Investment Banking Overview

Overview of the investment banking industry

What is Investment Banking?

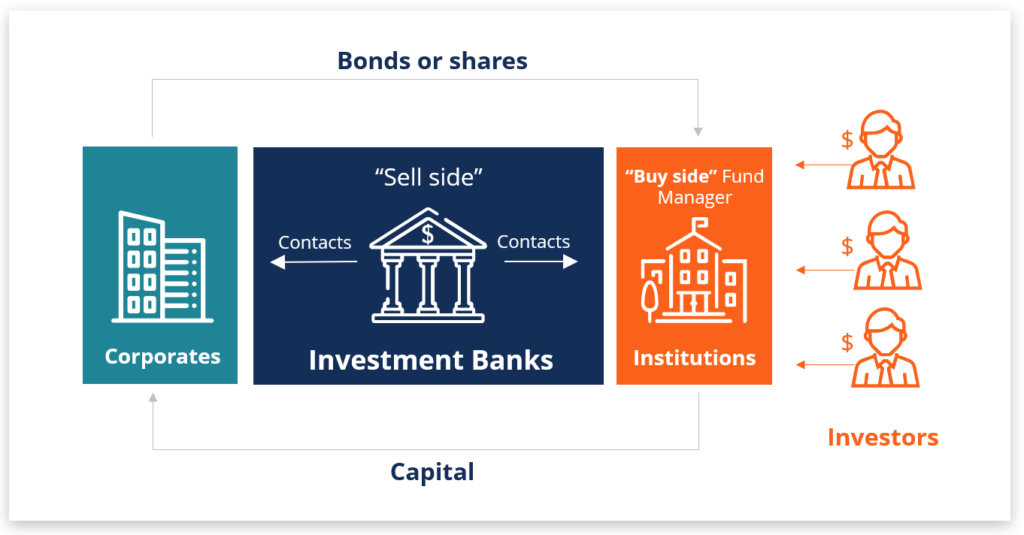

Investment banking is the division of a bank or financial institution that serves governments, corporations, and institutions by providing underwriting (capital raising) and mergers and acquisitions (M&A) advisory services. Investment banks act as intermediaries between investors (who have money to invest) and corporations (who require capital to grow and run their businesses). This guide will cover what investment banking is and what investment bankers actually do.

Image: Free Intro to Corporate Finance Course.

What Do Investment Banks Do?

There can sometimes be confusion between an investment bank and the investment banking division (IBD) of a bank. Full-service investment banks offer a wide range of services that include underwriting, M&A, sales and trading, equity research, asset management, commercial banking, and retail banking. The investment banking division of a bank provides only the underwriting and M&A advisory services.

Full-service banks offer the following services:

- Underwriting – Capital raising and underwriting groups work between investors and companies that want to raise money or go public via the IPO process. This function serves the primary market or “new capital”.

- Mergers & Acquisitions (M&A) – Advisory roles for both buyers and sellers of businesses, managing the M&A process start to finish.

- Sales & Trading – Matching up buyers and sellers of securities in the secondary market. Sales and trading groups in investment banking act as agents for clients and also can trade the firm’s own capital.

- Equity Research – The equity research group research, or “coverage”, of securities helps investors make investment decisions and supports trading of stocks.

- Asset Management – Managing investments for a wide range of investors including institutions and individuals, across a wide range of investment styles.

Underwriting Services in Investment Banking

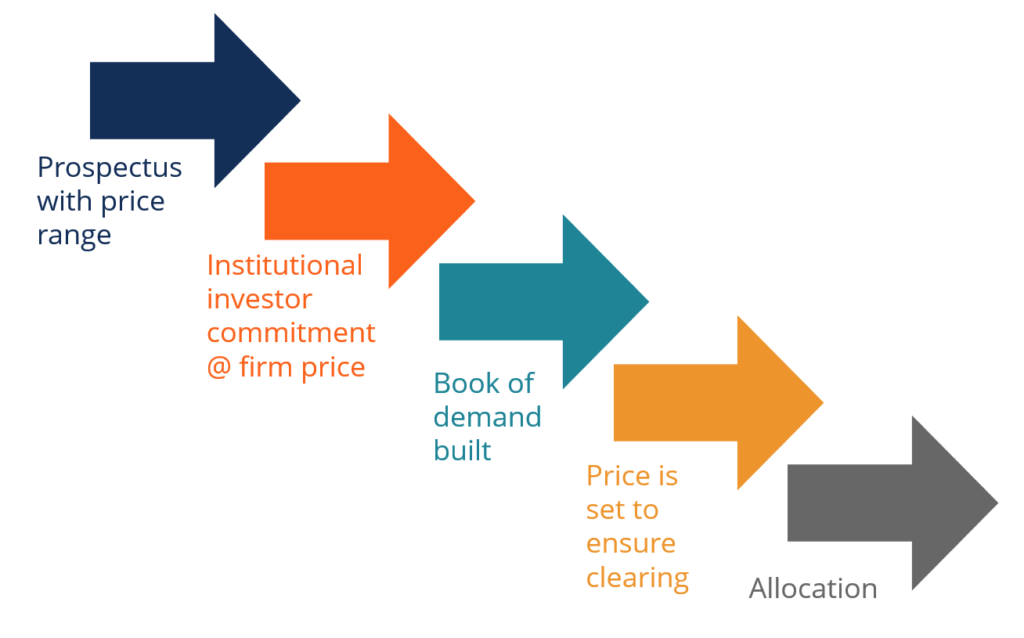

Underwriting is the process of raising capital through selling stocks or bonds to investors (e.g., an initial public offering IPO) on behalf of corporations or other entities. Businesses need money to operate and grow their businesses, and the bankers help them get that money by marketing the company to investors.

There are generally three types of underwriting:

- Firm Commitment – The underwriter agrees to buy the entire issue and assume full financial responsibility for any unsold shares.

- Best Efforts – Underwriter commits to selling as much of the issue as possible at the agreed-upon offering price but can return any unsold shares to the issuer without financial responsibility.

- All-or-None – If the entire issue cannot be sold at the offering price, the deal is called off and the issuing company receives nothing.

Once the bank has started marketing the offering, the following book-building steps are taken to price and complete the deal.

Image: Free Intro to Corporate Finance Course.

M&A Advisory Services

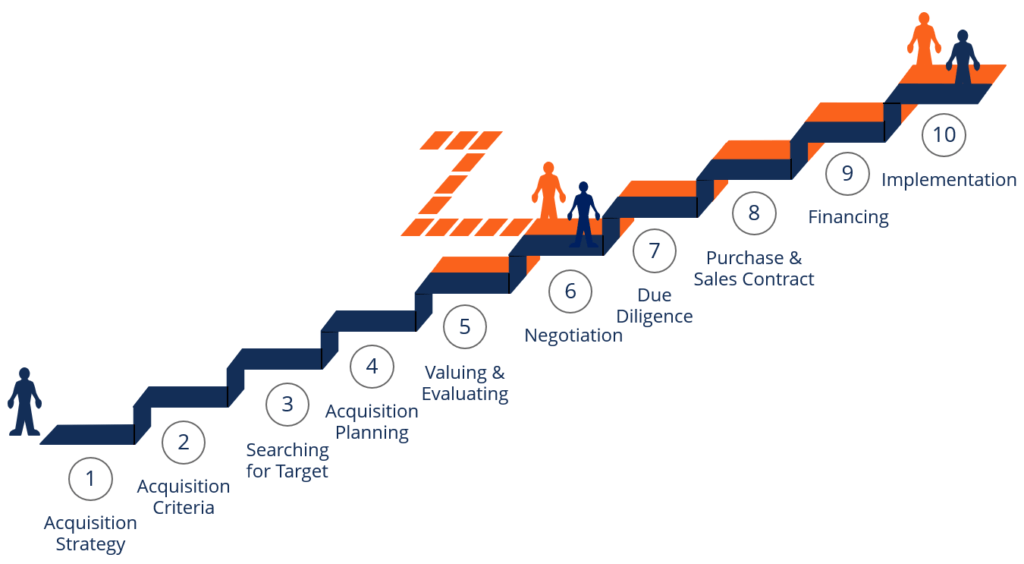

Mergers and acquisitions (M&A) advisory is the process of helping corporations and institutions find, evaluate, and complete acquisitions of businesses. This is a key function in i-banking. Banks use their extensive networks and relationships to find opportunities and help negotiate on their client’s behalf. Bankers advise on both sides of M&A transactions, representing either the “buy-side” or the “sell-side” of the deal.

Below is an overview of the 10-step mergers and acquisitions process.

Banking Clients

Investment bankers advise a wide range of clients on their capital raising and M&A needs. These clients can be located around the world.

Investment banks’ clients include:

- Governments – Investment banks work with governments to raise money, trade securities, and buy or sell crown corporations.

- Corporations – Bankers work with both private and public companies to help them go public (IPO), raise additional capital, grow their businesses, make acquisitions, sell business units, and provide research for them and general corporate finance advice.

- Institutions – Banks work with institutional investors who manage other people’s money to help them trade securities and provide research. They also work with private equity firms to help them acquire portfolio companies and exit those positions by either selling to a strategic buyer or via an IPO.

Investment Banking Skills

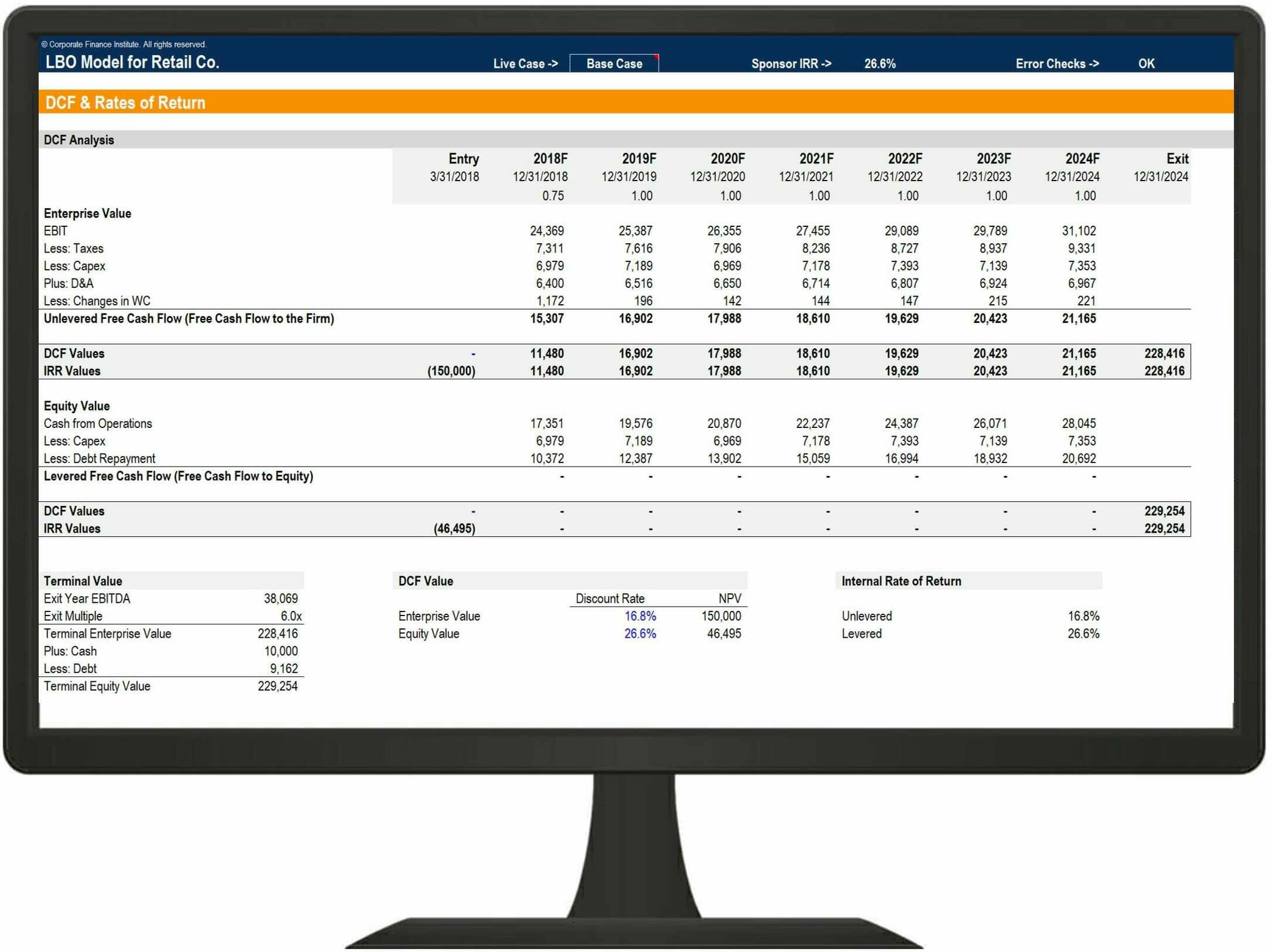

I-banking work requires a lot of financial modeling and valuation. Whether for underwriting or M&A activities, Analysts and Associates at banks spend a lot of time in Excel, building financial models and using various valuation methods to advise their clients and complete deals.

Investment banking requires the following skills:

- Financial modeling – Performing a wide range of financial modeling activities such as building 3-statement models, discounted cash flow (DCF) models, LBO models, and other types of financial models.

- Business valuation – Using a wide range of valuation methods such as comparable company analysis, precedent transactions, and DCF analysis.

- Pitchbooks and presentations – Building pitchbooks and PPT presentations from scratch to pitch ideas to prospective clients and win new business (check out CFI’s Pitchbook Course).

- Transaction documents – Preparing documents such as a confidential information memorandum (CIM), investment teaser, term sheet, confidentiality agreement, building a data room, and much more (check out CFI’s library of free transaction templates).

- Relationship management – Working with existing clients to successfully close a deal and make sure clients are happy with the service being provided.

- Sales and business development – Constantly meeting with prospective clients to pitch them ideas, offer them support in their work, and provide value-added advice that will ultimately win new business.

- Negotiation – Being a major factor in the negotiation tactics between buyers and sellers in a transaction and helping clients maximize value creation.

The screenshot above is of a leveraged buyout (LBO) model from CFI’s Financial Modeling Courses.

Careers in Investment Banking

Getting into i-banking is very challenging. There are far more applicants than there are positions, sometimes as high as 100 to 1. We’ve published a guide on how to ace an investment banking interview for more information on how to break into Wall Street.

In addition, you’ll want to check out our example of real interview questions from an investment bank. In preparing for your interview it also helps to take courses on financial modeling and valuation.

The most common job titles (from most junior to senior) in i-banking are:

- Analyst

- Associate

- Vice President

- Director

- Managing Director

- Head, Vice Chair, or another special title

Who are the Main Investment Banks?

The main banks, also known as the bulge bracket banks in investment banking, are:

- Bank of America Merrill Lynch

- Barclays Capital

- Citi

- Credit Suisse

- Deutsche Bank

- Goldman Sachs

- J.P. Morgan

- Morgan Stanley

- UBS

View a full list of the top 100 investment banks here. It is important to note that there are many smaller firms, often called mid-market banks, and boutique investment banks that make up a very large part of the market.

Video Explanation of How I-Banking Works

Below is a short video that explains how the capital markets function and who the key players are. You can see more free video tutorials on CFI’s YouTube channel.

Additional Resources

Thank you for reading CFI’s overview of i-banking and how the industry works. CFI is the official global provider of certification courses for aspiring investment banking professionals. To learn more about career paths and how to break into banking, please see these additional resources:

Create a free account to unlock this Template

Access and download collection of free Templates to help power your productivity and performance.

Already have an account? Log in

Supercharge your skills with Premium Templates

Take your learning and productivity to the next level with our Premium Templates.

Upgrading to a paid membership gives you access to our extensive collection of plug-and-play Templates designed to power your performance—as well as CFI's full course catalog and accredited Certification Programs.

Already have a Self-Study or Full-Immersion membership? Log in

Access Exclusive Templates

Gain unlimited access to more than 250 productivity Templates, CFI's full course catalog and accredited Certification Programs, hundreds of resources, expert reviews and support, the chance to work with real-world finance and research tools, and more.

Already have a Full-Immersion membership? Log in