- What is Financial Planning and Analysis (FP&A)?

- Should You Work in FP&A?

- Potential income and salary for FP&A professionals: $50k to $1 million

- Decision-making and learning skills

- Reading and analyzing financial statements

- Project management skills

- Education and Certifications for Corporate Financial Analysts

- Best Work Experience for Aspiring Financial Analysts

- FP&A Within a Corporate Structure (and for Small Businesses)

- Financial Analyst Specialties

- Post-FP&A Career: Exit Strategies

- FP&A is an Important Role with Major Opportunities

What is FP&A?

How FP&A supports a corporation

What is Financial Planning and Analysis (FP&A)?

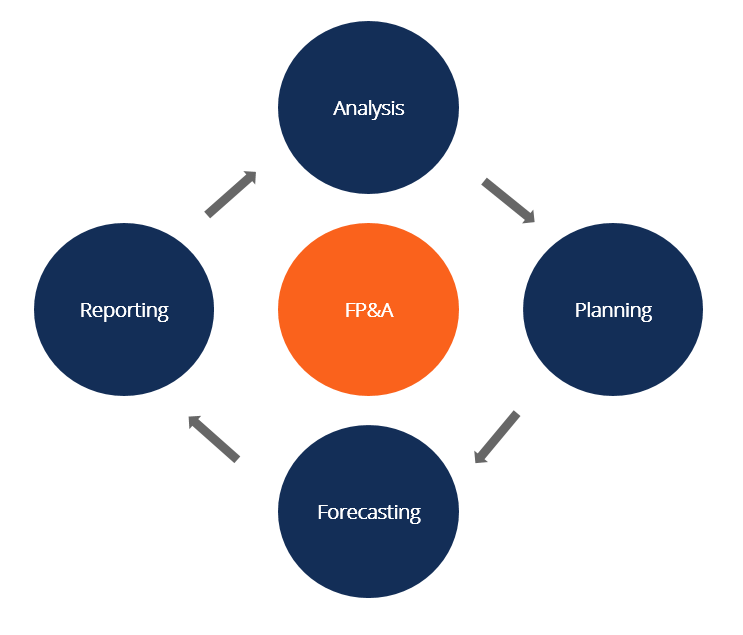

Financial Planning and Analysis (FP&A) teams play crucial company roles by performing budgeting, forecasting, and analysis that support major corporate decisions of the CFO, CEO, and the Board of Directors.

Very few, if any, companies can be consistently profitable and grow without careful financial planning and cash flow management. The job of managing a corporation’s cash flow typically falls to its FP&A team and its Chief Financial Officer (CFO). Read more about the role of the CFO.

Corporate financial planning and financial analyst professionals utilize both quantitative and qualitative analysis of all operational aspects of a company in order to evaluate the company’s progress toward achieving its goals and to map out future goals and plans. FP&A Analysts consider economic and business trends, review past company performance, and attempt to anticipate obstacles and potential problems, all with an eye toward forecasting a company’s future financial results.

FP&A professionals oversee a broad array of financial affairs, including income, expenses, taxes, capital expenditures, investments, and financial statements. Unlike accountants who are in charge of record-keeping, financial analysts are charged with examining, analyzing, and evaluating the entirety of a corporation’s financial activities, and mapping out the company’s financial future.

To learn more, launch CFI’s FP&A courses!

Should You Work in FP&A?

Good financial analysts are individuals capable of handling and intelligently analyzing a mountain of different types of data and data evaluation metrics.

Financial analysts are good problem solvers. They are able to decipher the various puzzle pieces that constitute a company’s finances and envision putting the pieces together to formulate a variety of possible growth scenarios.

If you just don’t like math or working with spreadsheets like Excel, you may want to consider an alternate career choice.

However, if you’re a creative problem solver, with a natural or cultivated talent for financial analysis, modeling, and forecasting, then becoming a corporate financial analyst may be the perfect career choice for you.

To see if a financial planning and analysis career is right for you, explore our Interactive Career Map.

Potential income and salary for FP&A professionals: $50k to $1 million

People who excel at the work of analyzing corporate finances and accurately identifying what financial moves a company should make in order to be optimally successful in an ever-changing marketplace are well paid for their skills.

Entry-level junior analysts command annual salaries in the neighborhood of $50k. Senior analysts can see a salary of up to $100k, usually combined with potential bonuses of 10-15%. A financial planning and analysis manager or director, and the Chief Financial Officer (CFO) at a major, multi-national company typically make somewhere between six and seven figures in salary, supplemented with sizable performance bonuses.

Compensation in the financial analysis field varies substantially between different industries and companies. Obviously, larger companies with larger profits can afford to pay more than a smaller company whose total net profit might not even reach seven figures.

Bonuses are usually very dependent on the company’s profits and/or the analyst’s skill in making accurate financial forecasts. (Of course, this can potentially lead to problems if an analyst creates overly conservative growth strategies designed primarily to ensure that profit targets are merely hit rather than maximized.)

Positions in corporate finance are projected to see annual job growth upwards of 20% through the mid-2020s.

Decision-making and learning skills

Although financial analysts have to evaluate a number of complex financial options and scenarios, they must also be capable of making firm decisions, being able to avoid having a vast array of financial choices paralyze them into indecision.

The desire to continually learn is an important personal strength for financial analysts. As businesses, markets, and economies change and adapt, so, too, must analysts continually change and adapt. In addition to honing financial skills and strategies, they are required to stay on top of business, industry, and economic trends. The best analysts are constantly learning more, becoming better and better at what they do.

Reading and analyzing financial statements

Corporate financial planning and analysis professionals are a group that has to be able to read and truly understand a company’s financial statements — balance sheets, cash flow statements, income statements, and in the case of public companies, shareholders’ equity statements.

A good analyst not only understands the meaning and implications of each individual financial statement, but also sees the larger picture of how a company’s total financial position is reflected by the combination of assets, liabilities, cash flow, and income.

A company’s financial analysis department needs to have an equal, if not better, grasp of accounting journal entries and financial reconciliation statements than the accounting department does. Analysts have to understand the interrelated aspects of debits and credits and be able to calculate and evaluate key financial ratios in order to determine where the company stands financially, and how best to move forward from there.

Project management skills

Financial analysts are also financial planners. Their purpose is to, based on research, data collection, and data analysis, advise a company’s management on the most financially efficient means of growing the company’s business and profits.

In putting together reports such as three-year and five-year financial projections, financial analysts are, in essence, constructing financial projects. Good financial analysts often bring to the table good project management skills, such as leadership, cost and time management, the ability to delegate, communication skills — and overall problem-solving skills.

Most financial analysts are well-schooled in using programs such as Microsoft Excel to create and analyze reports. Performing corporate financial analysis includes doing a great deal of data collection and data consolidation, and then generating numerous reports with lots of variables.

A lot of the work performed by financial analysts involves examining key financial metrics, such as profit margins, sales volume, and inventory turnover, and then utilizing the analysis to create strategic financial planning to move the company forward to the next level of profitability.

Education and Certifications for Corporate Financial Analysts

Aspiring corporate financial analysts can follow a number of educational paths to success in the industry. Degrees commonly held by analysts include accounting, business administration, statistics, and finance. The logical post-graduate course of study for financial analysts is an MBA degree.

CFI offers professional FP&A courses, along with continuing education training, all online. Having a certification from CFI helps with landing jobs, securing promotions, and being able to command higher levels of compensation.

Some corporate financial analysts also seek professional certification in the arena of investing, obtaining credentials such as Certified Financial Planner (CFP), Financial Risk Manager (FRM), or Financial Modeling and Valuation Analyst (FMVA).

Explore all CFI courses now to start advancing your career!

Best Work Experience for Aspiring Financial Analysts

The best practical work experience outside of direct financial analysis work is anything that shows you’ve demonstrated the ability to help a company grow, especially in a cost-efficient manner. That might be anything from boosting sales by doing a good window display, to reducing overhead costs through a total revamping of a company’s inventory system.

Virtually any general business experience that highlights your ability to solve problems and increase profitability can be a major plus on your resume when applying for work as a corporate financial analyst.

Working at a bank or at a public accounting firm can be a great way to get into FP&A.

FP&A Within a Corporate Structure (and for Small Businesses)

In a small business, the position of the corporate financial analyst may not exist as a separate job title, but instead effectively be held by the owner, CEO, CFO, or company controller.

Larger companies have a complete corporate financial analysis department, usually headed by either a Director of Financial Planning and Analysis or by the company’s Chief Financial Officer (CFO). Some companies have both positions, with the Director of Financial Analysis reporting to the CFO.

In a large corporate financial analysis department, entry-level junior financial analysts work in small groups headed by a senior financial analyst. In the largest, multi-national firms, junior analysts are assigned to evaluate a single product line, or perhaps even a single product. For example, if you worked as a junior analyst at The Hershey Company (NYSE: HSY), you might be assigned to produce all the relevant reports and recommendations regarding just one candy bar.

The chart below provides typical job responsibilities and compensation levels for major positions within the FP&A department of a large corporation.

| CFO or Director of FP&A |

Major Strategic Financial Planning | $700k plus bonuses |

| Senior Analyst or Manager |

Project Management; Analysis | $100k plus bonuses |

| Junior Analyst |

Specific Product(s), Department or Project Review | $60-70k (possible bonus) |

It typically takes about three to five years to make the transition from a junior to a senior financial analyst. Along the way, you might have the opportunity to showcase your skills, getting assigned the title of manager — in charge of a specific financial project, such as changing the way the company does inventory reporting or overseeing a substantial capital expenditure project.

Financial Analyst Specialties

There are various specializations available for corporate financial analysts. Some financial analysts eventually focus on handling company investments, while others apply their skills exclusively to obtaining the necessary funding for growth projects.

When looking at employment opportunities as a financial analyst, think about what sort of role and environment you’d be happiest and most comfortable in. Some individuals prefer a large corporation with clearly established career paths and the opportunity to gradually climb the ladder at a solidly established company. Others prefer the challenge of helping a smaller company navigate its way through a period of rapid growth, even if it requires wearing a lot more hats in terms of job responsibilities.

One significant change in the industry is the increased focus on financial regulatory matters. The Sarbanes-Oxley Act of 2002 in the United States, along with other new, related legislation (and similar laws in other countries) means that the financial personnel in companies have to devote a lot more time and attention to meeting fiduciary and other regulatory obligations, such as increased reporting requirements. If you’ve got a gift for dealing with government bureaucracies — specifically, regulators – that’s a valuable skill asset in today’s corporate world.

Post-FP&A Career: Exit Strategies

There’s a fair amount of disagreement about existing exit opportunities within the corporate finance industry. Nonetheless, there are some frequently traveled paths for professionals who have worked in financial planning and analysis.

A majority of corporate financial analysts remain in the industry but pursue new challenges (and higher salaries) by moving from one company to another.

Approximately 10% of corporate financial analysts eventually transition themselves into the fields of either investment banking or private equity. Another 10% move into some other area of corporate management, such as sales and marketing or human resources.

About 20% of financial analysts end up going into business for themselves, becoming private business consultants.

FP&A is an Important Role with Major Opportunities

Because the work of corporate financial analysis encompasses such a broad range of activities, and also because the work is so critically important to a company’s growth and basic financial survival, corporate financial planning and analysis (FP&A) is a career path that offers a wide variety of opportunities and higher than average compensation. With the proper skill set and a natural inclination for the work, you can carve out a very satisfying career for yourself as a corporate financial analyst.

Corporate FP&A plays a major role in supporting decisions made by a company’s CEO, CFO, and executive leadership team. As such, the opportunity to add value in FP&A is huge, and having a good time in place can lead to a huge potential boost in cash business planning, including budgeting, forecasting, cash flow optimization, return on investment analysis, capital structure, and ultimately the value of the entire business.

Additional Resources

Create a free account to unlock this Template

Access and download collection of free Templates to help power your productivity and performance.

Already have an account? Log in

Supercharge your skills with Premium Templates

Take your learning and productivity to the next level with our Premium Templates.

Upgrading to a paid membership gives you access to our extensive collection of plug-and-play Templates designed to power your performance—as well as CFI's full course catalog and accredited Certification Programs.

Already have a Self-Study or Full-Immersion membership? Log in

Access Exclusive Templates

Gain unlimited access to more than 250 productivity Templates, CFI's full course catalog and accredited Certification Programs, hundreds of resources, expert reviews and support, the chance to work with real-world finance and research tools, and more.

Already have a Full-Immersion membership? Log in