- What is a Financial Modeling Course?

- The Importance of Financial Modeling in Finance and Banking

- Informed Decision-Making

- Applications in Valuation, Forecasting, and Risk Analysis

- Enhanced Career Opportunities

- Types of Financial Modeling Courses

- Beginner and Advanced Courses

- Industry-specific Courses

- General Courses

- Self-paced Online Courses and Instructor-led Programs

- Short-term Programs and Long-term Comprehensive Programs

- Software-specific Courses

- Criteria for Choosing the Best Financial Modeling Course

- How to Get the Most Out of Your Financial Modeling Course

- Conclusion

How to Choose the Best Financial Modeling Course

Mastering financial modeling is essential for anyone looking to pursue a career in finance. This makes choosing the right financial modeling course crucial, as the quality and depth of your course can significantly impact the next step in your career path. You want to equip yourself with the skills needed to excel in finance and make informed business decisions. The right course can help you accelerate your career by enhancing your analytical capabilities and giving you a competitive edge in the job market.

If you’re trying to determine the best financial modeling course to take, you’ll want to consider several things — starting with your current skill level and career goals. Once you align your objectives with the courses available, you’ll want to ensure that you choose a course that provides comprehensive content, hands-on practice with real-world case studies, and instructors who have industry experience — among other things.

With so many options available, selecting the most suitable course can be challenging. Below, we’ll explain what goes into financial modeling courses and how to choose the right one for your future goals.

What is a Financial Modeling Course?

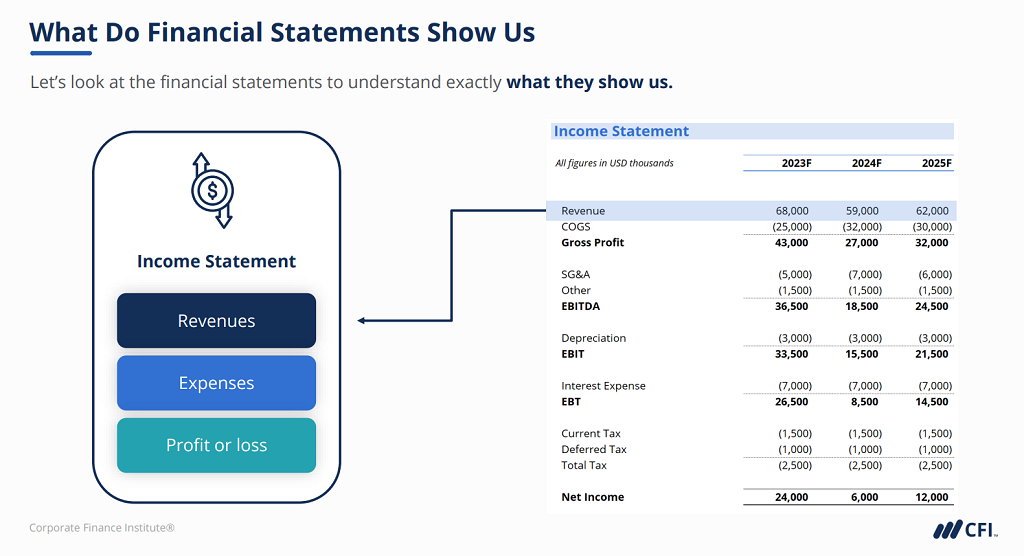

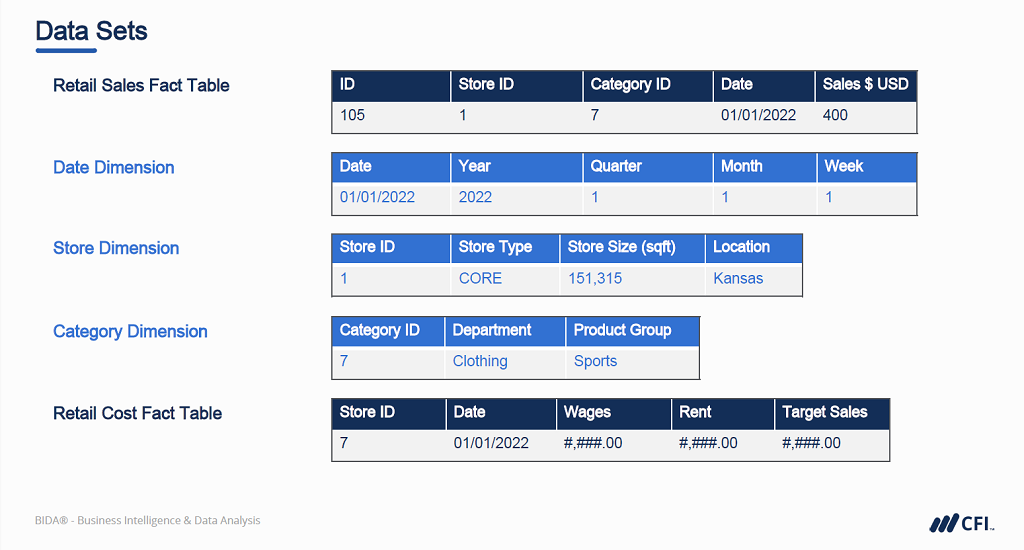

Financial modeling courses are designed to provide an in-depth view of creating mathematical representations of a company’s financial performance and training in the required skills. Most financial modeling courses focus on several types of models for measuring company performance, each serving specific purposes in finance and banking, including:

- Three-Statement Models: These integrate the income statement, balance sheet, and cash flow statement to provide a comprehensive view of a company’s financial position.

- Discounted Cash Flow (DCF) Models: Used for valuation purposes, DCF models estimate the value of an investment based on its future cash flows.

- Leveraged Buyout (LBO) Models: These are used to evaluate the financial impact of acquiring a company using a significant amount of borrowed money.

- Mergers and Acquisitions (M&A) Models: M&A models help analyze the financial impact of combining two companies or acquiring another business.

The skills you can expect to receive training for in these courses also include:

- Excel skills: Excel is the primary tool for financial modeling, and proficiency in It is a cornerstone of these courses.

- Accounting principles: Understanding financial statements and accounting concepts is crucial for building accurate models.

- Financial analysis techniques: Courses teach various methods to analyze financial data and make projections.

- Model structuring: You’ll learn how to efficiently organize and build different types of financial models.

- Projections and forecasting: A key component is creating future financial scenarios based on historical data and assumptions.

- Sensitivity analysis: Understanding how changes in variables affect the overall model is vital for robust financial planning.

The Importance of Financial Modeling in Finance and Banking

Understanding the significance of financial modeling in the finance and banking industry can help you appreciate the value of investing in a comprehensive course. Here’s what makes financial modeling integral to the industry:

Informed Decision-Making

Financial models provide a quantitative basis for making informed business decisions. They allow financial analysts and banking professionals to make the best possible recommendations regarding which business to invest or acquire capital by:

- Evaluating investment opportunities

- Assessing the financial viability of projects

- Comparing different strategic options

- Understanding potential outcomes before committing resources

By creating models that simulate various scenarios, finance professionals can make recommendations backed by data-driven insights, reducing the risk of costly mistakes.

Applications in Valuation, Forecasting, and Risk Analysis

Since financial models vary, they provide versatile applications that can be applied across different areas, such as:

- Valuation: Determining the worth of companies, assets, or investment opportunities.

- Forecasting: Projecting future financial performance based on historical data and market trends.

- Risk analysis: Identifying and quantifying potential financial risks to develop mitigation strategies.

- Capital budgeting: Evaluating long-term investment projects and their impact on the company’s finances.

- Strategic planning: Assessing the financial implications of different business strategies.

Enhanced Career Opportunities

Proficiency in financial modeling is highly valued across numerous financial roles, including:

- Investment banking: Financial modeling is used in investment banking firms for deal analysis, company valuations, and pitch-book preparation.

- Private equity: Certain financial models evaluate potential investments and monitor portfolio company performance in private equity firms.

- Corporate finance: Various financial models are used for budgeting, forecasting, and strategic decision-making in corporate finance.

- Financial planning and analysis (FP&A): Financial modeling works to create financial projections and support business planning.

- Equity research: Company analysis and stock recommendations rely on financial models for essential data.

Mastering financial modeling and its associated skills can lead to better job prospects, higher earning potential, and faster career progression within these fields.

Types of Financial Modeling Courses

When exploring your financial modeling course options, you’ll encounter several types. Each type of course specifically caters to a certain level of skills and goals. Understanding your options and which are best suited for you can help you choose the right course for your goals.

Beginner and Advanced Courses

Beginner courses typically cover basic Excel skills and simple models, while advanced courses delve into complex modeling techniques and industry-specific applications. Beginner courses would be ideal for those new to finance or with minimal financial modeling experience. Advanced courses are geared toward professionals and students with a firm grasp of financial models and who are ready to dive into the more challenging financial concepts.

Industry-specific Courses

Some financial modeling courses focus on specific sectors, such as real estate, energy, or tech startups. Here’s an example of what industry-specific financial modeling courses would cover in these sectors:

- Real estate: Focusing on property valuation, development feasibility, and REIT modeling.

- Energy: Covering oil and gas modeling, renewable energy project finance, and utility company analysis.

- Tech startups: Emphasizing metrics relevant to high-growth companies and venture capital valuation methods.

Finding a sector-specific financial modeling course will be in your best interest if your career goals involve a particular industry.

General Courses

These courses cover various modeling techniques applicable across various industries. This typically includes core financial statement modeling, valuation techniques, M&A modeling, and basic LBO modeling. These courses are ideal for those who are still deciding their actual career direction or who are looking to start diversifying their skills.

Self-paced Online Courses and Instructor-led Programs

Self-paced courses offer flexibility but require self-discipline. Instructor-led programs provide structure and direct interaction but may have fixed schedules. Choosing between a self-paced course versus an instructor-led course will depend on the type of courses available, your schedule, and how you learn.

Short-term Programs and Long-term Comprehensive Programs

Short-term programs offer intensive, short-term learning experiences, typically lasting only a few weeks. Long-term programs provide more in-depth coverage and practice over an extended period, such as an entire semester (three to four months). Short-term programs are often best for those interested in quickly acquiring a new skill or refreshing their knowledge. In contrast, long-term programs cater to those interested in making a career change or building a stronger foundation for their future career.

Software-specific Courses

While most courses focus on building Excel skills, some introduce specialized financial modeling tools like:

- Power BI for data visualization

- VBA for automating repetitive tasks in Excel

- Bloomberg Terminal for financial data analysis

Consider which platforms are most relevant to your career goals when deciding whether or not you need a software-specific financial modeling course.

Criteria for Choosing the Best Financial Modeling Course

With so many options and types of courses available, it can take time to determine which one is right for you. As you sift through your options, keep the following criteria in mind to ensure you make the right decision:

- Course content and depth: Look for courses that cover a wide range of models and provide in-depth explanations. The content should be comprehensive and up-to-date with current industry practices.

- Instructor expertise and background: Instructors with real-world experience in finance can provide valuable insights beyond textbook knowledge. Check their backgrounds and industry experience.

- Hands-on practice and real-world case studies: Practical application is crucial in financial modeling. Courses should offer plenty of exercises and case studies based on actual company data.

- Flexibility and accessibility: Consider whether the course format fits your schedule and learning pace. Some courses offer lifetime access to materials, which can benefit future reference.

- Cost and value for money: Compare the course fees with the depth of content and additional resources provided. Some courses may seem expensive but offer great value through extensive materials and support.

- Reviews and testimonials from past students: Check for feedback from previous students to gauge the course’s effectiveness and relevance. Look for specific comments about how the course helped in real-world applications.

How to Get the Most Out of Your Financial Modeling Course

Once you’ve chosen a course, maximizing your learning experience is the key to seeing a return on your investment. Here are a few types to get the most out of your financial modeling course:

- Set clear learning objectives: Define what you want to achieve from the course, whether a career change or skill enhancement. For example, are you looking for a career change or to enhance your skills for a specific role? This will help you focus on the most relevant aspects of the course.

- Create a study schedule: Allocate regular time for coursework to maintain consistency and progress. Treat the course like a real class or job responsibility by setting hard deadlines for completing modules or projects.

- Practice with real-world data and scenarios: Go beyond course exercises by applying learned techniques to publicly available financial data. For example, you can download annual reports of the companies you’re interested in working with to practice recreating their financial statements in your models. You can also try your hand at forecasting their future performance. This will enhance your understanding and prepare you for real-world applications.

- Network with instructors and peers: Building a network can lead to future career opportunities. So, engage in course forums or discussion groups to learn from others’ perspectives, attend live Q&A sessions regularly, and connect with classmates and professionals on networks like LinkedIn.

- Apply newly learned skills to personal projects or work assignments: Look for opportunities to use your new skills in your current job or personal investment analysis practices. Whether you volunteer your new skills for a local business or non-profit, create personal investment analysis models, or offer to help with financial modeling tasks at work, this practical application will reinforce your learning and demonstrate your new capabilities.

Conclusion

Choosing the best financial modeling course for your skill level and goals requires careful consideration. You can select a program that will significantly enhance your financial modeling skills by evaluating courses based on content depth, instructor expertise, practical application opportunities, and other vital criteria. Remember, the right course is an investment in your future, opening doors to exciting career opportunities and empowering you to make informed financial decisions.

If you’re interested in financial modeling, explore CFI’s extensive curriculum. Our Financial Modeling & Valuation Analyst (FMVA®) certification is industry-recognized and could be an invaluable next step in your professional development.

Create a free account to unlock this Template

Access and download collection of free Templates to help power your productivity and performance.

Already have an account? Log in

Supercharge your skills with Premium Templates

Take your learning and productivity to the next level with our Premium Templates.

Upgrading to a paid membership gives you access to our extensive collection of plug-and-play Templates designed to power your performance—as well as CFI's full course catalog and accredited Certification Programs.

Already have a Self-Study or Full-Immersion membership? Log in

Access Exclusive Templates

Gain unlimited access to more than 250 productivity Templates, CFI's full course catalog and accredited Certification Programs, hundreds of resources, expert reviews and support, the chance to work with real-world finance and research tools, and more.

Already have a Full-Immersion membership? Log in