- What is Asset Management?

- What is Wealth Management?

- Asset Management vs. Wealth Management: What are the Similarities and Differences?

- Career Opportunities in Asset Management and Wealth Management

- Education, Licenses, Certifications, and Essential Skills

- Asset Management vs. Wealth Management: Pros and Cons

- Making an Informed Choice

Asset Management vs. Wealth Management: What’s the Difference?

While both asset managers and wealth managers seek to improve clients’ financial well-being and financial success, they have distinct focuses and methods. This article delves into the similarities and differences between these fields and explores the career paths they offer.

Key Highlights

- Asset managers and wealth managers both aim to grow clients’ financial assets and ensure all actions taken serve their clients’ best interests.

- Asset management focuses on strategic asset allocation and managing investment portfolios for long-term growth.

- Wealth management focuses on growing and preserving clients’ wealth through a range of services, including investment management, tax planning, estate planning, and more.

What is Asset Management?

An asset manager primarily manages portfolios of diverse asset classes, such as stocks, bonds, and real estate, on behalf of clients. Asset management clients typically include institutional investors like pension funds, sovereign wealth funds, endowments, foundations, and corporations, as well as high-net-worth individuals. The ultimate objective for asset management firms is to increase assets under management (AUM).

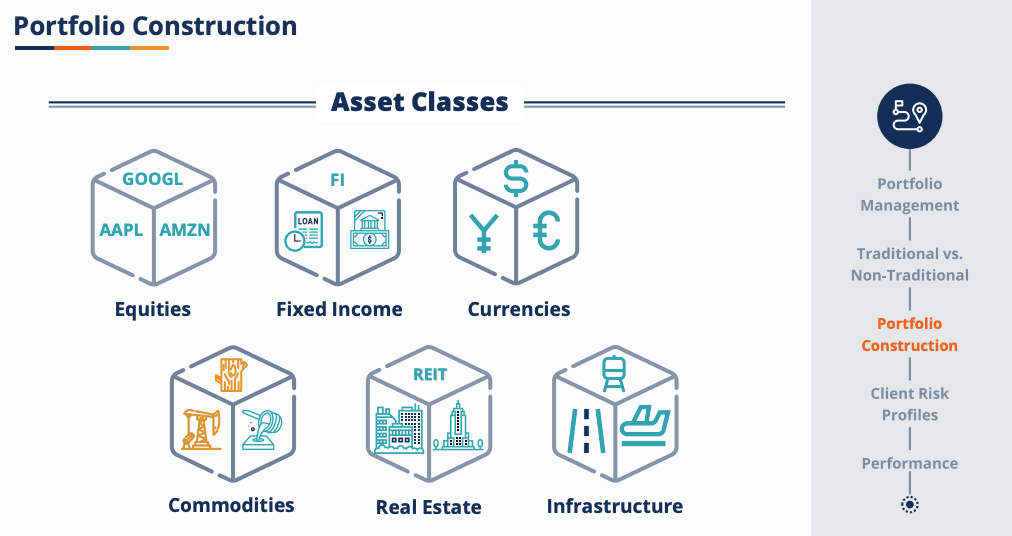

Types of Assets Managed

- Equities: Stocks representing company ownership, suited for growth-oriented portfolios.

- Fixed Income: Bonds offering steady interest income, suitable for conservative portfolios.

- Real Estate: Commercial or residential properties, providing rental income and potential capital gains.

- Commodities: Gold, oil, and agricultural products, which diversify portfolios and hedge against inflation.

- Alternative Investments: Hedge funds and private markets, such as private equity, venture capital, and private credit, which may reduce portfolio risk by offering negative correlation to publicly traded instruments like stocks and bonds.

Investment Strategies and Client Objectives

Asset managers, or investment managers, are tasked with strategic asset allocation and ongoing portfolio management to maximize investment returns while managing risks.

An asset manager can use various investment strategies according to clients’ investment objectives, risk tolerance, and financial situation, including:

- Growth Investing: Focusing on assets expected to grow significantly.

- Income Investing: Prioritizing assets that yield regular income.

- Value Investing: Buying undervalued assets and selling them when the market recognizes their value.

- Risk Management Strategies: Managing portfolio risk using strategies like portfolio diversification and hedging, among others.

Asset managers also create and sell investment products like mutual funds, index funds, and exchange-traded funds (ETFs), making their services accessible to individual investors through various vehicles and other financial instruments.

Image: CFI’s Portfolio Management Fundamentals course

What is Wealth Management?

Wealth management firms serve high-net-worth clients, including individuals or families that already own significant assets, through a range of wealth management services. The focus of a wealth manager is preserving and growing clients’ wealth over time, but it can include other short-term goals.

Wealth management entities may be lines of business within large banks or financial advisors at independent firms dedicated to asset and wealth management only. Like asset management firms, wealth management firms aim to increase their client AUM.

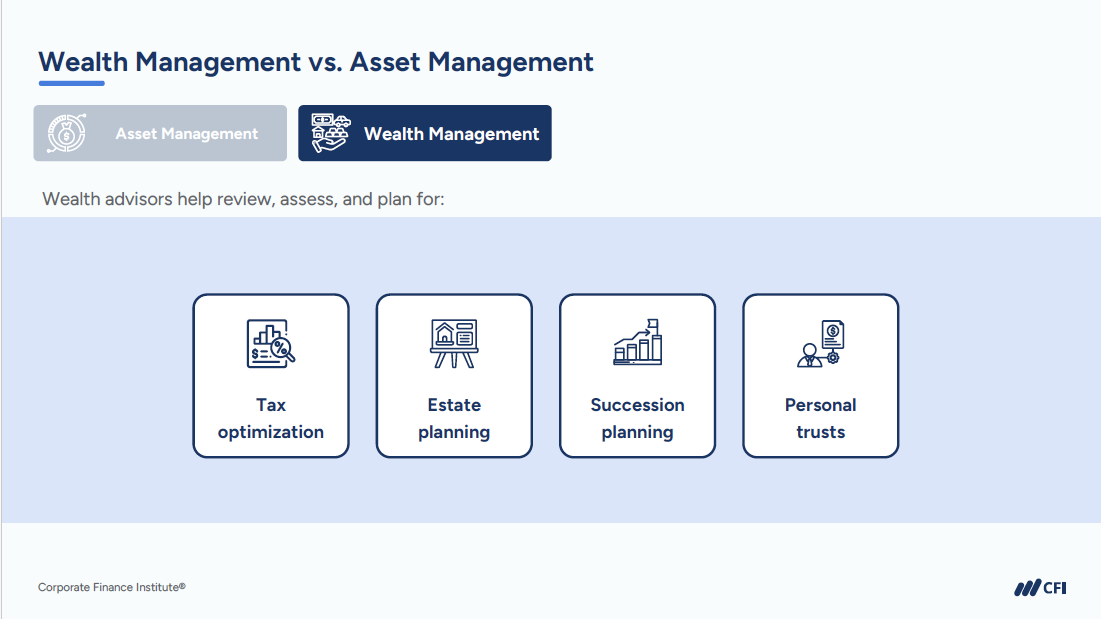

Wealth Management Services

A wealth manager typically offers a menu of wealth and asset management services, including:

- Investment Management: Managing client investment portfolios to maximize returns and achieve wealth preservation through appropriate asset allocation.

- Retirement Planning: Designing financial strategies to help clients achieve financial security during retirement.

- Estate Planning: Developing estate planning strategies for clients to transfer their wealth efficiently and effectively.

- Tax Planning: Minimizing clients’ tax burdens through careful planning and structuring.

- Insurance: Protecting clients’ assets and wealth through various insurance products.

Image: CFI’s Introduction to Financial Planning and Wealth Management course

Asset Management vs. Wealth Management: What are the Similarities and Differences?

Key Similarities

Although asset management and wealth management differ in scope and focus, they share several key similarities, making them interconnected fields within the financial industry.

Shared Goals

Both asset managers and wealth managers strive to increase the value of client assets. Whether managing client portfolios or offering comprehensive personal finance services, asset managers and wealth managers both aim to grow clients’ wealth and help them achieve their financial goals.

Client-Centered Approach

Both asset management and wealth management adopt a client-centered approach, tailoring their services to meet institutional or individual needs and risk tolerance. Asset managers develop investment strategies that align with clients’ goals, risk tolerance, and timelines. Wealth managers provide broader financial strategies, including asset management, to address all aspects of clients’ financial life and health.

Long-Term Relationships

Asset managers and wealth managers both establish long-term relationships with clients. Asset managers continuously monitor market trends and adjust portfolios to achieve sustained growth, while wealth managers offer ongoing support across client’s investment portfolio and various financial matters, fostering enduring relationships based on trust and reliability.

Fiduciary Obligations

Asset and wealth management operate as fiduciaries, meaning they are legally obligated to act in the best interests of their clients and comply with stringent regulatory standards. This fiduciary role involves maintaining transparency, avoiding conflicts of interest, and ensuring that all actions taken by asset or wealth management will serve to enhance clients’ financial health and meet their long-term financial goals first.

Skillset Overlap

Both fields require a robust set of analytical, technical, financial literacy, and interpersonal skills. Asset managers need strong financial modeling, portfolio construction, and market analysis skills, along with effective communication to explain strategies to clients. Wealth managers require comprehensive financial knowledge, including tax, estate, and investment planning, and must also communicate complex information clearly and effectively.

Key Differences

Asset managers and wealth managers both aim to grow clients’ financial assets and resources, but they differ in focus:

Scope

An asset manager primarily focuses on managing and investing in various asset classes. A wealth manager considers a client’s overall financial situation.

Clientele

Asset managers cater to institutional investors, pension funds and high-net-worth individuals, while wealth managers serve primarily high-net-worth clients with comprehensive wealth management needs.

Day-to-Day Responsibilities

Asset managers analyze market trends, manage portfolios, and make strategic investment decisions. Wealth managers handle a broader range of tasks, including retirement and estate planning, tax strategies, and managing investment portfolios.

Compensation

Asset manager compensation includes a base salary and performance-based bonuses tied to portfolio success. Wealth manager compensation includes fees from advisory services, brokerage fees, and potential bonuses based on client retention and portfolio growth.

Career Opportunities in Asset Management and Wealth Management

Both asset management and wealth management offer rewarding career paths with opportunities for growth and specialization.

Asset Management

- Entry-Level Roles and Career Progression: Entry-level roles include research analysts, who gather data, analyze investment opportunities, and support portfolio managers. Progression can lead to roles like portfolio manager, who is directly responsible for managing client portfolios.

- Mid-Career and Exit Opportunities: Mid-career professionals might transition to specialized areas such as hedge fund management, private equity, or venture capital. Others may move into roles in financial consulting, risk management, or corporate finance.

- Senior-Level Positions: At the senior level, asset management professionals may hold titles such as Chief Investment Officer (CIO) or Head of Asset Management. These roles involve strategic oversight of investment strategies, direct interaction with significant clients, and leadership of investment teams.

Wealth Management

- Entry-Level Roles and Career Progression: Initial positions in wealth management usually involve working as a financial advisor or financial planner, assisting clients in planning their financial futures across a spectrum of needs. Career progression can lead to more specialized roles in areas like tax planning, retirement planning, or broader roles such as wealth management advisor.

- Mid-Career and Exit Opportunities: Mid-career wealth managers often have the opportunity to specialize further or move into high-level advisory roles, potentially opening their own practice. Exit paths may include roles in private banking, non-profit financial management, or corporate executive positions in financial strategy.

- Senior-Level Positions: Senior roles like Director of Wealth Management involve strategic direction, client relationship management, and leadership of advisory teams.

Education, Licenses, Certifications, and Essential Skills

Understanding the educational background, necessary certifications, and key skills can help aspiring professionals prepare for successful careers as either an asset or wealth manager.

Breaking into asset management or wealth management demands a solid educational foundation alongside robust technical and soft skills. Professional certifications enhance these qualifications by providing practical skills that supplement formal education, preparing individuals for internships or entry-level positions.

Asset Management

- Education: A bachelor’s degree in finance, economics, accounting, or a related field is common but not required. For those aspiring to senior level roles, a master’s degree in finance or economics, or a Master of Business Administration (MBA), demonstrate advanced knowledge and commitment to the field.

- Licenses: Depending on the jurisdiction and specific job functions, some asset managers may need to register with regulatory bodies and obtain licenses, such as the Series 65 (Uniform Investment Adviser Law Exam), particularly if they provide direct investment advice to clients.

- Certifications: The Chartered Financial Analyst (CFA) designation is the most highly regarded credential in asset management. Other relevant credentials include CFI’s Capital Markets & Securities Analyst (CMSA®) Certification, which teach hands-on skills and can help in securing highly competitive internships or entry-level positions.

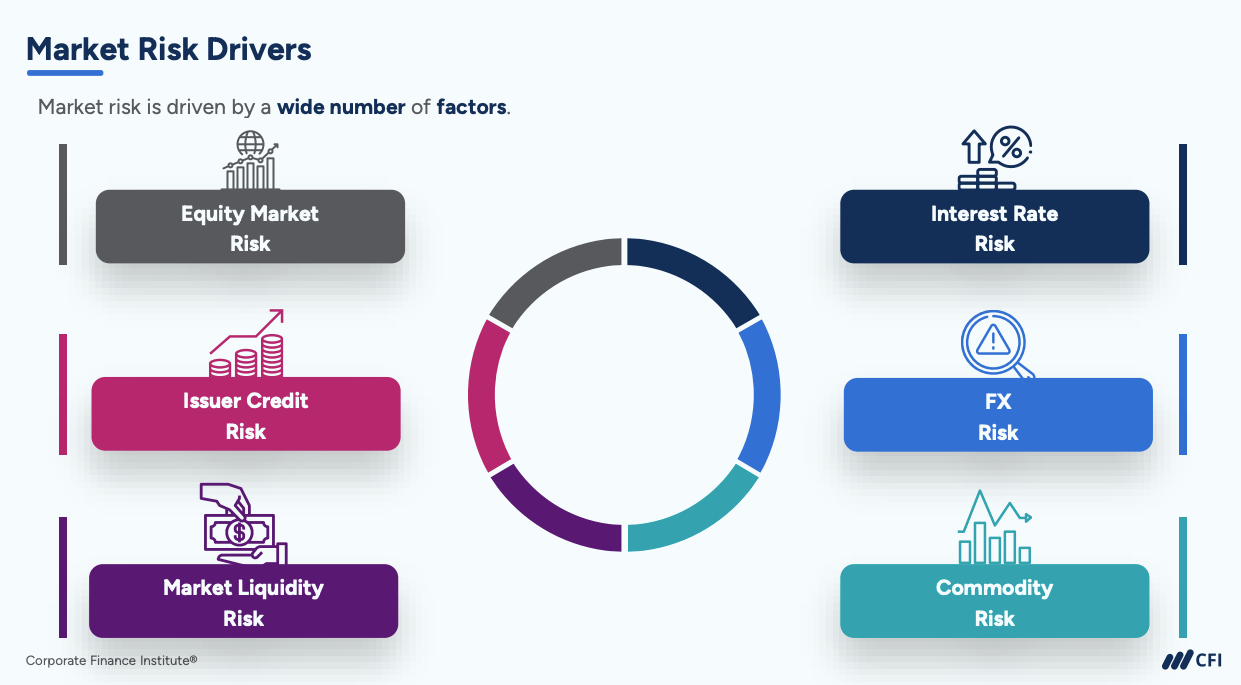

- Key Skills: Essential skills include financial modeling, portfolio construction, risk management strategies, economic analysis, and a deep understanding of financial instruments and capital markets. Strong analytical and interpersonal skills, attention to detail, and proficiency in Excel are also important.

Image: CFI’s Market Risk Fundamentals course

Wealth Management

- Education: A bachelor’s degree in finance, economics, or related fields is common. Advanced degrees such as a master’s in finance or an MBA are often seen as valuable for more senior roles, providing a deeper understanding of financial strategies and client management.

- Licenses: Depending on the jurisdiction, certain licenses are required to provide financial advice. In the U.S., these include Series 6, Series 7, Series 63, and Series 65 licenses. Most countries, including Canada, require equivalent licenses.

- Certifications: Certifications such as the Certified Financial Planner (CFP), Chartered Wealth Manager (CWM), and CFI’s Financial Planning and Wealth Management (FPWMP™) are beneficial. These certifications help professionals gain trust and credibility with clients and demonstrate a commitment to providing comprehensive financial advice.

- Key Skills: Wealth managers need a broad range of financial knowledge, including expertise in tax planning, estate planning, retirement strategies, and risk management. Interpersonal skills are equally important, as wealth managers must effectively communicate complex financial concepts to clients and tailor strategies to individual client needs. Strong relationship-building and problem-solving skills are essential.

Asset Management vs. Wealth Management: Pros and Cons

Choosing between an asset or wealth manager career path involves considering financial aspects, work-life balance, job security, and overall work environment.

- Asset Management: Working as an asset manager offers a stable career, with more balanced hours outside of market volatility, and focuses on long-term investments. However, it can be sensitive to market fluctuations and performance.

- Wealth Management: Provides the opportunity to help clients with various financial goals, such as increasing, preserving, and transferring wealth. It offers flexibility but requires managing a broader range of tasks and maintaining diverse expertise.

Making an Informed Choice

When choosing between asset management or wealth management, consider your interests, working style, and long-term financial goals first. Asset management might suit those who prefer managing investments for sustained growth, while wealth management suits those interested in broader financial strategies.

Both paths offer opportunities for success and personal fulfillment, with substantial financial rewards. The key is to choose a path that aligns with your interests and goals, ensuring a rewarding career.

Additional Resources

Create a free account to unlock this Template

Access and download collection of free Templates to help power your productivity and performance.

Already have an account? Log in

Supercharge your skills with Premium Templates

Take your learning and productivity to the next level with our Premium Templates.

Upgrading to a paid membership gives you access to our extensive collection of plug-and-play Templates designed to power your performance—as well as CFI's full course catalog and accredited Certification Programs.

Already have a Self-Study or Full-Immersion membership? Log in

Access Exclusive Templates

Gain unlimited access to more than 250 productivity Templates, CFI's full course catalog and accredited Certification Programs, hundreds of resources, expert reviews and support, the chance to work with real-world finance and research tools, and more.

Already have a Full-Immersion membership? Log in