- What is the Rule of 40?

- Why is It Called the Rule of 40?

- The Origins and Purpose of the Rule of 40

- How to Calculate the Rule of 40

- Revenue Growth Rate

- Profit Margin

- Download CFI's Free Rule of 40 Template

- Alternative Rule of 40 Calculation: The Weighted Rule of 40

- Why the Rule of 40 Matters for Finance Professionals

- Limitations and Criticisms of the Rule of 40

- Practical Applications: Using the Rule of 40 in Real-Life Scenarios

- Examples of How the Rule of 40 is Applied in Company Evaluations

The SaaS Rule of 40 Explained

The Rule of 40 is a simple calculation designed to quickly evaluate Software as a Service (SaaS) companies

What is the Rule of 40?

The Rule of 40 is a financial metric widely used in the Software-as-a-Service (SaaS) industry to assess the performance of a company. The formula itself contains only two metrics: 1) the revenue growth rate and 2) the profit margin. The Rule of 40 says that the sum of the revenue growth rate and the profit margin should be 40% or higher.

Because this metric takes into account both growth and profit, it allows investors and stakeholders a way to quickly determine whether a SaaS company is balancing growth with profitability.

To understand why the Rule of 40 is important, by combining a growth metric and a profit metric, analysts can consider whether the growth of the company or its profitability is sufficient to decide whether to invest or not. For example, if the company is growing sufficiently fast, then its current profitability is less important. Conversely, if a company is highly profitable, then a high growth rate is less important.

Keep in mind this metric does not eliminate a more thorough analysis and/or full valuation; it’s merely a “back-of-the-envelope” calculation to easily understand a SaaS company’s performance.

Key Highlights

- The Rule of 40 is a commonly used metric in the Software-as-a-Service (SaaS) industry. The rule says that the sum of the revenue growth rate and the profit margin should be 40% or higher for a well-performing SaaS company.

- The 40% threshold was created as a quick benchmark to determine if a company is balancing growth with profitability since a high investment in growth can reduce profits.

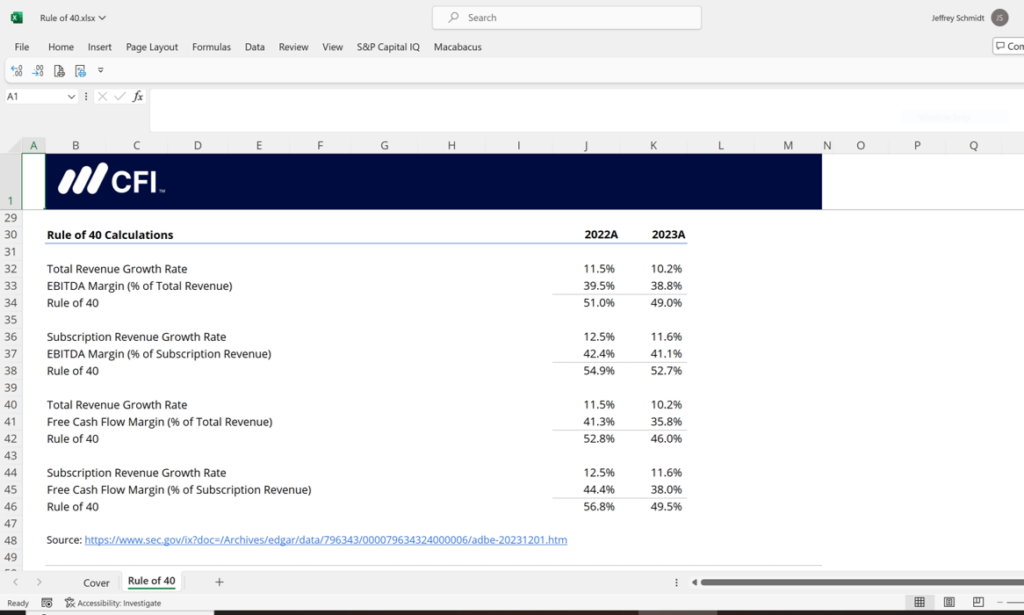

- There are different ways to calculate revenue growth, but most analysts favor using a recurring revenue stream. Additionally, there are different profit margin calculations, with EBITDA margin being the most common approach.

Why is It Called the Rule of 40?

The Rule of 40 derives its name from the idea that a SaaS company’s combined growth rate and profit margin should equal or exceed 40%. This 40% threshold was established to provide a quick benchmark for balancing growth and profitability since a high investment in growth can reduce profit margins.

The Rule of 40 is especially relevant in the SaaS industry because SaaS companies generate revenues through subscriptions. These subscriptions require building and maintaining long-term customer relationships and satisfaction. Therefore, investments in customer acquisition and product development are critical. This often puts growth and profitability at odds with one another so achieving high-growth and high profit margins can be challenging. The Rule of 40 is designed to eliminate this tension and serve as a measure that balances these distinct goals.

The Origins and Purpose of the Rule of 40

The origins of the Rule of 40 are rooted in venture capitalists assessing SaaS businesses for potential investment. The rule is particularly useful in the context of venture capital or private equity investment, where investors often seek a balance between short-term financial health with long-term growth potential.

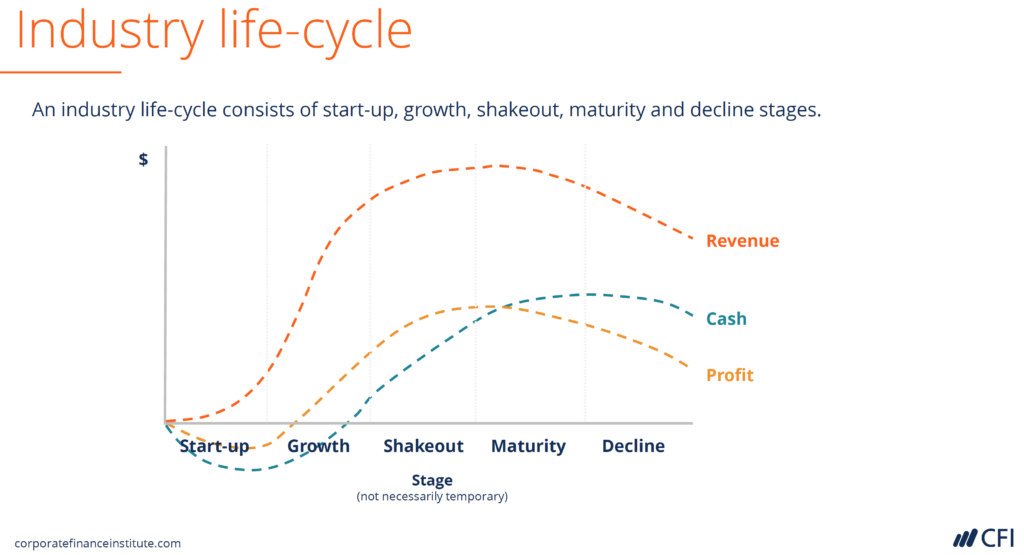

The rule also helps address the SaaS industry life cycle. Young, early-stage companies prioritize growth, which almost always comes at the cost of profitability. As companies mature, they tend to shift focus to profitability. The Rule of 40 helps contextualize these shifts and provides a way to evaluate a company at different stages of its life cycle.

How to Calculate the Rule of 40

Calculating the Rule of 40 is straightforward and only involves two key components: the company’s revenue growth rate and its profit margin.

The formula is:

Rule of 40 = Revenue Growth Rate (%) + Profit Margin (%)

For example, if a SaaS company has a revenue growth rate of 40% and a profit margin of 15%, the Rule of 40 would be calculated as follows:

Revenue Growth Rate of 40% + Profit Margin of 15% = 55%

Since the sum of the revenue growth rate and the profit margin is well above 40%, this SaaS company would likely be considered to be in very good financial health.

However, if the revenue growth rate was instead 10% with a profit margin of 15%, the Rule of 40 calculation would only equal 25%. This might lead an analyst to question whether the company is properly investing in growth.

Some other potential examples of the Rule of 40 include the following:

- Revenue Growth Rate of 20% + Profit Margin of 20% = 40%

- Revenue Growth Rate of 0% + Profit Margin of 40% = 40%

- Revenue Growth Rate of 40% + Profit Margin of 0% = 40%

Of course, the above scenarios are likely more preferable compared to a company with a 100% revenue growth rate but a negative 60% profit margin, which would technically meet the Rule of 40 (100% + -60%). Therefore, it’s important to remember that the Rule of 40 is just a benchmark and further analysis should be performed before investing.

Additionally, it’s important to understand the underlying metrics as well, since revenue growth can be calculated differently and there are ultimately different profit margins as well.

Revenue Growth Rate

The revenue growth rate represents the year-over-year increase in the company’s total revenue. However, it’s important to understand the SaaS business model and how there are different ways to generate revenues.

In general, SaaS companies generate revenues from:

- Subscription services (hence the name)

- Other services

Subscription Services

The main revenue stream for SaaS companies is the subscription-based model. Customers pay a recurring fee (typically monthly or annually) to access and use the software. The subscription-based model ensures a predictable and consistent revenue stream for the SaaS company.

This subscription revenue is usually calculated on a monthly basis in which case it’s known as monthly recurring revenue (MRR). Alternatively, recurring revenue can be calculated annually, in which case it’s known as annual recurring revenue (ARR).

Regardless, ARR or MRR only considers recurring revenue and does not include any one-time or variable fees.

Other Services

SaaS companies often generate additional revenues by offering other services alongside their core subscription service. These other services may include:

- Consulting Services: Some SaaS companies provide services such as custom integrations, migrations, or technical support for clients.

- Training: SaaS companies may offer training programs or certification courses, helping customers get the most out of the software.

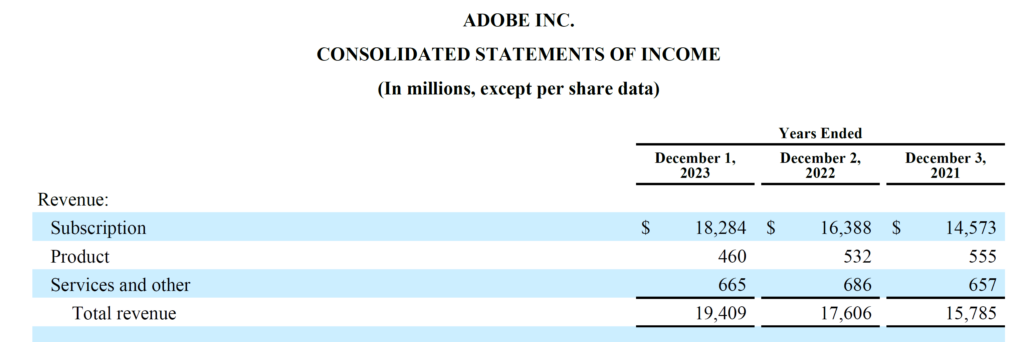

Since there are multiple different revenue streams and calculations, it’s important to calculate the revenue growth rate of the Rule of 40 consistently. In general, it’s better to use the recurring revenue stream to calculate the growth rate since it’s more predictable. The revenue growth rate can be calculated based on ARR or MRR if the company discloses those metrics (they are non-GAAP metrics so it’s possible a company may not report these numbers publicly). Alternatively, an analyst can use company-reported subscription revenue (as shown below from Adobe’s recent 10-K filing).

Profit Margin

Profit margin is the company’s profitability as a percentage of its revenue. The choice of which profit margin to use is also important, as there are different profit margin calculations.

Although profit margin can be calculated using net income or operating income, for Rule of 40 purposes, it is most common to use EBITDA (earnings before interest, taxes, depreciation, and amortization). The rationale behind using EBITDA is that earnings before interest and taxes (EBIT) are usually considered operating income and are not impacted by non-operating expenses like interest expense. Additionally, depreciation and amortization are non-cash expenses, so they are added back to EBITDA to derive a metric that is closer to cash flow than other profit margins.

Alternatively, some practitioners suggest using free cash flow to calculate the profit margin. While this is not a typical profit-margin calculation since free cash flow is not an income statement metric, it does capture the cash-generating potential of the company.

Download CFI’s Free Rule of 40 Template

Complete the form below to download our free Rule of 40 template!

Alternative Rule of 40 Calculation: The Weighted Rule of 40

An alternative approach to the standard Rule of 40 calculation is the Weighted Rule of 40. The Weighted Rule of 40 places greater emphasis on the growth portion of the calculation and less on the profit margin.

The calculation for the weighted rule is (1.33 x revenue growth) + (0.67 x profit margin). Basically, the weighted rule attributes twice as much value to growth as the profit margin (1.33/0.67 = ~2x).

Continuing the earlier example, if a SaaS company has a revenue growth rate of 40% and a profit margin of 15%, the Weighted Rule of 40 would be calculated as follows:

(1.33 x 40%) + (0.67 x 15%) = 63%

The Weighted Rule of 40 is generally better for smaller companies since revenue growth will happen before profitability.

Why the Rule of 40 Matters for Finance Professionals

The Rule of 40 provides a quick and intuitive way to assess a SaaS company’s financial performance. It’s user-friendly and allows finance professionals the ability to understand the balance between growth and profitability, which ultimately drives a company’s valuation.

Additionally, the Rule of 40 acts as a benchmark to compare company performance against other, similar companies as well as the overall industry. Because SaaS businesses often operate with different growth levels and profitability trajectories, the Rule of 40 allows finance professionals to compare companies of different sizes and life cycles.

The Rule of 40 can also serve as a guide for internal decision-making. Management teams can use the rule to ensure they are not sacrificing long-term profitability for short-term growth, or vice versa. The Rule of 40 provides a framework for balancing growth initiatives, such as launching new products, with the need to eventually generate profits for investors.

Limitations and Criticisms of the Rule of 40

Despite its popularity and ease of use, the Rule of 40 is not without its criticisms. The largest and most obvious criticism is that it oversimplifies a company’s financial prospects by focusing on just two metrics. While growth and profitability are important metrics, they may not tell the whole story of a company’s performance. For example, a company may meet the Rule of 40 but still have poor cash flow or high customer churn.

The Rule of 40 also does not account for differences in business models or life cycles. Early-stage SaaS companies may prioritize growth over profitability, while more mature companies may focus on profitability over growth. The Rule of 40 applies the same standard to both, which can lead to skewed analysis.

The Rule of 40 is generally better for more mature companies than startups. This is because younger companies will have more volatility in growth and profitability, resulting in large changes in the Rule of 40 calculation.

Finally, the Rule of 40 doesn’t distinguish between different types of growth. For example, a company could achieve high revenue growth by offering deep discounts or engaging in aggressive marketing efforts that may not be sustainable in the long term. Alternatively, a company might be able to achieve profitability by cutting essential research and development or customer acquisition initiatives, which could ultimately harm future growth.

It’s also important to note that many SaaS companies fail to achieve the Rule of 40. According to research by McKinney, only one-third of software companies achieve the Rule of 40. Furthermore, an analysis of more than 200 software companies between 2011 and 2021 found that only 16 percent of the time did businesses exceed the Rule of 40.

Practical Applications: Using the Rule of 40 in Real-Life Scenarios

The Rule of 40 is commonly used in practice. Some of the most common examples include the following:

- Venture Capital (VC): VC investors often use the Rule of 40 to evaluate SaaS companies as candidates for investment. A company that exceeds the Rule of 40 is likely to attract more interest since it can demonstrate a strong balance between growth and profitability.

- Mergers and Acquisitions (M&A): The Rule of 40 can help potential acquirers evaluate whether a company is an attractive target for an acquisition. A company that scores well on the Rule of 40 is likely a good target but will also command a higher valuation.

- Internal Performance Monitoring: SaaS companies can use the Rule of 40 as an internal benchmark or key performance indicator (KPI). For instance, company management might set goals to meet or exceed the Rule of 40, using it as a guide for strategic resource allocation, hiring, and expansion.

Examples of How the Rule of 40 is Applied in Company Evaluations

Many SaaS companies use the Rule of 40 as a KPI, either for internal purposes or as a metric for investors. Here are a couple of examples of how that may occur in practice:

Company A is an early-stage SaaS company that is growing rapidly, with an ARR growth rate of 60%. However, the company’s EBITDA margin is -20% due to significant investments in customer acquisition, product development, and sales and marketing efforts. Despite the negative margin, the company achieves a Rule of 40 score of 40% (60% growth + -20% margin), indicating that its growth justifies the (hopefully) temporary loss.

Company B is a more mature SaaS company than Company A. Company B has recently shifted its focus from aggressive growth to profitability. With a 20% revenue growth rate and a 25% profit margin, Company B achieves a Rule of 40 score of 45%. The balance of growth and profitability makes Company B attractive to investors.

In both cases, the Rule of 40 provides a quick assessment of the companies’ ability to balance growth and profitability.

Additional Resources

Thank you for reading CFI’s guide on the Rule of 40. To keep advancing your career and skills, the following CFI resources will be useful:

Create a free account to unlock this Template

Access and download collection of free Templates to help power your productivity and performance.

Already have an account? Log in

Supercharge your skills with Premium Templates

Take your learning and productivity to the next level with our Premium Templates.

Upgrading to a paid membership gives you access to our extensive collection of plug-and-play Templates designed to power your performance—as well as CFI's full course catalog and accredited Certification Programs.

Already have a Self-Study or Full-Immersion membership? Log in

Access Exclusive Templates

Gain unlimited access to more than 250 productivity Templates, CFI's full course catalog and accredited Certification Programs, hundreds of resources, expert reviews and support, the chance to work with real-world finance and research tools, and more.

Already have a Full-Immersion membership? Log in