- Separating AI Fact from Fiction

- Current Applications of AI in Finance

- Interactivity and Accessibility of Financial Data

- Upskilling and Reskilling for AI

- Future Outlook of Generative AI in the Financial Services Industry

- Challenges and Ethical Considerations of AI

- The Path Forward with AI

- Navigating the AI Revolution

Leveraging Generative AI for Financial Analysis

Separating AI Fact from Fiction

With all the hype around artificial intelligence (AI), it can be difficult to separate fact from fiction when it comes to what capabilities are available today vs. what might be available soon. We see its potential, but for many, it is unclear how we can leverage it to improve our work right now.

While the technology is rapidly evolving and implementation of AI systems may become much easier in the coming years or even months, tech-minded finance professionals can already leverage the power of generative AI to automate manual tasks, enhance workflows, and perform detailed financial analysis and forecasting.

It is possible today to integrate AI into existing finance technology stacks (e.g. ERP, CRM, AP/AR systems), which is already starting to revolutionize the way we work in finance and accounting.

Key Highlights

- Artificial Intelligence (AI) is currently being utilized to automate routine tasks in financial analysis, ratio analysis, and reporting, significantly reducing the time required for these activities.

- AI can be integrated into existing financial systems like ERP and CRM to enhance financial planning, analysis, and decision-making processes.

- AI tools aid FP&A professionals in activities like budgeting and variance analysis, improving accuracy and predictive capabilities which help in forecasting future performance.

Current Applications of AI in Finance

Tech-forward enterprises have been using AI in the form of machine learning algorithms for more than a decade in their financial analysis and modeling.

Companies that have been using this technology have a leg up on those who don’t, as they have already had to aggregate and organize their data to power these sophisticated algorithms. This same work will be required by companies that have not yet entered the era of data-driven decision-making.

Financial Planning and Analysis

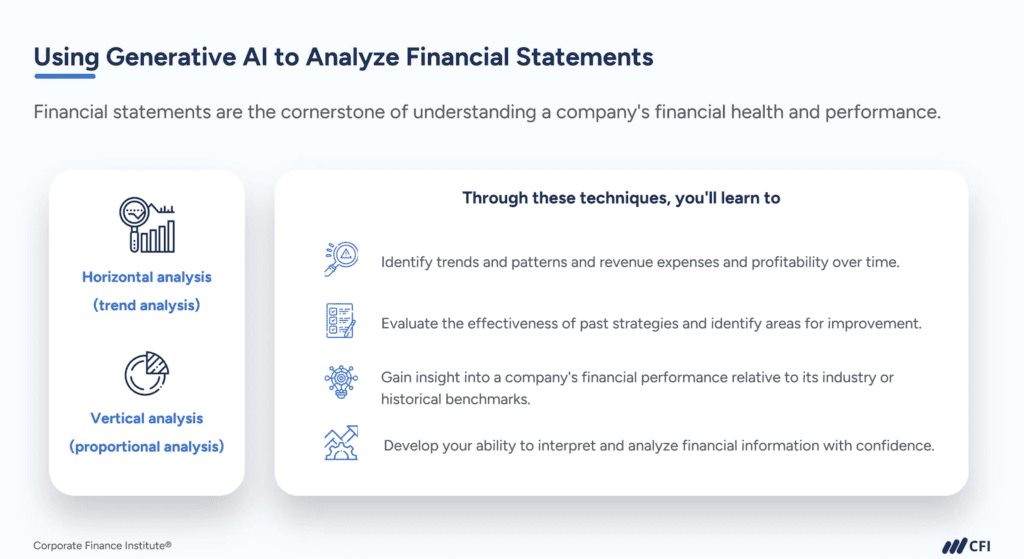

Existing generative AI technology can already be applied to several areas of Financial Planning & Analysis (FP&A). Daily tasks like financial ratio analysis and financial statement analysis, variance analysis, and reporting can be completed in a fraction of the time using tools like OpenAI’s Data Analyst tool to provide insights into a company’s financial health. AI is also transforming financial review processes, enabling more efficient monthly and quarterly reviews through automated horizontal and vertical analysis.

Budgeting and Variance Analysis

In budgeting and variance analysis, AI tools can identify patterns and anomalies, improving accuracy and providing explanations for variances. Moreover, AI is enhancing forecasting techniques and predictive analytics to better forecast future performance, allowing finance professionals to develop sophisticated forecast models that can adapt to changing market conditions.

Performance Metrics and KPIs

The tracking and analysis of performance metrics and KPIs by AI-powered tools brings a new level of depth and understanding of these indicators — allowing users to quickly and easily compare their company’s performance against industry benchmarks. These companies are able to gain insights beyond those using traditional dashboards and reporting.

Interactivity and Accessibility of Financial Data

By linking generative AI-powered chatbots to financial data, finance professionals can interact directly with their company’s financial statements (Income Statement, Balance Sheet, Statement of Cash Flow), general ledgers, and management reports to gain deeper insights. In this environment, AI is democratizing financial data, making it more accessible and understandable for all levels of an organization’s management.

Interactive financial management tools powered by AI allow real-time interaction with financial statements and operational data, enabling users to drill down into specific areas of interest and gain valuable insights. Further, self-service analytics, made possible by AI, empowers non-financial managers to access and analyze financial data independently, fostering data-driven decision-making across the organization.

Using Generative AI in Financial Analysis

This is not a future promise, but a reality that is available today. CFI’s online AI-Enhanced Financial Analysis course teaches learners how to effectively apply AI techniques to enhance financial analysis, making complex data more accessible and actionable in real-time decision-making.

The course provides in-depth training on how to use AI to generate detailed financial reports, optimize budget forecasts, and conduct precise risk assessments. Through practical examples and interactive content, participants learn to harness powerful AI tools to streamline processes and improve accuracy in financial operations.

Traditional financial analysis involves time-consuming work in Excel or other spreadsheet programs, and it can take hours of a financial analyst’s time just to compile the reports. This is before any true analysis has even started. The time and effort involved in assembling these reports can impact a company’s ability to make timely decisions.

Conversely, AI-assisted financial analysts can drastically reduce the amount of time spent analyzing financial statements by letting AI tools complete routine tasks such as ratio analysis, trend analysis, and sensitivity analysis, freeing up their time to provide greater value beyond compiling reports. Freed from the drudgery of report creation, analysts could shift their time and focus to tasks like data analytics and strategic planning.

Upskilling and Reskilling for AI

As the corporate finance landscape continues to evolve, finance leaders and professionals alike are increasingly recognizing the importance of upskilling to work effectively with AI technologies. While the adoption of AI in financial analysis and decision-making processes offers numerous benefits, it also presents new challenges for finance professionals. To fully capitalize on the potential of AI, individuals and teams must develop the necessary skills and knowledge to use these tools effectively.

Investing in continuous learning and development programs that focus on AI-related skills can help finance professionals stay ahead of the curve. Training on AI fundamentals, data analysis techniques, and the practical application of AI in financial processes can empower finance professionals to leverage these technologies confidently. AI skills can enhance individual career prospects, as well as a team or company’s overall AI competency.

AI Competency as a Competitive Advantage

This upskilling is mandatory to stay competitive in the new AI-powered world. As AI becomes more prevalent, companies need finance professionals who are well-versed in these technologies. With a deep bench of AI talent, companies are better positioned to make data-driven decisions, identify new opportunities, and optimize their financial strategies. This strategic advantage can translate into improved business outcomes, such as increased efficiency, cost savings, and better risk management.

However, it is essential to approach the upskilling process thoughtfully. Finance professionals and team leaders should assess their own or their team’s current skill levels and identify the specific areas where AI training would be most beneficial.

Imagine, for example, how valuable a skilled financial analyst could be with new AI superpowers. They should also consider the long-term goals of the organization and align the upskilling efforts with those objectives. Likewise, finance leaders can ensure that their teams are well-prepared to navigate the evolving landscape of corporate finance by taking a targeted and strategic approach to AI-focused learning and development.

Future Outlook of Generative AI in the Financial Services Industry

As AI continues to advance, we can expect to see even more transformative changes in finance and across all sectors. AI has the potential to revolutionize strategic financial decisions through advanced predictive capabilities, such as scenario planning and risk assessment. The convergence of AI with other technologies like blockchain and the Internet of Things (IoT) could also open up new possibilities for financial management and reporting.

For example, AI could analyze blockchain data to enhance security and transparency, automate smart contracts, and offer personalized financial services. Similarly, IoT data could be leveraged by AI for real-time financial forecasting, risk management, and ESG reporting. This convergence improves efficiency, enables adaptive business models, and provides reliable data for informed decision-making.

Transformative Potential

It is important to remember that the AI we’re using today is the worst we will see from this point forward. As transformative as it is, it will only get better. We are in a time similar to the early days of dial-up internet — we see the transformative potential but don’t yet know how it will manifest in our professional and personal lives. This increases the importance of working to make sure we understand and can use these nascent capabilities now and in the future.

Challenges and Ethical Considerations of AI

While the benefits of AI in finance are significant, there are also challenges and ethical considerations to address. Implementing AI solutions requires overcoming technical and organizational hurdles, such as data quality and security concerns. Ensuring the integrity and security of financial data is crucial when deploying AI tools.

Regulation and Compliance

Additionally, finance professionals must navigate ethical and compliance issues related to AI, such as algorithmic bias and the role of human oversight. Compliance with industry standards like SOC (System and Organization Controls) is essential to maintain trust and transparency in AI-driven financial processes.

This includes ensuring that AI algorithms are unbiased, fair, and aligned with regulatory requirements. Finance leaders must also establish clear guidelines for human oversight and intervention in AI decision-making processes, particularly in high-stakes scenarios.

Mitigating Bias Risk

It is important to realize as well that the ethical considerations surrounding AI extend beyond the finance industry itself. As financial institutions increasingly rely on AI for decision-making, there is a risk of perpetuating or even amplifying societal biases and inequalities. For example, AI algorithms used in credit scoring or loan approval processes may inadvertently discriminate against certain groups if the training data reflects historical biases.

Data Privacy and Security

Another critical aspect of responsible AI implementation in finance is data privacy and protection. As custom AI systems trained to work for a particular company would rely heavily on the sensitive financial data used by the model, ensuring the confidentiality and security of this information is paramount. This involves not only stringent cybersecurity measures but also clear data governance policies that outline how data is collected, stored, and used by AI algorithms.

The Path Forward with AI

Addressing these challenges and ethical considerations requires a proactive and collaborative approach. Finance professionals must engage in ongoing dialogue with regulators, industry peers, and academic experts to stay informed about best practices and emerging standards in AI governance.

They should also foster a culture of transparency and accountability within their organizations, encouraging open discussion about the ethical implications of AI and empowering employees to raise concerns or suggest improvements.

Navigating the AI Revolution

AI is changing the face of financial planning and analysis, offering new opportunities for efficiency, insight, and competitive advantage. To fully realize these benefits, it is imperative that finance professionals develop the skills and knowledge to work effectively with AI tools. This requires an investment in learning and development programs that cover not only the technical aspects of AI but also the ethical and compliance considerations.

Integrating AI into corporate finance is not without its challenges. Addressing issues such as algorithmic bias, data privacy, and the appropriate level of human oversight is crucial to maintaining trust and transparency. By tackling these challenges head-on and ensuring that AI is implemented responsibly, finance leaders can position their teams to thrive in an AI-powered world.

The future of finance is here, and it’s driven by AI. It’s up to everyone – finance professionals, leaders, and their teams – to seize this opportunity, embrace the necessary changes, and lead the way in shaping the industry’s future. With the right skills, mindset, and commitment to responsible AI adoption, the possibilities are endless.

Additional Resources

AI for Finance: Top AI Tools for a Finance Professional

Artificial Intelligence in Finance & Banking

What is Artificial Intelligence (AI)?

Create a free account to unlock this Template

Access and download collection of free Templates to help power your productivity and performance.

Already have an account? Log in

Supercharge your skills with Premium Templates

Take your learning and productivity to the next level with our Premium Templates.

Upgrading to a paid membership gives you access to our extensive collection of plug-and-play Templates designed to power your performance—as well as CFI's full course catalog and accredited Certification Programs.

Already have a Self-Study or Full-Immersion membership? Log in

Access Exclusive Templates

Gain unlimited access to more than 250 productivity Templates, CFI's full course catalog and accredited Certification Programs, hundreds of resources, expert reviews and support, the chance to work with real-world finance and research tools, and more.

Already have a Full-Immersion membership? Log in