Overview

The Amazon Case Study

Welcome to CFI’s advanced financial modeling course – a case study on how to value Amazon.com, Inc (AMZN). This course is designed for professionals working in investment banking, corporate development, private equity, and other areas of corporate finance that deal with valuing companies and applying various methods of valuation.

Advanced Financial Modeling Course Objectives

This advanced financial modeling course has several objectives including:

- Use Amazon’s financial statements to build an integrated 3-statement financial forecast

- Learn how to structure an advanced valuation model effectively

- Set up all the assumptions and drivers required to build out the financial forecast and DCF model

- Create a 10-year forecast for Amazon’s business, including an income statement, balance sheet, cash flow statement, supporting schedules, and free cash flow to the firm (FCFF)

- Learn how to deal with advanced topics like segmented revenue, capital additions, finance leases, operating leases, and more

- Perform comparable company analysis (Comps) utilizing publicly available information

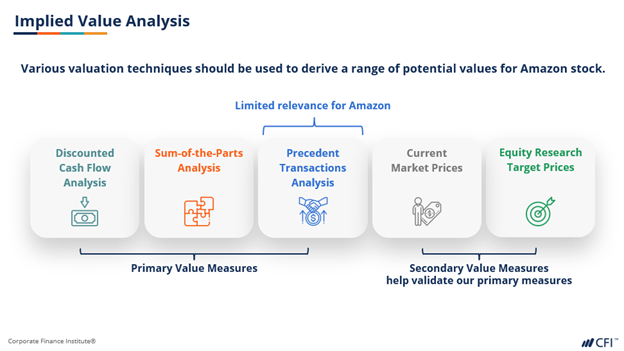

- Perform a Sum-Of-The-Parts (SOTP) valuation of Amazon, as well as consider precedent transactions, equity research price targets, and Amazon’s 52-week trading range

- Generate multiple operating scenarios to explore a range of outcomes and values for the business

- Perform detailed sensitivity analysis on key assumptions and assess the overall impact on equity value per share

Amazon (AMZN) Case Study

This course is built on a case study of Amazon, where students are tasked with building a financial modeling and performing comparable company analysis to value AMZN shares and make an investment recommendation.

Through the course of the transaction, students will learn:

- How to build a detailed financial forecast of Amazon

- How to apply various valuation methodologies to derive an implied value for Amazon

- How to develop an investment recommendation on the shares of Amazon

- How to create a dashboard and summary output that highlights the most important information from the model

Why Take CFI’s Advanced Financial Modeling Course?

This course is perfect for anyone who wants to learn how to build a detailed financial model for a public company, from the bottom up. The video-based lessons will teach you all the formulas and functions to calculate things like segmented revenue, marketable securities, accrued expenses, unearned revenue, stock-based compensation, long-term debt, finance and operating leases, and much more.

In addition to learning the detailed mechanics of how to build the financial model for Amazon, students will also learn how to think about intrinsic value, and develop an investment recommendation.

What’s Included in the Advanced Modeling Course?

This advanced financial modeling and valuation course include all of the following:

- Blank Amazon model template

- Completed Amazon model template (dashboard, DCF model, Comps model, WACC analysis, scenarios, etc.)

- 4+ hours of detailed video instruction

- Certificate of completion

Recommended Preparatory Courses

We recommend you complete the following courses or possess the equivalent knowledge before taking this course:

- Excel Fundamentals – Formulas for Finance

- DCF Valuation Modeling

- Comparable Valuation Analysis

- 3-Statement Modeling

Disclaimer

This course is intended solely for educational and training purposes. The information contained herein does not constitute investment advice, or an offer to sell, or the solicitation of any offer to buy any securities of Amazon.com, Inc. (NasdaqGS: AMZN) or any other security.

This content in this course has not been approved or disapproved by (a) Amazon.com, Inc., (b) S&P Global Market Intelligence Inc., (c) any equity research analyst that covers Amazon.com, Inc., or (d) any securities regulator in any province or territory of Canada, the United States Securities and Exchange Commission or any other United States federal or state regulatory authority, and no such commission or authority has passed upon the merits, accuracy or adequacy of this content, nor is it intended that any will.

The information in this course does not constitute the provision of investment, tax, legal or other professional advice. As with all investments, there are associated risks and you could lose money investing – including, potentially, your entire investment. Prior to making any investment, a prospective investor should consult with its own investment, accounting, legal and tax advisers to evaluate independently the risks, consequences and suitability of that investment.

No reliance may be placed for any purpose on the information and opinions contained herein or their accuracy or completeness, and nothing contained herein may be relied upon in making any investment decision.

The Amazon Case Study (New Edition)

Level 4

Approx 12.5h to complete

100% online and self-paced

Get StartedWhat you'll learn

Building a Financial Forecast

Implied Value Analysis

Course Conclusion

Qualified Assessment

This Course is Part of the Following Programs

Why stop here? Expand your skills and show your expertise with the professional certifications, specializations, and CPE credits you’re already on your way to earning.

Financial Modeling & Valuation Analyst (FMVA®) Certification

- Skills Learned Financial modeling and valuation, sensitivity analysis, strategy

- Career Prep Investment banking and equity research, FP&A, corporate development