Overview

Recommended Prep Courses

These preparatory courses are optional, but we recommend you to complete the stated prep course(s) or possess the equivalent knowledge before enrolling in this course:Renewable Energy – Solar Financial Modeling Course Overview

This Renewable Energy – Solar Financial Modeling course covers critical concepts in evaluating a renewable energy project. This advanced course will guide you through a case study on a solar energy project. You’ll be given a confidential information memorandum (CIM) containing all the project details and financials you will need to build a financial model and analyze the return to investors.Renewable Energy Learning Objectives

By completing this course, you’ll be able to:- Learn the definition of renewable energy and important terms used in the industry.

- Understand the development timeline and funding structure of a solar project.

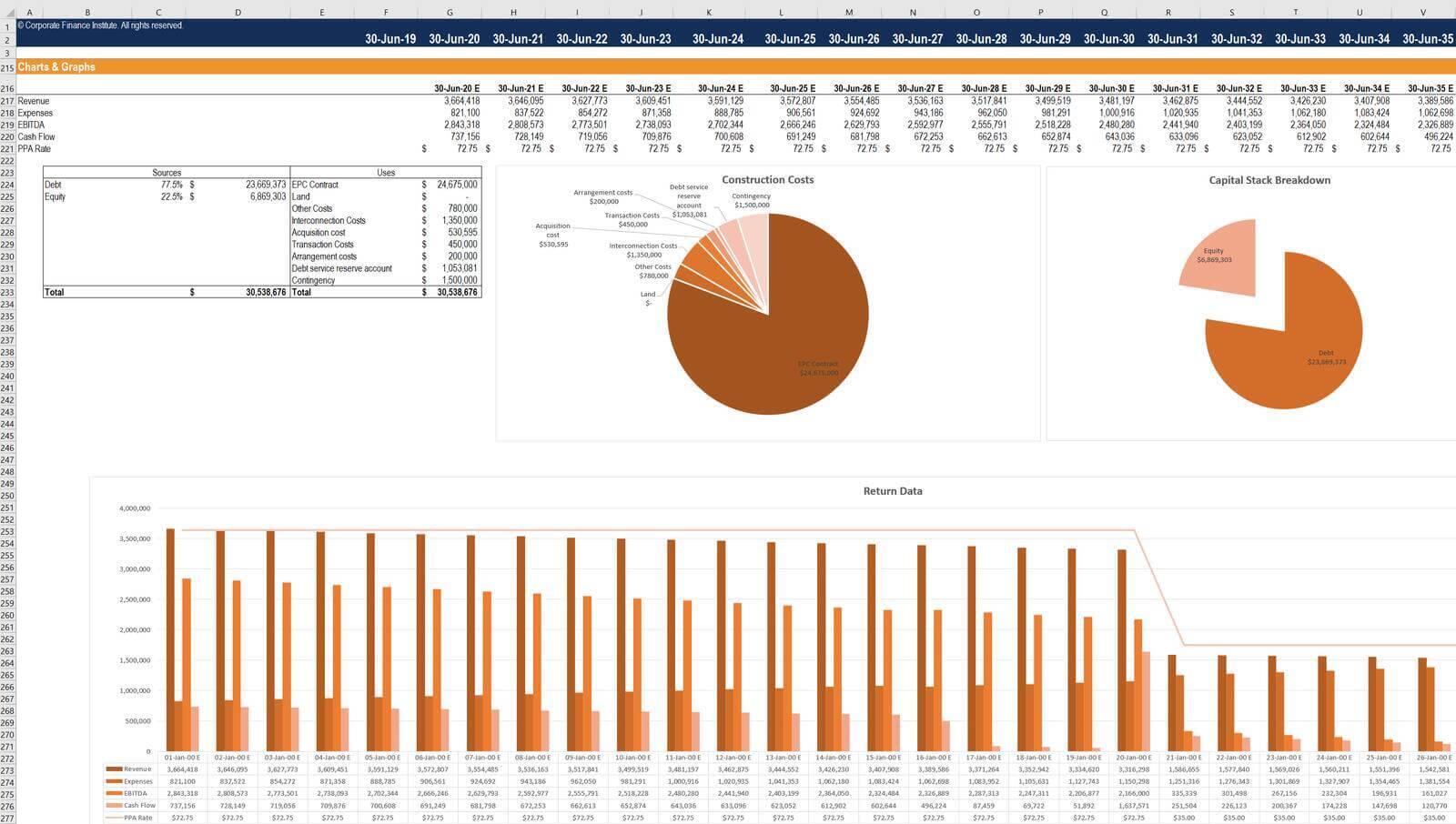

- Construct a robust financial model for a solar project based on the provided assumptions.

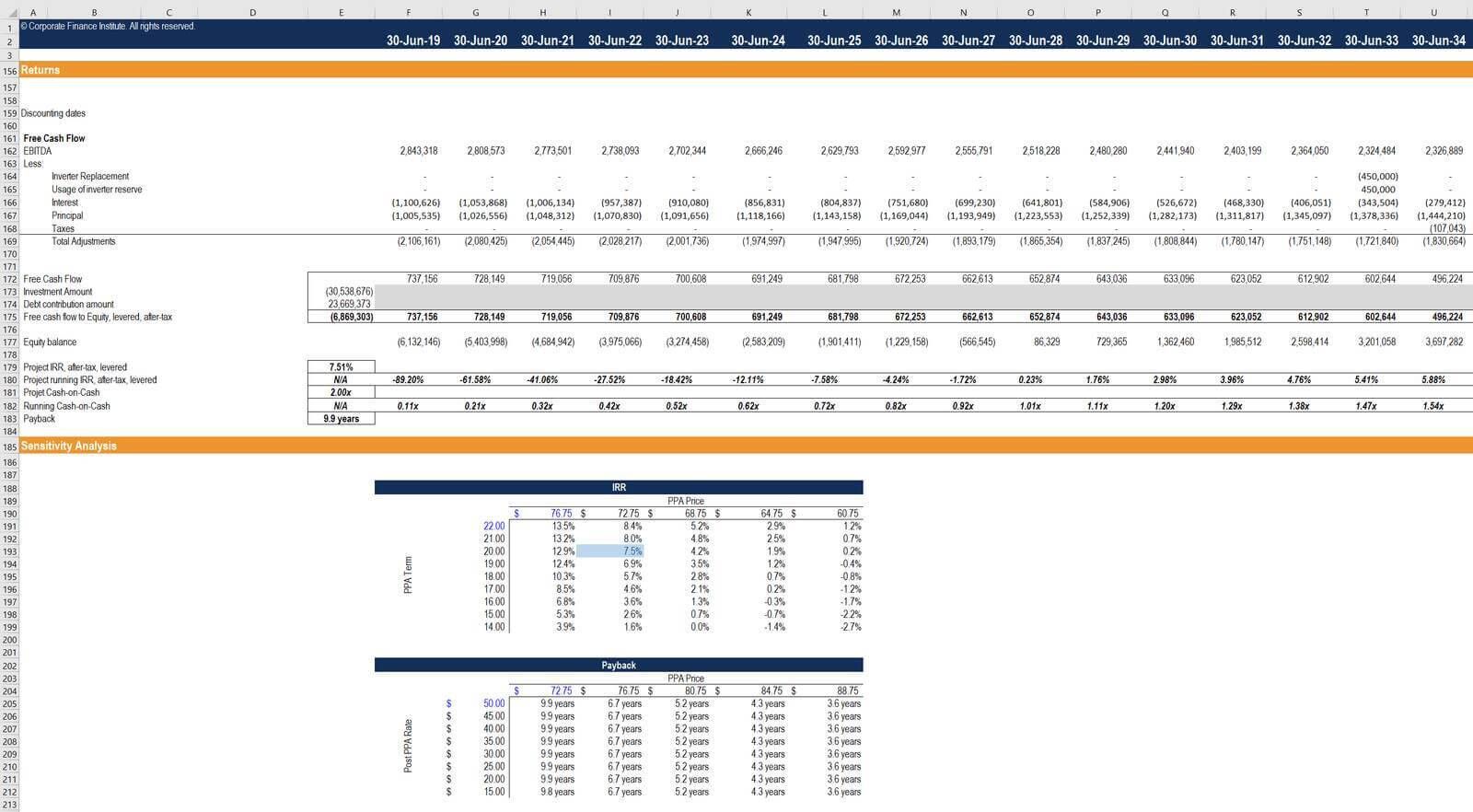

- Calculate the key return metrics (NPV, IRR, credit metrics, cash flow, and payback) and capital stack to assess the project’s profitability.

Why take this renewable energy course?

This Renewable Energy – Solar Financial Modeling course is built around a comprehensive solar energy case study. Upon completing this course, you’ll be able to construct an industry-specific financial model to evaluate the profitability of a renewable energy project.Who should take this renewable energy course?

This renewable energy financial modeling course is designed for finance professionals who are looking to develop advanced financial modeling skills or want to learn how to build a financial model for a renewable energy project.Renewable Energy - Solar Financial Modeling

Level 5

Approx 6.5h to complete

100% online and self-paced

Get StartedWhat you'll learn

Return Metrics

Financial Model – Layout and Structure

Financial Model – Financial Section

Financial Model – Returns Section

Financial Model – Sensitivity Analysis

Qualified Assessment

This Course is Part of the Following Programs

Why stop here? Expand your skills and show your expertise with the professional certifications, specializations, and CPE credits you’re already on your way to earning.

Financial Modeling & Valuation Analyst (FMVA®) Certification

- Skills Learned Financial modeling and valuation, sensitivity analysis, strategy

- Career Prep Investment banking and equity research, FP&A, corporate development