- What is Data Science?

- Are Data Scientists in High Demand?

- Careers in Data Science

- Why Choose a Career in Data Science?

- Skills and Qualifications Required in Data Science Careers

- Challenges and Rewards of Being a Data Scientist

- How to Become a Data Scientist

- Build a Solid Educational Foundation

- Develop Core Technical Skills

- Gain Financial Knowledge

- Build a Portfolio of Projects

- Gain Practical Experience

- Network and Stay Current

- Thinking About Starting a Career in Data Science?

What is Data Science?

Data science is a multidisciplinary field that combines statistics, mathematics, computer science, and domain expertise to extract meaningful insights and knowledge from large amounts of structured and unstructured data. In the financial services industry, data science is crucial in helping organizations make informed decisions, mitigate risks, and drive innovation.

Data scientists within the financial services industry use advanced analytical techniques, machine learning algorithms, and statistical models to analyze complex financial data, predict market trends, detect fraud, and optimize business processes. They work with various data sources, including transaction records, market data, customer information, and economic indicators, to provide valuable insights that shape business strategies and improve operational efficiency and decision-making.

Are Data Scientists in High Demand?

The demand for data scientists, particularly in the financial services industry, is exceptionally high and continues to grow rapidly. According to the 2023 U.S. Bureau of Labor Statistics, the job outlook for data scientists is projected to grow 36% by the year 2033 — which is much faster than the average growth rate for most other occupations.

The surge in demand for data scientists is driven by several factors, including:

- Increasing data volumes: Financial institutions generate and collect vast amounts of data daily, creating a specific need for professionals who can effectively manage and analyze this information.

- Regulatory requirements: Stricter regulations in the financial sector also require more sophisticated risk management and compliance monitoring, which rely heavily on data analysis and, therefore, data scientists.

- Competitive advantage: Financial firms and institutions recognize the value of making accurate and quick data-driven decisions to gain a competitive edge in the market.

- Technological advancements: The rapid advancements in machine learning and artificial intelligence (AI) technologies create new opportunities for data scientists to innovate and improve financial services.

- Personalization: There’s a growing need to provide personalized financial products and services, which requires advanced data analysis and predictive modeling.

Given these factors, individuals pursuing a career in data science within the financial services industry can expect a fruitful and rewarding career path with numerous opportunities for growth and advancement.

Careers in Data Science

A career in data science encompasses a wide range of potential roles and responsibilities. While data scientists work across various industries, the financial services sector offers unique challenges and opportunities for those with the right credentials and specializations. There are several types of data science roles within finance, each focusing on different aspects of data analysis and application.

Here’s an overview of the three key roles of data scientists in the financial services industry:

Data Science Analyst

A data science analyst, also commonly referred to as a data analyst (despite data analysis being a slightly different field), is often considered an entry-level position within the data science field. These professionals play a crucial role in interpreting financial data and translating it into actionable insights for business decisions.

The day-to-day responsibilities of a data science analyst in finance typically include:

- Collecting and cleaning financial data from various sources

- Performing statistical analyses to identify trends and patterns

- Creating data visualization tools to present findings to stakeholders

- Assisting in the development of predictive models

- Collaborating with other teams to understand business needs and provide data-driven solutions

Data Scientist

Data scientists in the financial services industry are more advanced professionals who combine strong analytical skills with deep domain knowledge to solve complex problems and drive innovation.

Their day-to-day responsibilities often include:

- Developing sophisticated machine learning models for risk assessment, fraud detection, and market prediction

- Creating and maintaining data pipelines for efficient data processing

- Conducting advanced statistical analyses to uncover hidden patterns in financial data

- Collaborating with business analysts and executives to align data science projects with organizational goals

- Staying up to date with the latest advancements in data science and applying them to financial problems

Machine Learning Engineer

Machine learning engineers specialize in developing and implementing machine learning fundamentals for models and algorithms. The financial services industry focuses on creating automated systems that can learn from experience and improve.

Their usual responsibilities include:

- Designing and developing machine learning algorithms tailored to financial applications

- Implementing and maintaining scalable machine learning systems

- Optimizing existing models to improve performance and accuracy

- Collaborating with data scientists and software engineers to integrate machine learning solutions into existing systems

- Researching and implementing cutting-edge machine learning techniques relevant to finance

Why Choose a Career in Data Science?

Choosing a career in data science within the context of the financial services industry can offer several advantages. More and more young professionals are considering this specific career path for the following reasons:

- High demand and job security: The growing need for data science professionals in finance ensures a stable and promising career outlook, which is why so many people interested in financial services are drawn to this type of career.

- Competitive salaries: Data scientists in finance typically command high salaries due to their specialized skills and the value they bring to organizations.

- Intellectual stimulation: The entire field of data science presents complex challenges that require continuous learning and problem-solving, keeping the work engaging and rewarding. This is especially true for these types of careers within the scope of financial services.

- Impact on decision-making: Data scientists play a crucial role in shaping strategic decisions, giving them the opportunity to significantly influence their organization’s success.

- Career growth: There are plenty of opportunities for advancement, from analyst positions to senior data scientist roles and even executive positions like Chief Data Officer within data science.

- Diverse applications: Financial data science spans various areas, including risk management, algorithmic trading, customer analytics, and fraud detection, allowing professionals to explore different specializations and grow their skills as they choose.

- Innovation potential: The financial sector is at the forefront of adopting new technologies, providing data scientists with the opportunity to work on cutting-edge projects.

Overall, a career in data science within the financial services industry can be highly fulfilling. It offers analytical challenges, technological innovation, and the opportunity to significantly impact the industry — all of which keep these types of careers interesting and the professionals within them highly motivated.

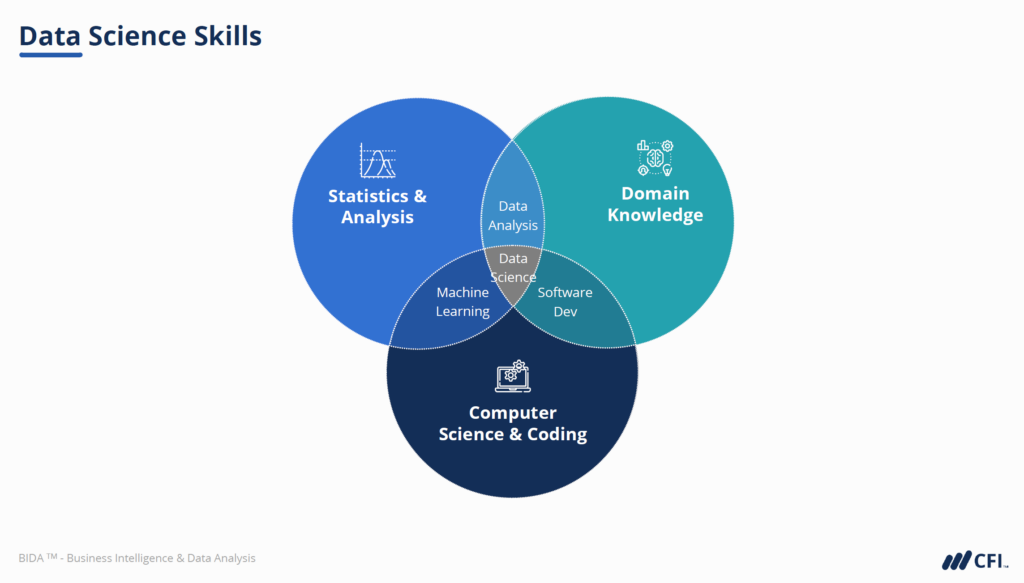

Skills and Qualifications Required in Data Science Careers

To succeed in a data science career in the financial services industry, professionals need a combination of technical skills and industry-specific knowledge.

These are the skills normally required in data science careers:

- Programming: Proficiency in languages such as Python, R, or SQL is essential for data manipulation and analysis.

- Statistical analysis: Strong understanding of statistical concepts and techniques is crucial for interpreting financial data.

- Machine learning: Knowledge of various machine learning algorithms and their applications in finance is increasingly important.

- Data visualization: Ability to create clear and compelling visualizations to communicate insights effectively.

- Big data technologies: Familiarity with tools like Hadoop, Spark, or cloud-based data platforms is often required for handling large datasets.

- Financial modeling: Understanding of financial concepts and the ability to create financial models for risk assessment, pricing, or market prediction.

- Communication: Strong verbal and written communication skills are vital for explaining complex findings to non-technical stakeholders.

- Problem-solving: Ability to approach complex financial problems with creativity and analytical rigor.

- Domain knowledge: Understanding financial markets, products, and regulations is crucial for applying data science effectively in this industry.

The qualifications a data scientist should possess include the following:

- Education: Most positions require at least a bachelor’s degree in a related field, such as data science, computer science, statistics, mathematics, or finance. Many roles may also prefer an advanced degree, such as a master’s or Ph.D.

- Certifications: While not always mandatory, certifications like Certified Analytics Professional (CAP) or various machine learning certifications can enhance job prospects.

- Experience: Practical experience through internships, projects, or previous data analysis or financial services roles is highly valued and typically preferred among employers.

- Continuous learning: Given the rapidly evolving nature of both data science and finance, a commitment to ongoing education and skill development is essential.

Challenges and Rewards of Being a Data Scientist

A career in data science within the financial services industry can be highly fulfilling, offering a unique blend of analytical challenges and the opportunity to make a significant impact. However, like any career path, it comes with its own set of challenges and rewards.

The Challenges

- Data quality and accessibility: Due to regulatory constraints, financial data can be complex, inconsistent, and sometimes difficult to access.

- Keeping up with technological advances: The rapid pace of technological advancement requires continuous learning and adaptation.

- Balancing technical and business needs: Data scientists must bridge the gap between complex technical concepts and business requirements.

- Regulatory compliance: Navigating the strict regulatory environment in finance can be challenging and may limit certain approaches or data uses.

- Managing pressure and responsibility: The high-stakes nature of financial decisions based on data analysis can create significant pressure.

The Rewards

- Intellectual stimulation: Working with complex financial data and solving challenging problems provides constant mental engagement.

- High compensation: Data scientists in finance typically earn competitive salaries and benefits.

- Impact on decision-making: The ability to influence major business decisions and strategies can be highly satisfying.

- Innovation opportunities: Finance is often at the forefront of adopting new technologies, providing exciting opportunities to work with cutting-edge tools and techniques.

- High career growth potential: Data science offers numerous paths for advancement and specialization within the financial services industry (and even outside the industry).

How to Become a Data Scientist

Embarking on a career as a data scientist in the financial services industry requires a combination of education, skills development, and practical experience. If you’re interested in pursuing a career in financial services as a data scientist, these are the steps you’ll need to take:

Build a Solid Educational Foundation

Start by earning a bachelor’s degree in a relevant field such as data science, computer science, statistics, mathematics, or finance. Many positions in finance prefer or require an advanced degree, so consider pursuing a master’s or Ph.D. in data science or a related field down the road.

Develop Core Technical Skills

Focus on building strong programming skills, particularly in languages like Python, R, and SQL. Learn statistical analysis techniques and familiarize yourself with machine learning algorithms. It’s also a good idea to practice working with big data technologies and data visualization tools as much as possible.

Gain Financial Knowledge

Since you’ll be working within the financial services industry, you’ll also need to work on developing a solid understanding of financial concepts, markets, and regulations. This can be done through coursework, certifications, or self-study. Knowledge of financial modeling and risk assessment is not only valuable but is usually required in this field.

Build a Portfolio of Projects

Get to work on data science projects that demonstrate your skills, particularly those relevant to finance. This could include analyzing stock market data, building predictive models for credit risk, or creating a fraud detection system. Be sure to create and track metrics for each project to demonstrate your capabilities and successes further.

Gain Practical Experience

Seek internships or entry-level positions in data analysis or financial services. This hands-on experience is crucial for understanding how data science is applied in real-world financial contexts. Whether you’re getting paid or interning for mentorship, having practical experience will bolster your resume and enable you to develop first-hand skills and knowledge as it is applied.

Network and Stay Current

Attend industry conferences, join professional organizations, and participate in online communities to stay current with the latest trends and advancements in data science and finance. By staying connected with others in the industry, you’ll gain the advantage of learning about new opportunities and build a reputation for yourself among potential colleagues.

Thinking About Starting a Career in Data Science?

A career in data science within the financial services industry can offer a unique experience in applying advanced analytical skills to solve complex financial problems. With high demand, competitive salaries, and the chance to make a significant impact, it’s an attractive path for those with a passion for data and an interest in finance. While the journey requires dedication to continuous learning and skill development, the rewards can be substantial, both professionally and personally.

Are you ready to take the first step toward a career in data science? Browse CFI’s online data science courses and online certification program selection to get started on your data science career path. Whether you’re looking to build foundational skills or specialize in financial applications of data science, CFI offers a range of programs to help you achieve your career goals.

Create a free account to unlock this Template

Access and download collection of free Templates to help power your productivity and performance.

Already have an account? Log in

Supercharge your skills with Premium Templates

Take your learning and productivity to the next level with our Premium Templates.

Upgrading to a paid membership gives you access to our extensive collection of plug-and-play Templates designed to power your performance—as well as CFI's full course catalog and accredited Certification Programs.

Already have a Self-Study or Full-Immersion membership? Log in

Access Exclusive Templates

Gain unlimited access to more than 250 productivity Templates, CFI's full course catalog and accredited Certification Programs, hundreds of resources, expert reviews and support, the chance to work with real-world finance and research tools, and more.

Already have a Full-Immersion membership? Log in