, the better it can learn and generalize to new situations.

“The exponential growth of digital data has been a key driver of the AI revolution. Andrew Ng, co-founder of Coursera and former head of Google Brain, stated, “As data sets have grown larger, more intricate machine learning techniques can be applied to them to find patterns buried in that data.”

Data Quality is Just as Important as Data Quantity

To ensure the effectiveness of AI models, data must be accurate, relevant, and representative of the problem at hand. This involves several key steps:

- Data cleaning: Removing or correcting inaccurate, incomplete, or irrelevant data points to improve data quality.

- Data validation: Verifying that the data meets specified criteria and is suitable for the intended purpose.

- Ensuring diversity and representativeness: Making sure that the data covers a wide range of scenarios and includes a fair representation of different groups to avoid bias.

Building a robust data pipeline is crucial for the success of AI projects. This involves automating data collection from various sources, establishing governance frameworks to ensure data quality and security, and investing in scalable storage solutions to accommodate the ever-growing volume of data.

Training Large Language Models Relies on Data Quality

By leveraging high-quality data, AI has achieved remarkable breakthroughs in various fields. In natural language processing, large language models like OpenAI’s GPT-4o and Meta’s Llama-3 have been trained on massive amounts of text (and now audio, image, and video) data, enabling them to generate human-like text and perform tasks such as translation and summarization. In computer vision, deep learning models trained on millions of images have achieved impressive results in object recognition and image classification.

As the world continues to generate more data, the potential for AI and machine learning will only grow. By harnessing the power of data, these technologies have the potential to transform industries, revolutionize scientific research, and create new opportunities for innovation.

Data in Business Analytics

Businesses have undergone a significant transformation in their approach to data management and utilization. The introduction of enterprise resource planning (ERP) systems in the 1990s marked a crucial milestone, enabling businesses to integrate and manage their core processes, such as finance, supply chain, and human resources, through a centralized database. This laid the foundation for more efficient data management and analysis.

Business analytics has emerged as a key driver of data-driven decision-making in this new era. By leveraging various types of analytics, businesses can gain a comprehensive understanding of their performance and make informed decisions.

Types of Business Analytics

- Descriptive analytics: This type of analytics focuses on interpreting historical data to understand past performance. It involves summarizing and visualizing data to identify trends, patterns, and anomalies. Descriptive analytics provides a foundation for understanding the current state of the business.

- Predictive analytics: Building upon descriptive analytics, predictive analytics uses statistical models and machine learning techniques to forecast future outcomes. By identifying patterns and relationships in historical data, predictive analytics can help businesses anticipate customer behavior, demand fluctuations, and potential risks.

- Prescriptive analytics: Taking analytics a step further, prescriptive analytics recommends actions to achieve desired outcomes based on data-driven insights. It involves using optimization and simulation techniques to evaluate various scenarios and determine the best course of action. Prescriptive analytics can help businesses make proactive decisions and optimize their strategies.

“To effectively implement advanced analytics, businesses need to develop a clear understanding of their objectives and invest in the right tools and talent. Hal Varian, Chief Economist at Google, emphasized, “The ability to take data — to be able to understand it, to process it, to extract value from it, to visualize it, to communicate it — that’s going to be a hugely important skill in the next decades.”

Varian’s quote highlights the importance of data literacy and the need for businesses to build a data-driven culture.

Build a Data-Driven Culture

By embracing business analytics and fostering a data-driven mindset, organizations can unlock valuable insights, make informed decisions, and gain a competitive edge in the market.

In the realm of corporate finance, data-driven insights can revolutionize the way companies approach mergers and acquisitions, capital allocation, and investment decisions. By leveraging advanced analytics techniques, such as scenario modeling and Monte Carlo simulations, finance professionals can evaluate various strategic options and optimize their decision-making processes based on data-driven evidence.

Actionable Tip: Implementing Advanced Analytics in Your Business

Incorporating these steps into your business strategy will help you effectively implement advanced analytics, driving informed decision-making and fostering a data-driven culture. |

Data Maturity: The Key to Unlocking AI’s Potential

For finance departments, the adoption of advanced analytics can lead to significant efficiency gains and cost savings. By automating routine tasks, such as financial reporting and data reconciliation, finance teams can free up valuable time and resources to focus on more strategic initiatives. Additionally, the use of AI-powered tools can help finance professionals identify cost optimization opportunities, such as identifying areas of wasteful spending or optimizing working capital management.

Achieving a high level of data maturity is crucial for businesses looking to fully leverage the power of AI. Data maturity refers to an organization’s ability to effectively manage, integrate, and utilize its data assets. It encompasses various aspects, such as data quality, governance, security, and the overall data culture within the organization.

Stages of Data Maturity

|

Data Governance

Improving data maturity is a multi-faceted process that requires a strategic approach. One of the key components is implementing robust data governance practices. This involves establishing policies, standards, and procedures to ensure consistent and reliable data management across the organization. Data governance helps to define roles and responsibilities, ensures data security and privacy, and promotes data transparency and accountability.

Data Quality

Data quality is another critical aspect of data maturity. Poor quality data can lead to inaccurate insights, flawed decision-making, and diminished trust in AI systems. Ensuring data quality involves implementing processes for data validation, cleansing, and enrichment. It also requires ongoing monitoring and maintenance to keep data accurate, complete, and up to date.

Data-Driven Culture

Fostering a data-driven culture is essential for achieving high levels of data maturity. This involves promoting data literacy and encouraging data-driven decision-making at all levels of the organization. It requires providing employees with the necessary tools, training, and support to effectively utilize data in their roles. A data-driven culture empowers individuals to embrace data as a strategic asset and leverage it for continuous improvement and innovation.

Ongoing Assessments

Assessing and improving data maturity levels is an ongoing process. It starts with conducting a thorough assessment of the organization’s current data capabilities and identifying gaps and areas for improvement. This assessment can be done using established data maturity models, such as the Data Management Maturity (DMM) model or the CMMI Institute’s Data Management Maturity (DMM) framework. These models provide a structured approach to evaluating an organization’s data maturity across various dimensions.

Initiative Roadmap

Once the assessment is complete, the next step is to develop a roadmap for addressing the identified gaps and improving data maturity. This roadmap should prioritize initiatives based on their impact and feasibility and align with the organization’s overall business strategy. It may include investments in data infrastructure, talent development, process improvements, and cultural change initiatives.

“Data is the new science. Big Data holds the answers.”

– Pat Gelsinger, CEO of VMware

By investing in data maturity, businesses can unlock the full potential of their data assets and harness the power of AI to drive innovation, improve decision-making, and gain a competitive edge in the market. It is a journey that requires commitment, collaboration, and continuous improvement, but the rewards are significant for those who embrace it.

Looking Ahead: The Future of Data and AI

As we look to the future, the rapid evolution of data technologies shows no signs of slowing down. Advances in data storage, processing, and analysis will continue to shape the landscape of AI, unlocking new possibilities for businesses to extract value from their data assets.

The future of finance is inextricably linked to the advancements in data and AI technologies. As blockchain and distributed ledger technologies gain traction, they have the potential to revolutionize financial transactions and improve transparency and security. Moreover, the integration of AI with robotic process automation (RPA) can streamline financial processes, reduce manual errors, and enhance compliance. Finance professionals who stay abreast of these emerging technologies and adapt their skills accordingly will be well-positioned to thrive in the data-driven future of finance.

The adoption of cloud computing will continue to accelerate, providing businesses with scalable and flexible data storage and processing capabilities. Cloud platforms offer a wide range of AI and machine learning services, making it easier for organizations to develop and deploy AI applications without the need for extensive in-house expertise. This democratization of AI will enable more businesses to leverage the power of data-driven insights and decision-making.

To stay competitive in this rapidly evolving landscape, businesses must prioritize data management, quality, and accessibility. Investing in modern data infrastructure, such as cloud platforms and data lakes, will be crucial for storing, processing, and analyzing large volumes of data efficiently. Implementing robust data governance practices and ensuring data quality will be essential for building trust in AI systems and making informed decisions.

To prepare for future data and AI advancements, businesses should stay informed about emerging trends and technologies. This involves actively monitoring industry developments, attending conferences and workshops, and collaborating with academic institutions and research organizations. By staying at the forefront of technological advancements, businesses can identify new opportunities, adapt to changing market conditions, and gain a competitive edge.

The future of data and AI is filled with both challenges and opportunities. As data continues to grow in volume, variety, and velocity, businesses that can effectively harness its power will be well-positioned to drive innovation, improve decision-making, and create new business models. By embracing the potential of data and AI, organizations can unlock new insights, streamline operations, and deliver greater value to their customers.

Additional Resources

AI for Finance: Top AI Tools for a Finance Professional

Artificial Intelligence in Finance & Banking

Leveraging Generative AI for Financial Analysis

Create a free account to unlock this Template

Access and download collection of free Templates to help power your productivity and performance.

Already have an account? Log in

Supercharge your skills with Premium Templates

Take your learning and productivity to the next level with our Premium Templates.

Upgrading to a paid membership gives you access to our extensive collection of plug-and-play Templates designed to power your performance—as well as CFI's full course catalog and accredited Certification Programs.

Already have a Self-Study or Full-Immersion membership? Log in

Access Exclusive Templates

Gain unlimited access to more than 250 productivity Templates, CFI's full course catalog and accredited Certification Programs, hundreds of resources, expert reviews and support, the chance to work with real-world finance and research tools, and more.

Already have a Full-Immersion membership? Log in