What’s the Difference Between FP&A and Finance Controller?

As companies grow in size and complexity, they will often recruit for both FP&A and Finance Controller roles. This is particularly true for mid-sized to large corporations across pivotal industries like manufacturing, technology, healthcare, and retail.

In these cases, the FP&A role is to establish forward-looking insights through budgeting, forecasting, and analysis, while the Financial Controller is more oriented to ensuring accurate financial reporting, compliance, and internal controls.

Confusion can arise because both roles work with similar financial data and share responsibility for the company’s financial success. However, their focus and time horizons differ significantly. In this piece, we explain how a correct understanding of their distinct responsibilities leads to effective collaboration, which is crucial for strategic decision-making.

The Key Differences Between the Roles

We can clarify the key differences by comparing the two roles in terms of their analytical focus, the skills they develop, and the tools they use:

Analytical Focus

FP&A professionals are the company’s financial strategists, always looking ahead. They analyze trends, market data, and internal performance to forecast future financial outcomes. Their insights are used in budgeting, developing financial plans, and evaluating investment opportunities.

Financial Controllers, on the other hand, act as custodians of the company’s accounts and financial records, which means ensuring that the company’s historical data is correct and up to date. They ensure accuracy and compliance with accounting standards and maintain internal controls to prevent fraud and errors. This keeps risk manageable and protects assets.

Skills and Tools

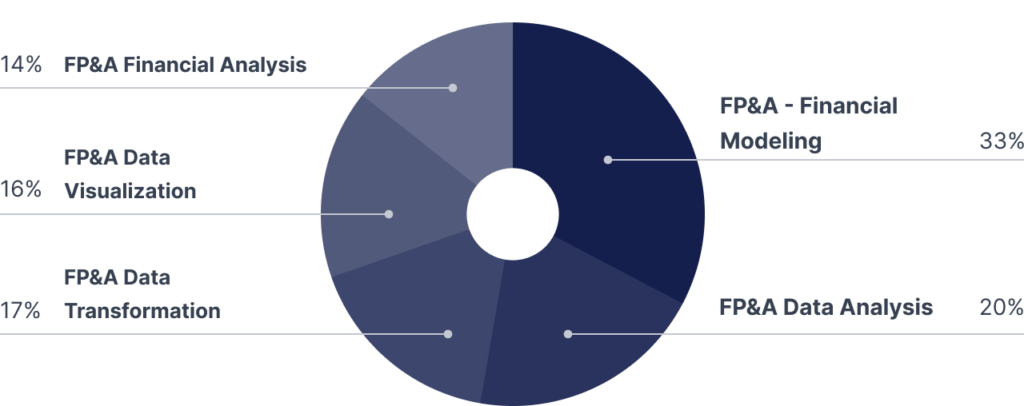

FP&A experts are adept at financial modeling, data analysis, and communicating complex financial information to non-financial stakeholders. They leverage advanced financial modeling software, business intelligence tools, and data visualization platforms to analyze data, solve specific problems, and create insightful reports.

Finance Controllers need a deep understanding of accounting principles and regulations, such as Generally Accepted Accounting Principles (GAAP), and must be proficient in financial reporting, auditing, and risk management. They utilize accounting software, ERP systems, and audit tools to maintain accurate financial records and to comply with regulatory requirements.

These differences are best reflected with examples of the tasks these finance professionals typically perform:

The FP&A team may be required to develop a five-year financial forecast to accompany a product launch. This would involve analyzing market research, estimating sales and production costs, and projecting profitability under various scenarios. Senior management would then use the recommendations to inform investment decisions and strategic planning for the launch.

A typical task for the Finance Controller would be overseeing the month-end financial close process. This would include ensuring all transactions are recorded accurately, reviewing account reconciliations, and preparing the monthly financial statements. The entire process must conform to local accounting standards and the company’s internal controls.

Different Career Trajectories

There is a hierarchy between the two positions in that the Financial Controller has greater responsibility and generally reports to the Chief Financial Officer, whereas FP&A teams often report to the Controller or a senior finance manager.

Controllers will have followed up their initial degree — in accounting or finance — by qualifying as a Certified Public Accountant (CPA), and many also hold a Master’s degree in Business Administration (MBA) or a Master’s in Accounting. They only enter the Controller position after several years of experience in accounting or auditing, passing through several levels of seniority.

The path to becoming an FP&A professional is more direct, often building on a bachelor’s degree in finance or economics with on-the-job experience at investment banks or in corporate finance positions. Many also pursue MBAs or specialized certifications like the CFI’s FP&A Specialization.

There is no direct transition from the FP&A role to the Controller role apart from acquiring the necessary accounting qualifications and experience. FP&A professionals, therefore, progress within their field, moving into senior analyst or managerial roles and potentially reaching the CFO position.

FP&A and Controller Roles in Detail

Let’s break down the tasks of each position in terms of their day-to-day activities:

Financial Controller Roles

- Risk Manager and Asset Protector: Financial Controllers safeguard the company’s financial well-being by reviewing and approving financial documents like invoices, expense reports, and journal entries. They also monitor internal control systems by reviewing access logs, segregation of duties, and reconciliation procedures.

- Financial Strategist: Controllers contribute to the organization’s strategic direction by providing financial expertise on accounting software implementations, module requirements, and desired changes. They ensure financial reporting aligns with strategic goals.

- Financial Operator: Controllers oversee daily financial operations, ensuring efficient processes for purchasing, payments, and record-keeping within the accounting software.

- Preparing Financial Statements: Controllers oversee the preparation of monthly, quarterly, and annual financial statements, working closely with the accounting team. This extends to the role of communicating with various stakeholders, including auditors, tax authorities, investors, and senior management.

- Program Catalyst: Controllers facilitate change by establishing and implementing new procedures. They ensure compliance with external reporting deadlines and regulatory requirements, acting as catalysts for financial progress.

FP&A Roles

- Financial Planner and Forecaster: The FP&A team plans budgets and forecasts future outcomes. They create financial models that consider internal and external factors to predict sales, profit, and overall financial health.

- Financial Reporter: FP&A prepares essential financial statements, including cash flow statements, P&L statements, variance reports, and board reports. They gather, verify, and consolidate data from various departments to calculate key financial metrics.

- Financial Analyst: FP&A conducts in-depth analysis to identify profitable product lines, assess departmental performance, and evaluate cost-effectiveness. They provide insights to support data-driven decision-making.

- Scenario Planner: FP&A explores various possibilities by modeling different sales and volume outcomes to understand their impact on the company’s financial condition. They provide insights into best-case, expected-case, and worst-case scenarios.

- Ad-hoc Reporter: FP&A generates on-demand reports to provide senior management with in-depth analysis of specific KPIs or business areas. Their timely and accurate insights support strategic decision-making.

How the FP&A Team and Finance Controller Work Together

While distinct in their focus and responsibilities, the FP&A team and the Financial Controller form a partnership that drives informed financial decision-making. Their collaboration ensures that the company’s financial health is both well-managed and strategically guided.

Let’s look at the main aspects of this symbiotic relationship:

Bi-directional Feedback

Both departments depend on input from the other. For example, FP&A professionals rely heavily on the accuracy and completeness of historical financial data provided by the Finance Controller, and the Finance Controller uses FP&A’s forward-looking insights to put company history into perspective. By understanding potential trends, risks, and opportunities identified by FP&A, the Controller can proactively manage financial resources, implement necessary controls, and ensure compliance.

Ensuring Data Accuracy

Collaboration also ensures that the same financial data is used for both historical reporting and future planning. Based on a holistic understanding of the company’s financial position, this consistency promotes transparency and accuracy in financial reporting and decision-making.

Teamwork in Practice

A good example of a collaborative FP&A-Controller relationship is the budgeting process. In this case, FP&A leverages historical financial data provided by the Controller to set realistic targets and identify areas for potential cost savings. The Controller, in turn, ensures that the budget adheres to accounting principles and internal controls.

Alternatively, when evaluating potential investments, FP&A creates financial models to project returns and risks, while the Financial Controller supports these analyses with insights into the company’s current financial position.

When the Two Roles Clash

Confusion can arise in functions like budgeting and performance analysis, where the FP&A and Finance Controller roles intersect. In these cases, both departments refer to the same financial data but with distinct perspectives: FP&A focuses on projecting future performance, while Financial Controllers report past results and financial statements. This can potentially lead to disagreements on the relevance of certain datasets, how they are interpreted, and what constitutes adequate financial reporting.

Additionally, shared responsibilities like budget preparation and variance analysis, coupled with potential communication gaps and ambiguous job descriptions, can create misunderstandings and inefficiencies. There may even be misunderstandings over hierarchical differences or power dynamics, which can foster a competitive rather than cooperative atmosphere.

Tips for Collaboration Between the Two Areas

While the two departments differ in their focus and skill sets, they must stay on the same page to effectively deal with present challenges and future opportunities. Some key points to foster the relationship include:

- Open communication: Regular interaction is the lifeblood of a successful FP&A-Finance Controller relationship. Both teams should actively share information, discuss potential risks and opportunities, and compare notes on financial planning and analysis initiatives.

- Shared tools and systems: Appropriate technology use can streamline information sharing, reduce errors, and promote transparency.

For example, the ERP system serves as a single source of truth for financial and operational data, whether historical or real-time. Specialized FP&A software integrates with the ERP system, allowing the team to share their analyses with the Controller.

It also helps if FP&A and the Controller use the same Business intelligence (BI) tools to visualize and analyze financial and operational data from different perspectives. And tools like shared drives, project management software, and chat platforms facilitate seamless communication between the two teams.

Build a Spirit of Partnership and Common Goals

In summary, the two-pronged approach of maintaining separate FP&A and Finance Controller roles can provide a solid foundation for financial stability and growth.

Fostering a collaborative culture that values teamwork, trust, and open dialogue helps both teams keep the company on a path of financial prudence and strategic vision.

However, the starting point is appropriate training and education. Your team can build the essential skills for FP&A roles with designations like CFI’s Financial Modeling & Valuation Analyst (FMVA®) certification or CFI’s FP&A Specialization. Training in Business Intelligence and Data Science can further enhance your skills and abilities.

Create a free account to unlock this Template

Access and download collection of free Templates to help power your productivity and performance.

Already have an account? Log in

Supercharge your skills with Premium Templates

Take your learning and productivity to the next level with our Premium Templates.

Upgrading to a paid membership gives you access to our extensive collection of plug-and-play Templates designed to power your performance—as well as CFI's full course catalog and accredited Certification Programs.

Already have a Self-Study or Full-Immersion membership? Log in

Access Exclusive Templates

Gain unlimited access to more than 250 productivity Templates, CFI's full course catalog and accredited Certification Programs, hundreds of resources, expert reviews and support, the chance to work with real-world finance and research tools, and more.

Already have a Full-Immersion membership? Log in