- What is Statistics for Finance?

- Why Statistical Analysis is Crucial

- Applications of Statistical Analysis in Finance

- Basic Statistical Concepts for Finance

- Advanced Statistical Techniques for Finance

- Data Analysis Tools for Financial Applications

- Real-World Applications

- Applying Statistical Methods to Analyze Investment Opportunities

- Risk Assessment Using Statistical Models

- Statistical Analysis of Market Trends and Economic Data

- Benefits of Understanding Statistical Analysis for Financial Professionals

Statistics for Finance

A helpful guide to statistics for finance professionals

What is Statistics for Finance?

Statistics plays a pivotal role in finance by providing a robust framework for data-driven decision-making and dealing with the uncertainty of future expected outcomes. Within the financial services industry, where vast amounts of financial market data are generated daily, statistics for finance enables professionals to sift through this information, identify meaningful patterns, and solve specific problems.

Key Highlights

- Statistics for finance enables professionals to sift through vast amounts of financial and market information, identify meaningful patterns, and solve specific problems.

- Statistical analysis provides a systematic approach to collecting and analyzing financial data, which is crucial for informed decision-making and managing uncertainty.

- There are various statistical concepts financial professionals should master, including time series analysis, probability distributions, and regression analysis.

Why Statistical Analysis is Crucial

The importance of statistical finance and financial mathematics in general comes down to two factors: informed decision-making and managing uncertainty.

Informed Decision-Making

All modern businesses and industries revolve around data. Statistical analysis provides a systematic approach to collecting and analyzing financial data, as well as unveiling patterns and trends from historical data, which is crucial for informed decision-making.

Moreover, statistics empowers finance professionals with predictive modeling capabilities, allowing them to anticipate market trends, economic conditions, and asset prices. Econometric modeling, a subset of statistics, further enhances the understanding of the relationships between economic variables, aiding in comprehensive financial analysis.

The adaptability of statistical tools ensures that finance professionals can continuously refine their strategies in response to evolving market conditions, fostering a proactive approach to the challenges posed by global events, economic shifts, and technological advancements. In essence, statistics is the compass guiding financial decision-makers, providing insights and analytical tools critical for success in the ever-changing landscape of finance.

Managing Uncertainty

Navigating the inherent uncertainty of financial markets demands a sophisticated analytical approach, and statistical analysis emerges as a crucial tool in constructing a resilient framework. Depending on their exact role, financial professionals need to consider a myriad of unpredictable factors, from economic fluctuations and geopolitical events to unforeseen market behaviors.

In this landscape, statistical analysis provides a structured methodology for comprehending and quantifying the uncertainty embedded in financial data. By leveraging statistical models, professionals can systematically assess the potential outcomes of various scenarios, allowing them to anticipate and plan for a spectrum of market conditions. This analytical foresight not only aids in risk mitigation but also empowers decision-makers with a strategic advantage, enabling them to make informed choices in the face of uncertainty.

The strategic advantage offered by statistical analysis in managing uncertainty lies in its ability to go beyond simple trend predictions. Traditional forecasting methods may falter in the face of external factors, but statistical tools allow professionals to delve deeper into the data. By uncovering hidden patterns, relationships, and dependencies, statistical analysis enables a more nuanced understanding of market dynamics. This depth of insight equips financial professionals with the means to adapt their strategies dynamically, identify emerging trends, and proactively respond to changing conditions.

Applications of Statistical Analysis in Finance

Basic Statistical Concepts for Finance

Basic Analysis

Depending on the role, some individuals may be using very advanced statistics for finance. However, many roles need to be able to carry out simple statistical analysis, such as taking an appropriate sample from a population and estimating parameters that explain the sample, such as the mean return or correlation.

Variables and Probability Distributions

The use of probability distributions can be found across all disciplines within the financial services industry. For example, the normal distribution can be found everywhere, from option valuation to measuring market risk, where a confidence interval approach can be used to calculate Value at Risk, or VaR.

Just as businesses use statistical analysis to summarize data, finance analyzes variables like stock prices through probability distributions to help build financial models, calculate the expected value of a portfolio, and predict financial phenomena.

Time Series Analysis

Time series analysis, a fundamental tool in statistical finance, helps in studying trends over time, a vital aspect of financial prediction. Time series analysis is essential for examining historical trends and patterns in asset prices, aiding in the construction of portfolios that consider the time-dependent behaviors of financial instruments.

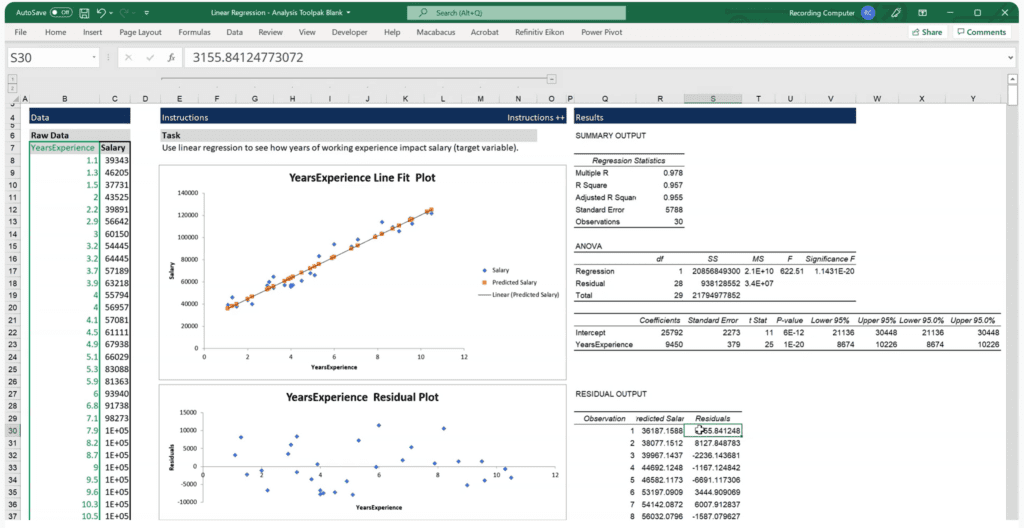

Regression Analysis

A multiple linear regression model is a statistical model used to help explain the relationship between independent variables and a dependent variable. Regression analysis can help economists predict how inflation, GDP, and other economic variables can impact stock returns. It can also be used to identify interest rate models.

Image from CFI’s Regression Analysis – Fundamentals & Practical Applications Course

Advanced Statistical Techniques for Finance

Stochastic Calculus Models

Advanced techniques used in financial engineering, such as financial mathematics and stochastic differential equations, are employed to price financial derivatives and manage risk effectively.

An example is the use of Itō’s formula to price financial derivatives and derive optimal hedging strategies, and to cover specific problems related to the derivation of interest rates used in interest rate models.

Nonlinear Time Series Analysis

Linear models assume a constant relationship, but in reality, the nonlinearity of financial markets demands sophisticated tools like nonlinear time series analysis for accurate predictions and risk assessments.

Data Analysis Tools for Financial Applications

Just as businesses use statistical software for data analysis, financial analysts utilize tools like R and Python to process and analyze vast datasets, enhancing the precision of financial predictions.

Real-World Applications

Applying Statistical Methods to Analyze Investment Opportunities

Consider a scenario where statistical analysis aids investors in evaluating potential stocks by analyzing historical performance and predicting future trends.

Risk Assessment Using Statistical Models

Post the 2008 financial crisis, statistical models became instrumental in evaluating and mitigating risks associated with various financial instruments.

Statistical Analysis of Market Trends and Economic Data

Statistical tools in finance are employed to analyze market trends, providing valuable insights into the correlation between economic indicators and financial markets.

Benefits of Understanding Statistical Analysis for Financial Professionals

Gaining a Competitive Edge

Possessing statistical skills sets finance professionals apart in a competitive job market. Employers value individuals who can leverage statistics for finance to support strategic decision-making, making candidates with statistical proficiency more attractive.

Versatility in Roles

Statistical skills provide versatility, allowing finance professionals to excel in various roles. Whether in risk management, portfolio analysis, or market research, professionals with statistical acumen can adapt to different responsibilities within the finance industry. It also helps individuals to be better able to synthesize and manage empirical research on which many mathematical techniques and models used in finance are based.

Quantitative Analysis Roles

For roles that involve quantitative analysis, such as quantitative analyst or financial analyst positions, statistical skills are often a prerequisite. Individuals with a strong statistical background are better equipped to handle complex financial modeling and analysis tasks.

Data-Driven Decision Roles

As organizations increasingly emphasize data-driven decision-making, finance professionals with statistical skills are well-positioned to take on roles where the ability to analyze and interpret data is crucial. This is particularly relevant in areas like business intelligence and data analytics.

Rigorous Treatments and Empirical Research

As financial markets become more complex, statistical tools are indispensable for rigorous research, trend identification, and hypothesis testing. The ability to apply statistical concepts ensures professionals are well-equipped to navigate the challenges of the modern financial landscape.

In conclusion, statistics is not merely a tool in the financial professional’s toolkit; it is the foundation guiding them to success. As the financial landscape evolves, the importance of statistical analysis in finance will only grow, making it an essential skill for thriving in this competitive environment.

Related Readings

CFI is the official provider of the global Business Intelligence & Data Analyst (BIDA)® certification program, designed to help anyone become a world-class financial analyst. To keep learning and advancing your career, the additional CFI resources below will be useful:

Create a free account to unlock this Template

Access and download collection of free Templates to help power your productivity and performance.

Already have an account? Log in

Supercharge your skills with Premium Templates

Take your learning and productivity to the next level with our Premium Templates.

Upgrading to a paid membership gives you access to our extensive collection of plug-and-play Templates designed to power your performance—as well as CFI's full course catalog and accredited Certification Programs.

Already have a Self-Study or Full-Immersion membership? Log in

Access Exclusive Templates

Gain unlimited access to more than 250 productivity Templates, CFI's full course catalog and accredited Certification Programs, hundreds of resources, expert reviews and support, the chance to work with real-world finance and research tools, and more.

Already have a Full-Immersion membership? Log in