- What is Insurance?

- What are Financial Statements for Insurance Companies?

- What does Float Mean for an Insurance Company?

- Key Components of Insurance Company Financial Statements

- Emphasis on Reserves

- Incurred But Not Reported (IBNR)

- Revenue Recognition

- Investment Income and Fair Value

- Importance of Financial Statement Analysis for Insurance Companies

- Key Financial Ratios for Insurance Companies

- Challenges in Financial Statement Analysis for Insurance Companies

Insurance Company Financial Statements: A Detailed Overview

Financial statements for insurance companies can look quite different compared to regular companies

What is Insurance?

Insurance is a financial product sold by insurance companies that protects people (and companies) from unexpected losses or damages. Insurance companies are able to offer this product by spreading individual risks among a large group of people, so if something bad happens to one person, like a serious car accident, the insurance company helps cover the cost of repairs or replacement. In exchange for paying an insurance premium, people gain greater financial security, knowing they won’t face the significant financial burden alone.

What are Financial Statements for Insurance Companies?

The main financial statements for insurance companies are the same as most other companies: (1) the balance sheet, (2) the income statement, and (3) the cash flow statement. Each of the financial statements provides important financial information for both the internal and external stakeholders of an insurance company.

Notice that the balance sheet is the first financial statement in the above list. This is different from how we normally list financial statements. That’s because, as a financial institution, insurance companies’ operations and income statements are heavily driven by their balance sheets, more so than regular companies that produce physical goods or services.

That’s not to say that the balance sheet is the only financial statement that matters. Like all other companies, financial analysts use all three core financial statements to analyze the results and health of insurance companies.

Understanding the financial health of insurance companies is essential, not just for the companies themselves, but also for investors, regulatory bodies, and the broader economy. It’s also important for insurance companies’ clients, who want to be sure the company can honor its obligations when accidents happen.

Key Highlights

- Insurance companies underwrite policies to help people and companies better manage risk. In exchange for paying a premium, people and companies obtain better financial security when faced with a loss that’s covered by the insurance policy.

- Insurance companies use “float” to invest in securities to generate investment income. Float is created by insurance premiums, which are paid before claims are made. This float is a source of low-cost financing for the insurer.

- Insurance companies typically invest the float in high-quality and liquid fixed income investments.

What does Float Mean for an Insurance Company?

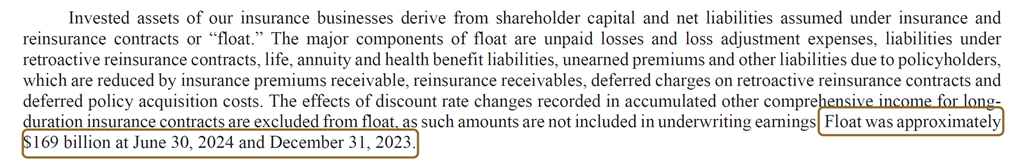

An insurance company’s “float” is a very important topic to understand and is critical to understanding an insurance company’s business model.

What is Float?

Float refers to the premiums paid by customers to insurance companies. These funds are not immediately paid out as insurance claims. Instead, insurance companies use the float to invest in securities to generate investment income. Unlike banks, which sometimes will pay interest to depositors, insurance companies do not normally pay interest on premiums to customers. Because of this, insurance premiums effectively provide a source of low-cost or even free financing to the insurance company.

Below is an excerpt from a recent filing by Berkshire Hathaway, which has a large insurance operation.

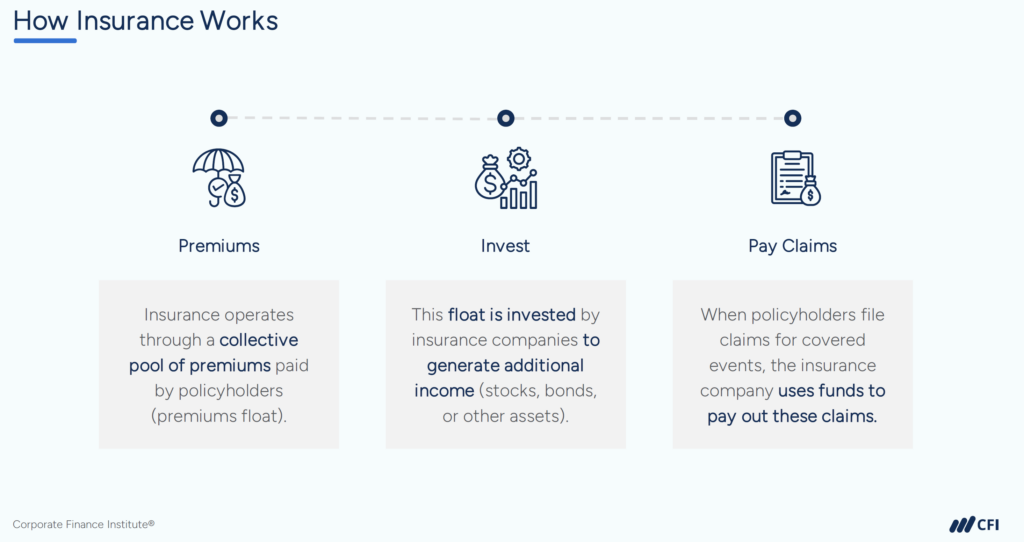

How is Float Used?

Insurance collects a pool of insurance premiums paid by policyholders, forming the float. The float is then invested by insurance companies to generate additional income, typically through bonds, stocks, and other assets.

When policyholders file insurance claims for covered events such as accidents or property damage, the insurance company uses funds from the float to pay out these claims. And by spreading risk across a large group and investing premiums, insurance companies ensure they have the financial resources to fulfill their obligations to policyholders while also earning investment returns to sustain their operations and grow their businesses.

Key Components of Insurance Company Financial Statements

Emphasis on Reserves

Because claims are very hard to predict, insurance companies must maintain adequate reserves to cover claims. This is both a practical requirement as well as a regulatory requirement. These reserves are in the form of equity, or share, capital.

Equity acts as a buffer against greater-than-expected losses. The proper amount of equity buffer is determined by applicable regulatory authorities as well as the insurance company’s internal modeling.

Incurred But Not Reported (IBNR)

As discussed previously, claims are very hard to predict. Even after an accident occurs it can take a while before the insurance company is even notified. Additionally, the insurance company will usually want to investigate any claims to make sure they are proper, covered, and not fraudulent. Because of these factors, it’s difficult for the insurance company to estimate any claims-related expenses. However, the insurer must do so in order to comply with the matching principle of accounting.

Because of this, insurance companies must estimate likely claims and record this as an expense on the income statement. This estimate is known as Incurred But Not Reported (IBNR). Since this is an estimate, it will eventually be adjusted up or down based on the actual claims that are incurred.

When claims are reported, they become part of the incurred claims costs. Combining this with IBNR reveals the total cost of claims in a given accounting period.

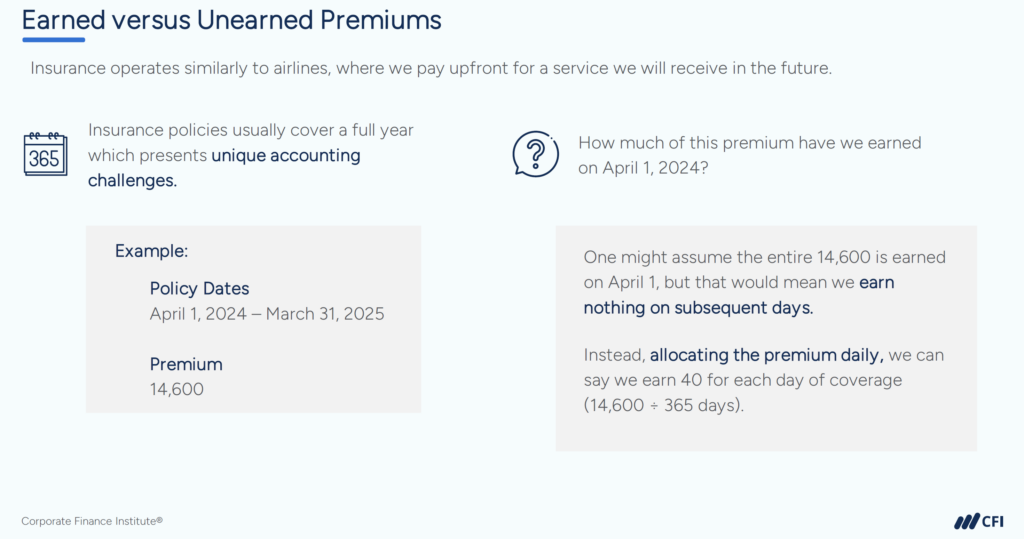

Revenue Recognition

The insurance industry operates similarly to the airline industry in that we pay upfront for a service that will be provided in the future. The general accounting principle is to allocate premiums over the policy period and not immediately upon the sale of the policy.

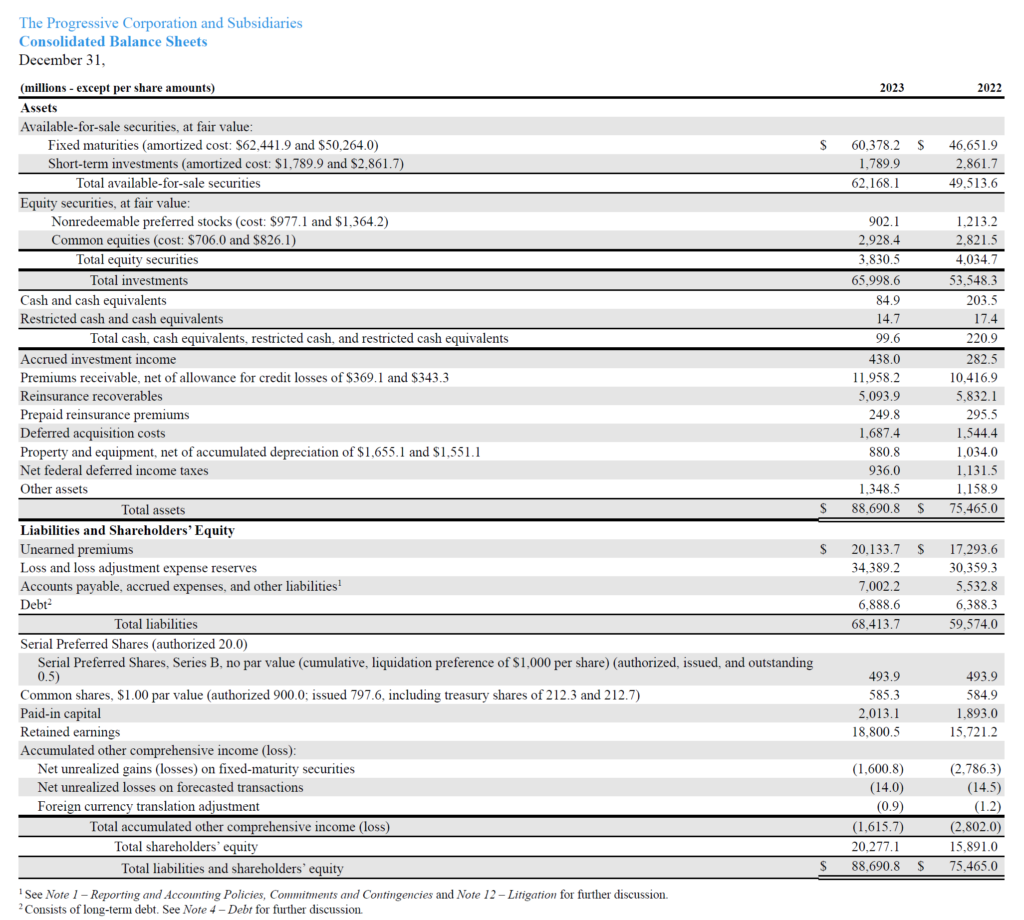

Investment Income and Fair Value

As discussed earlier, insurance companies receive premiums well before they are paid out in claims (float). In the meantime, insurance companies will invest that float into various investments to earn some income or gains. While the specific accounting standards may vary depending on the investment, many investments are measured at fair value. This means that if these investments increase in value, then the insurance company will show an unrealized gain on the income statement. Of course, if the investments fall, this will result in an unrealized loss.

Note that not all investments impact the income statement. Some unrealized gains or losses are recognized in other comprehensive income instead.

Importance of Financial Statement Analysis for Insurance Companies

It’s important to analyze insurance companies for multiple reasons:

Assessing Solvency

Insurance companies must be solvent so that they are financially able to fulfill any claims. As part of that, insurers must maintain adequate equity reserves and will generally invest in fixed income investments.

Fixed income investments, particularly high-grade bonds like government and corporate bonds, generally provide stable and predictable returns. The predictable cash flows from bonds helps ensure that funds are available when claims need to be paid.

Evaluating Profitability

In order to grow the business, as well as ensure they are able to pay claims, insurance companies need to be profitable. Profits can come in the form of underwriting insurance policies as well as from making profitable investments. Either way, profitability increases equity capital, making sure the insurer can honor its financial obligations.

Risk Management

Insurance is in the business of risk, so proper risk management is critical for insurance companies. Risk management is important for ensuring solvency and financial stability, properly understanding the risk of various claims (and correctly pricing those risks), regulatory compliance, and maintaining customer trust and reputation, among many other aspects.

Key Financial Ratios for Insurance Companies

An insurance company can be analyzed based on many of the same metrics that we would use when analyzing a regular, operating company. For example, return on equity could be calculated the same as with any other company. However, there are also various insurance-specific financial ratios. Some of the more common include the following:

Loss Ratio: The loss ratio is calculated by dividing the incurred losses by the earned premiums. The higher this ratio, the lower the insurance underwriting profitability and vice versa.

Expense Ratio: The expense ratio is calculated by dividing the costs associated with acquiring, underwriting, and servicing premiums by the earned premiums. Like the loss ratio, the lower this ratio the better.

Combined Ratio: This ratio is calculated by taking any expenses directly related to generating insurance premiums and dividing these expenses by the earned premiums generated in a specific period. Alternatively, the combined ratio can be calculated by adding the loss ratio to the expense ratio.

In other words, the combined ratio formula is (Commissions + Expenses + Claims) / Premiums. The higher this ratio, the less profitable the company is when underwriting insurance policies (and vice versa). Any investment income (or expense) is not included in this calculation so even a combined ratio of 100% or more doesn’t necessarily mean the insurer is losing money.

Underwriting Ratio: The underwriting ratio is simply one minus the combined ratio. If the combined ratio is 95%, then the underwriting ratio is 5% (1 – 95%). In other words, after all underwriting expenses, claims, and commissions, the insurer has 5% of earned premiums left.

Challenges in Financial Statement Analysis for Insurance Companies

Analyzing insurance company financial reports comes with many challenges:

- Complex Accounting Rules: A thorough understanding of industry-specific accounting rules is necessary to accurately evaluate an insurer’s profitability and operations.

- Estimating Financial Health: Accurately understanding an insurer’s financial health is critical to assessing whether the company is able to pay for claims. This requires the ability to accurately project future financial statements as well as a proper assessment of future claims.

- Reinsurance: The presence of reinsurance companies and reinsurance agreements further complicates understanding the risk that is ultimately born by the insurance company.

- Regulatory Differences: Insurance companies are very large and may operate in multiple jurisdictions with different regulatory requirements.

Additional Resources

Thank you for reading CFI’s guide on Insurance Company Financial Statements. To keep advancing your career and skills, the following CFI resources will be useful:

Create a free account to unlock this Template

Access and download collection of free Templates to help power your productivity and performance.

Already have an account? Log in

Supercharge your skills with Premium Templates

Take your learning and productivity to the next level with our Premium Templates.

Upgrading to a paid membership gives you access to our extensive collection of plug-and-play Templates designed to power your performance—as well as CFI's full course catalog and accredited Certification Programs.

Already have a Self-Study or Full-Immersion membership? Log in

Access Exclusive Templates

Gain unlimited access to more than 250 productivity Templates, CFI's full course catalog and accredited Certification Programs, hundreds of resources, expert reviews and support, the chance to work with real-world finance and research tools, and more.

Already have a Full-Immersion membership? Log in