The Strategic Importance of CAC Payback Period

Understanding and managing financial metrics is crucial for any business aiming for sustainability and growth. One pivotal metric is the Customer Acquisition Cost (CAC) Payback Period.

CAC Payback Period measures the time it takes for a business to recoup the investment made in acquiring new customers. Optimizing the CAC Payback Period can significantly impact a company’s cash flow and profitability, which is especially important in industries with high upfront marketing and sales costs, including SaaS businesses.

What is CAC Payback Period?

CAC Payback Period measures the time required for the revenue generated by a customer to cover the initial costs incurred to acquire that customer. It provides a straightforward gauge of how long a business must wait before it starts to profit from a new customer, emphasizing the efficiency of its marketing and sales efforts.

Why is CAC Payback Period Important?

Here are four main reasons why measuring and improving the CAC Payback Period is important to a business’s health.

1. Financial Efficiency: CAC Payback Period highlights the cost-effectiveness of a business’s customer acquisition strategies. A shorter payback period indicates a more efficient business model that allows for quicker recovery of acquisition costs, paving the way for potential profits or further investments.

2. Risk Management: Businesses with long CAC Payback Periods might struggle with cash flow, particularly if growth stalls or market conditions shift unfavorably. Managing and minimizing the payback period is crucial for financial stability.

3. Growth and Scalability: CAC Payback Period affects decisions related to scaling operations. Businesses with shorter payback periods can reinvest in growth initiatives sooner, such as expanding to new markets or creating new product lines.

4. Investor Expectations: Investors often evaluate a company’s CAC Payback Period to assess a company’s efficiency. A favorable payback period can improve a business’s ability to attract capital or financing.

How to Calculate CAC Payback Period

To calculate the CAC Payback Period, follow these steps:

1. Determine Customer Acquisition Cost (CAC): Calculate the total costs associated with acquiring new customers over a specific period and divide this by the number of customers acquired. Costs typically include marketing, sales staff, and any other direct costs related to customer acquisition.

2. Calculate new Monthly Recurring Revenue (MRR): The new and expansion revenue associated with new and existing customers in the period. The easiest method to find MRR is by calculating the MRR per customer.

3. Gross Margin: The value remaining after deducting direct costs (or cost of delivering the services) from revenue.

4. Compute the CAC Payback Period: Divide the CAC by (MRR Per Customer X Gross Margin). The result is the number of months it takes to generate enough revenue to cover the cost of acquiring the customer.

Examples of Calculating CAC Payback Period

To further clarify how to calculate the CAC Payback Period, let’s examine a few practical examples. These scenarios will illustrate how different business models and revenue streams can impact the payback period.

Example 1: Tech Startup

A tech startup spends $100,000 on sales and marketing activities in a quarter and acquires 500 new customers for a total of $50,000 on new monthly recurring revenue (MRR).

1. Determine the CAC: Divide the sales and marketing (S&M) expense ($100,000) by the total number of new customers (500).

CAC = $100,000 / 500 = $200 Per Customer

2. Determine MRR per customer: We find this by dividing the total new MRR ($50,000) by the number of new customers (500).

MRR = $50,000 / 500 = $100 Per Customer

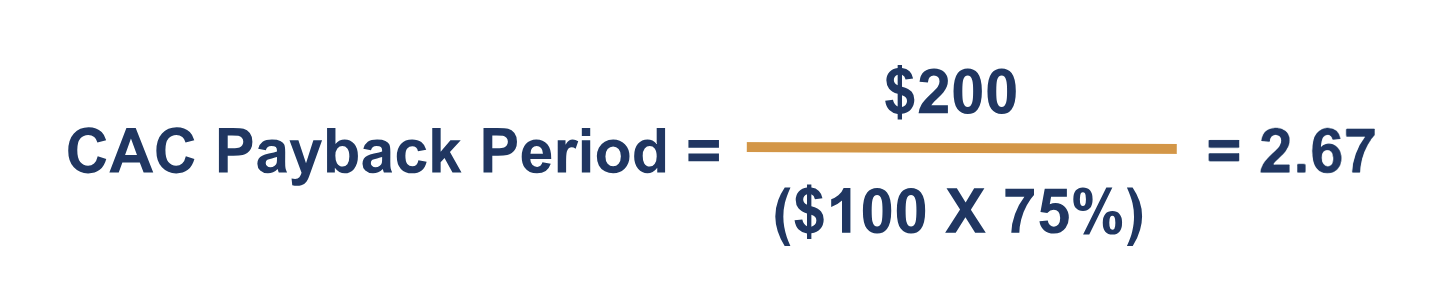

3. Calculate the CAC Payback Period: Assuming a gross margin of 75%, we can calculate the CAC Payback Period as follows.

Therefore, the CAC payback period for the startup, given the assumptions, is approximately 2.67 months. In other words, it takes about 2.67 months for the profit from a new customer to cover the cost of acquiring them.

Example 2: SaaS Provider

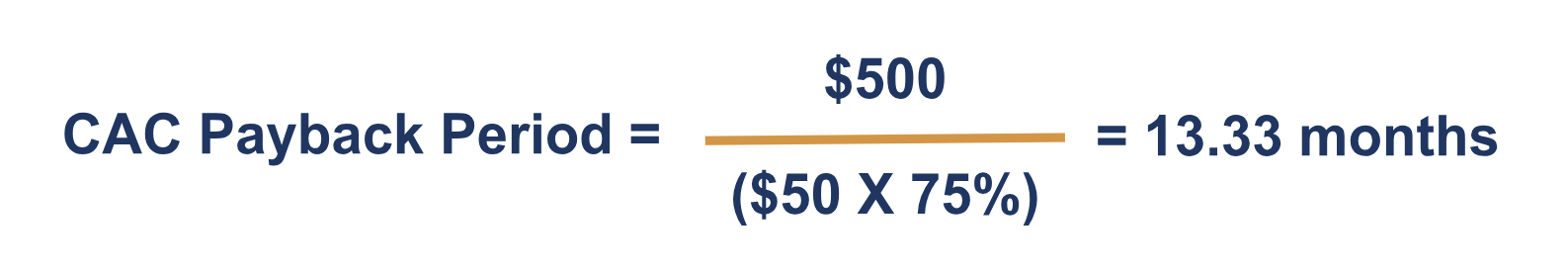

A SaaS provider spends $500,000 on customer acquisition. It gained 1,000 new subscribers and $50,000 in new MRR. Assume a gross margin of 75%.

- CAC = $500,000 / 1,000 = $500

- MRR Per Customer = $50,000 / 1,000 = $50

The CAC Payback Period is approximately 13.33 months, so it will take 13.33 months for the profit from a new customer to cover the cost of acquiring them.

Example 3: E-commerce Platform

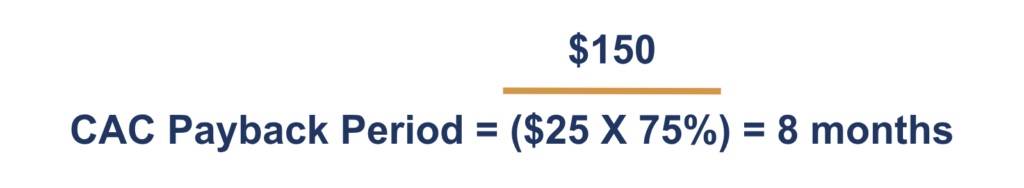

An e-commerce platform spends $300,000 on various marketing strategies, resulting in 2,000 new customers and $50,000 in new MRR. Assume a gross margin of 75%.

- CAC = $300,000 / 2,000 = $150

- MRR Per Customer = $50,000 / 2,000 = $25

The CAC Payback Period is approximately 13.33 months, so it will take 13.33 months for the profit from a new customer to cover the cost of acquiring them.

How Long Should a CAC Payback Period Be?

A strong target CAC Payback Period is generally less than 12 months, which indicates a healthy balance between growth and profitability. However, the ideal payback period can vary significantly depending on the business model and market dynamics.

For instance, a high-touch SaaS business with a substantial lifetime value (LTV) might tolerate a longer CAC Payback Period, as the return on each customer acquisition is greater over time. Conversely, a lower-margin eCommerce operation might require a quicker payback to remain sustainable.

The effectiveness of a company’s customer acquisition strategies also plays a critical role. More efficient strategies can significantly reduce the CAC, thus shortening the CAC Payback Period. A shorter CAC Payback Period contributes directly to the financial health and scalability of the business.

Additional Resources

Additional Resources

CFI is a global provider of financial modeling courses and of the FMVA Certification. CFI’s mission is to help all professionals improve their technical skills. If you are a student or looking for a career change, the CFI website has many free resources to help you jumpstart your Career in Finance. If you are seeking to improve your technical skills, check out some of our most popular courses. Below are some additional resources for you to further explore:

The Financial Modeling Certification

Analyst Certification FMVA® Program

CFI is a global provider of financial modeling courses and of the FMVA Certification. CFI’s mission is to help all professionals improve their technical skills. If you are a student or looking for a career change, the CFI website has many free resources to help you jumpstart your Career in Finance. If you are seeking to improve your technical skills, check out some of our most popular courses. Below are some additional resources for you to further explore:

The Financial Modeling Certification

Below is a break down of subject weightings in the FMVA® financial analyst program. As you can see there is a heavy focus on financial modeling, finance, Excel, business valuation, budgeting/forecasting, PowerPoint presentations, accounting and business strategy.

A well rounded financial analyst possesses all of the above skills!

Additional Questions & Answers

CFI is the global institution behind the financial modeling and valuation analyst FMVA® Designation. CFI is on a mission to enable anyone to be a great financial analyst and have a great career path. In order to help you advance your career, CFI has compiled many resources to assist you along the path.

In order to become a great financial analyst, here are some more questions and answers for you to discover:

- What is Financial Modeling?

- How Do You Build a DCF Model?

- What is Sensitivity Analysis?

- How Do You Value a Business?

Accounting Crash Courses

CFI is a global provider of financial modeling courses and of the FMVA Certification. CFI’s mission is to help all professionals improve their technical skills. If you are a student or looking for a career change, the CFI website has many free resources to help you jumpstart your Career in Finance. If you are seeking to improve your technical skills, check out some of our most popular courses. Below are some additional resources for you to further explore:

The Financial Modeling Certification

Boost your confidence and master accounting skills effortlessly with CFI’s expert-led courses! Choose CFI for unparalleled industry expertise and hands-on learning that prepares you for real-world success.

Create a free account to unlock this Template

Access and download collection of free Templates to help power your productivity and performance.

Already have an account? Log in

Supercharge your skills with Premium Templates

Take your learning and productivity to the next level with our Premium Templates.

Upgrading to a paid membership gives you access to our extensive collection of plug-and-play Templates designed to power your performance—as well as CFI's full course catalog and accredited Certification Programs.

Already have a Self-Study or Full-Immersion membership? Log in

Access Exclusive Templates

Gain unlimited access to more than 250 productivity Templates, CFI's full course catalog and accredited Certification Programs, hundreds of resources, expert reviews and support, the chance to work with real-world finance and research tools, and more.

Already have a Full-Immersion membership? Log in