Index Option

A financial derivative contract whose value is derived from an underlying stock market index

What is an Index Option?

An index option is a financial derivative contract whose value is derived from an underlying stock market index. It gives the holder the right (but not the obligation) to buy or sell the underlying index at a specified strike price. Index options comprise call and put options that confer the holder the right to buy and sell, respectively.

Index options are derivative contracts that represent an index which is a collection of individual component stocks. The underlying index can be a broad-based index, such as the S&P 500 Index, or it can be sector-based, such as the TSX Composite Bank Index.

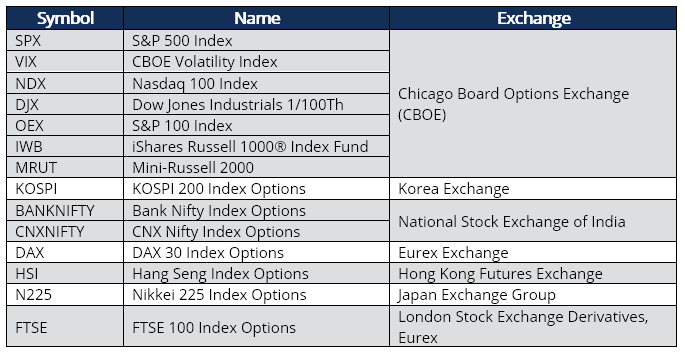

They allow options traders to bet on the direction or volatility of the whole stock market or a market segment represented by the underlying index without the need to trade individual stock options. Stock market indices most popular with index options include the following:

According to the Futures Industry Association (FIA), during the period January – June 2020, the highest volume of index options contracts traded was the Bank Nifty Index Options at 1.78 billion, a 30% increase from the same period the previous year. It was followed in a distant second by the CNX Nifty Index Options at 941 million, and a distant third was the KOSPI 200 Options at 341 million. The S&P 500 Index (SPX) Options was the fourth active index with a volume of 179 million.

How Index Options Work

With index options, there are no actual stocks that are traded, as the underlying index is the one that is referenced. Index options often make use of index futures contracts as the underlying asset. Physical delivery of the underlying index is not possible; hence, settlement is done through cash payments. Index options are typically European-style options that are settled only at the expiration date. There is no early exercise. An index call option allows for the purchase of the index, and a put option gives rights to sell the index option.

Index option derivatives are low-risk instruments used to take advantage of the directional swings of a particular index. An index call option allows for unlimited profit potential, while the downside loss is limited to the premium paid for the call option. Index put options’ profit potential is capped at the level of the index less the put premium paid, and the downside is limited to the put premium.

Index options normally come with a multiplier that determines the overall contract price, and it is usually 100 on most indices and exchanges. One of the most appealing benefits of index options is the ability to incur limited losses while gaining exposure to a basket of stocks at a fraction of the cost.

In most cases, it is in the investor’s interest to protect the investor’s portfolio from a decline beyond a predetermined floor price by locking in any gains accumulated. It can be achieved through buying a put option contract on each of the index holdings to lock in a specific sale price on each stock. Such a strategy is suitable for a small portfolio and protects it in the event of a market crash. However, if the portfolio is large and diversified, it is not cost-effective to insure each position in this way.

Thus, for large, diversified portfolios, index options are used to hedge the overall portfolio position. It is done by determining the correct index to use as a proxy for the portfolio. After the determination, the next step is to figure out the number of index options to use as a portfolio hedge.

Practical Example

An investor buys a Nasdaq 100 Index call option with the following attributes:

- Index spot price: 13,300

- Index call option premium: $100

- Contract multiplier: 100

- Contract cost: $10,000 ($100 x 100)

- Strike price: 13,700

- Breakeven point: 13,800 (13,700 + $100)

- Nasdaq 100 Index at expiration: 14,000

The investor would exercise the call option as it exceeds the strike price plus the premium making it profitable to undertake. The profit is determined by subtracting the contract cost from the gross proceeds (the difference between the index price at expiration and the strike price).

Proceeds if the call is exercised: $30,000, i.e. (14,000 – 13,700) x 100

Profit for the investor: $20,000, i.e., ($30,000 – $10,000)

Characteristics of Index Options

European style exercise

Index options are exercised in European style, where settlement is made on maturity or expiration of the index option contract. It is unlike the settlement for American style, where the option is exercised any time before the expiration date of the option. However, very few index options are exercised the American way, notably the OEX.

Expiration

The majority of index options are serial, i.e., they mature in March, June, September, and December. However, there are notable exceptions, such as KOSPI options, which mature every month for the first three consecutive months and then serial afterward.

Cash settlement

Most index options exercised through the European style are settled in cash as physical delivery is not possible. Cash payment is done the next business day after the exercise date. However, the determination of settlement price is different from index to index or exchange to exchange; hence, reference is made to contract specifications.

The KOSPI index options settlement price is determined by the weighted average of the component stocks in the index in the last 30 minutes of trading on the final trading day. The settlement price for the Nikkei 225 Index Options is determined by the weighted average of the opening price of stocks in the index the morning after the final trading day. The FTSE settlement price is based on the Exchange Delivery Settlement Price (EDSP) reported by LIFFE on the last day of trading.

Valuation of Index Options

The valuation of an index option is the same for other options, such as equity options with European exercise. The inputs for the valuation include:

- The underlying index spot price

- Strike price

- Risk-free rate

- Days to expiry

- The volatility of the stock price

- Dividend

The factors above are fed into a Black-Scholes option pricing model to calculate the call or put premium. The biggest challenge in index option pricing is estimating the dividend. Estimating the dividend component accurately requires knowing all individual stock dividends and weighting them in proportion to each stock weighting in the index.

The research division of large investment banks, hedge funds, and asset management firms can carry out such functions. Third-party information sources such as Bloomberg, Refinitiv, and S&P Global are capable of providing the dividend yield for each index as well. Another method used by traders is front-month futures contract and also leaving the dividend completely to determine the theoretical forward of the option.

Options valuation is essentially about pricing the call or put premium. The premium can also be calculated using a replicating portfolio with the use of hedge ratios and binomial trees, and Vanna Volga pricing.

The Black Scholes option pricing formula is expressed as below:

c = S0 N(d1) – Ke-rTN(d2)

p = Ke-rT N(-d2) – S0 N(-d1)

Where:

- d1 = ln(S0/K)+ (r+σ2/2)T / σ√T

- d2 = ln(S0/K)+ (r+σ2/2)T / σ√T = d1- σ√T

Where:

- c = Premium/ price of the call option

- p = Premium/ price of the put option

- S0 = Spot price

- K = Strike price

- N(d1) = Probability distribution of Spot or delta of the option

- N(d2) = Probability distribution of forward price movement

- T = time to expiry

- r = Risk-free rate of return

- σ = Estimated volatility

Index Options Strategies

There are numerous strategies used with index options. The following itemized strategies are just some of them:

- Buying outright an index call and put option when betting on the underlying index to rise or fall, respectively, generating a profit from the movement.

- Buying a bull call spread on an index involves buying a call option at a low strike price and selling a call option at a higher price. The sold options are sold far out of the money, which makes traders spend less on the option premium. The strategy limits profit if the index rises and protects capital because of the sold option.

- Bear put spread – Going long on a put with a higher strike price and going short on a put with a lower strike price. Both puts should use the same underlying index and the same expiration date. As the index declines, costs are netted, and profits are realized.

- Buying index put options to hedge portfolios as an insurance strategy. The portfolio gains profits if the index declines, but the upside profit potential is retained.

- Selling covered call options on an index – Buying the underlying index and selling call options against the same index. Investors gain from a rising index whilst losing the premium paid and can sell the index at the strike price if it goes above the strike price.

Importance and Benefits of Index Options

- Index options are used by hedgers and speculators to get exposure to the entire market or industry sector through a single transaction.

- An option holder’s loss is limited to the premium paid for it, but the upside gain potential is unlimited.

- Bullish traders can buy call options on the index if they are betting the index to go up and buy index put options if they are betting on the index going down.

- Index options offer diversification benefits.

- Index options are less volatile than the individual stocks that make up the index; hence, there is more predictability and no wild swings up and down.

- Index options are very liquid because of their popularity with traders and investors. The bid-ask spread is usually thin because of high demand.

- Index call options provide an investor with leverage as the premium paid is much lower than the contract value with potentially huge gains if the index moves slightly in the investor preferred position.

- Risk is predetermined as it is limited to a loss of the premium paid.

More Resources

CFI is the official provider of the global Capital Markets & Securities Analyst (CMSA)® certification program, designed to help anyone become a world-class financial analyst. To keep advancing your career, the additional CFI resources below will be useful:

Create a free account to unlock this Template

Access and download collection of free Templates to help power your productivity and performance.

Already have an account? Log in

Supercharge your skills with Premium Templates

Take your learning and productivity to the next level with our Premium Templates.

Upgrading to a paid membership gives you access to our extensive collection of plug-and-play Templates designed to power your performance—as well as CFI's full course catalog and accredited Certification Programs.

Already have a Self-Study or Full-Immersion membership? Log in

Access Exclusive Templates

Gain unlimited access to more than 250 productivity Templates, CFI's full course catalog and accredited Certification Programs, hundreds of resources, expert reviews and support, the chance to work with real-world finance and research tools, and more.

Already have a Full-Immersion membership? Log in