- Understanding the Difference Between Accounting and Finance Degrees

- Impact of Accounting and Finance on Corporate Finance Careers

- The Impact of Accounting in Corporate Finance

- The Impact of Finance in Corporate Finance

- How They Work Together in Corporate Finance

- Advantages of an Accounting Degree

- Advantages of a Finance Degree

- Advantages of Doubling Down with Both Degrees

- Which Degree is Right for You?

- Your Next Steps

Accounting vs. Finance Degree: Which is Right for You?

Choosing between a career path in finance and accounting can be tough. However, both accounting and finance degrees can provide you with a strong foundation for a career in the financial sector as they can equip you with the essential skills needed for analyzing financial data, understanding economic principles, and making well-informed business decisions on behalf of clients and employers.

While there’s an overlap between the two fields, financial accounting focuses more on creating financial reports and reporting on financial transactions, whereas finance emphasizes managing money and investments. The choice between these two degrees will significantly impact your career path and opportunities within the financial world; therefore, it’s not a decision to make lightly.

Below, we’ll break down the major differences when it comes to a finance vs accounting degree as well as their impact on finance jobs, which can help lead you to making the right choice.

Understanding the Difference Between Accounting and Finance Degrees

Accounting Degrees

An accounting degree primarily focuses on the detailed recording, classifying, and reporting of financial transactions. When studying accounting, students will learn about things like financial statements, tax regulations, auditing procedures, and accounting information systems. It’s also designed to prepare each accounting major to become a detail-oriented financial record-keeper and analyst. Graduates are equipped to handle tasks such as preparing tax returns, conducting audits, and ensuring compliance with financial rules and regulations.

Accounting programs also typically include more specialized courses in areas like tax accounting, auditing, and financial reporting, whereas finance programs often feature more courses in investments, financial markets, and risk management. Lastly, accounting graduates often pursue careers as Certified Public Accountants (CPAs), forensic accountants, auditors, or corporate accountants.

Finance Degrees

Finance degrees, on the other hand, concentrate on the management and growth of money and assets. Financial curriculums typically include topics such as investment analysis, financial markets, risk management, and corporate finance. Finance majors learn how to manage financial resources and make investment decisions, which prepares them for roles in areas such as investment banking, capital markets, portfolio management, and corporate financial management.

Impact of Accounting and Finance on Corporate Finance Careers

In the corporate finance world, both accounting and finance skills are valuable. Accounting knowledge and experience are crucial for understanding financial statements and ensuring regulatory compliance, in addition to understanding the financial health of a business. Finance skills are essential for strategic financial planning and decision-making. In corporate finance roles, professionals often need to blend accounting and finance skills to effectively manage a company’s financial resources, analyze investment opportunities, and make strategic financial decisions.

Let’s take a closer look at how accounting and finance impact corporate finance jobs:

The Impact of Accounting in Corporate Finance

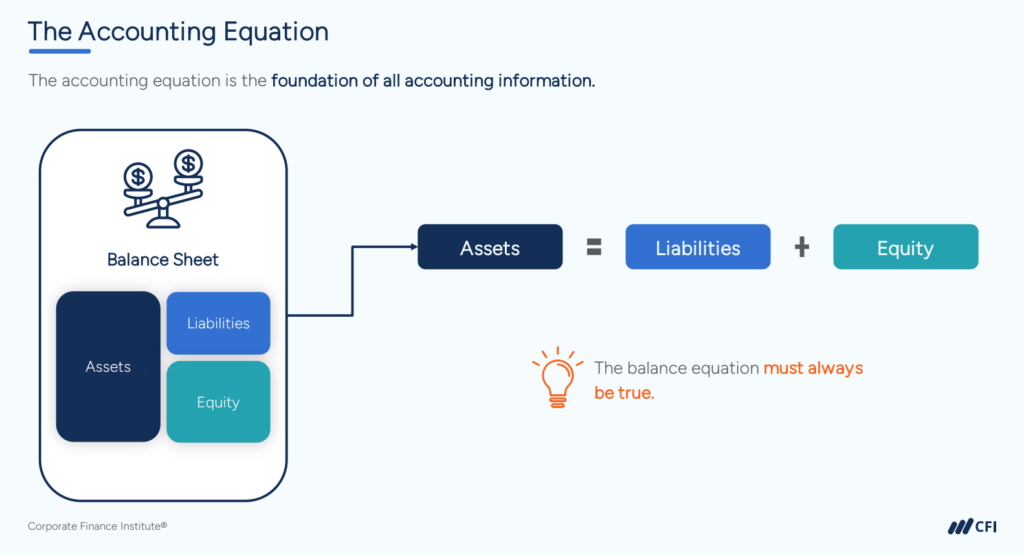

- Financial reporting: Accounting skills are essential for financial reporting regarding balance sheets, income statements, cash flow statements, preparing and interpreting financial statements, and working to strategize company finances for better financial health.

- Compliance: Accountants must ensure the company they work for follows financial regulations and standards to avoid liability and risk.

- Cost management and budgeting: Accounting knowledge helps in analyzing and controlling costs, and accountants play a key role in creating and managing budgets for both employers and clients.

The Impact of Finance in Corporate Finance

- Strategic planning: Finance skills are crucial for long-term financial planning and forecasting, which leads to better decision-making.

- Investment decisions: Finance professionals must evaluate investment opportunities and manage corporate portfolios for success.

- Capital structure: Finance professionals are also responsible for determining the optimal balance for debt and equity financing.

- Risk management: Finance skills are essential for identifying and mitigating market risk when managing portfolios and when it comes to long-term financial planning.

How They Work Together in Corporate Finance

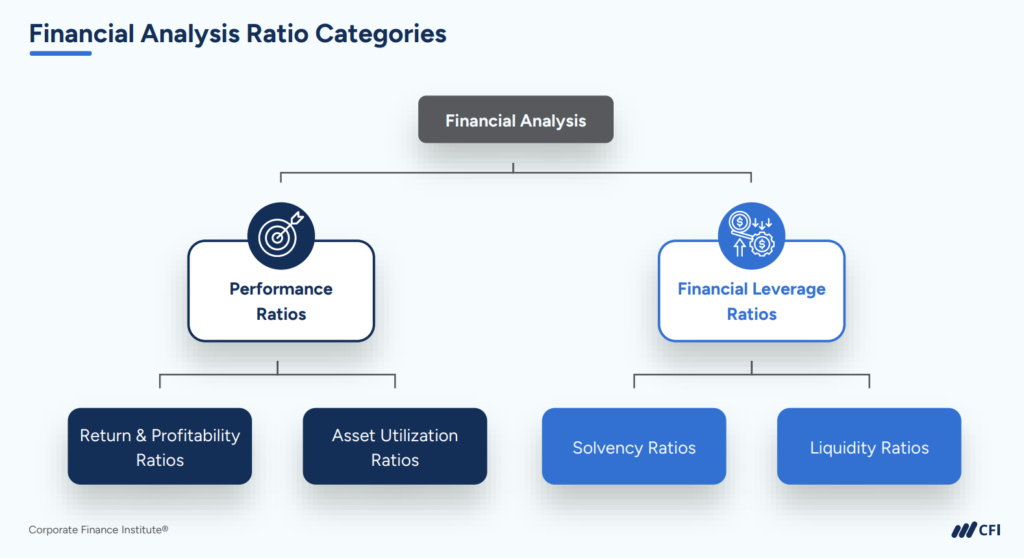

- Financial analysis: Both accounting and finance skills are necessary to fully understand a company’s economic health and performance.

- Decision-making: Accounting provides the data, whereas financing provides the analytical framework for making strategic decisions.

- Mergers and acquisitions (M&A): These complex transactions require both detailed accounting knowledge and strategic financial analysis.

- Investor relations: Communicating with investors requires understanding both the accounting details and the broader scope of financial strategy to accommodate a diverse range of investors.

Advantages of an Accounting and Finance Degree in the Corporate Finance World

Advantages of an Accounting Degree

- Strong foundation in financial reporting: Accounting graduates excel in preparing and analyzing financial statements, which is crucial for assessing a company’s financial health and making informed decisions in corporate finance.

- Expertise in tax planning and compliance: Accounting knowledge is invaluable for navigating complex tax regulations, potentially saving companies significant amounts through strategic tax planning.

- Auditing skills: The ability to conduct internal audits helps maintain financial integrity and identifies areas for improved efficiency within an organization.

- Forensic accounting capabilities: These skills are useful for detecting and preventing financial fraud, an increasingly important aspect of corporate finance.

Advantages of a Finance Degree

- Investment analysis expertise: Finance graduates are well-equipped to evaluate investment opportunities and manage investment portfolios, crucial for maximizing returns on assets.

- Risk management skills: Understanding financial risk and developing strategies to mitigate it is essential in corporate finance, especially in volatile markets.

- Proficiency in financial modeling: Finance degree holders are adept at creating complex financial models to forecast future performance and aid in strategic decision-making.

- Capital structure knowledge: Finance graduates understand how to optimize a company’s capital structure, balancing debt and equity to minimize the cost of capital and maximize shareholder value.

- Mergers and acquisitions expertise: Finance degree holders are well-prepared to analyze and facilitate corporate mergers, acquisitions, and other strategic transactions.

Advantages of Doubling Down with Both Degrees

A combined accounting and finance degree offers a comprehensive understanding of both fields, making graduates highly versatile in the job market. This dual expertise is particularly valuable in corporate finance roles that require both detailed financial analysis and strategic financial management.

Graduates with degrees in both areas will have the knowledge and versatility to:

- Bridge the gap between accounting and finance departments, facilitating better communication and collaboration.

- Provide more comprehensive financial analyses, considering both detailed accounting data and broader financial strategies.

- Make more informed decisions by understanding both the immediate financial impacts and long-term strategic implications.

- Identify potential issues or opportunities that might be missed by someone with expertise in only one area.

- Aim for high-level positions like Chief Financial Officer (CFO) or Finance Director, where a holistic understanding of a company’s financial operations is crucial.

- Excel in roles that require a blend of skills, such as financial controller or management accountant.

- Be well-positioned for consulting roles, where you can advise on both accounting practices and financial strategy.

- Thrive in entrepreneurial ventures, where you’d need to manage both day-to-day financial operations and long-term financial planning.

Moreover, having both skill sets in the finance world can accelerate your career progression. You’ll be able to take on a wider variety of projects and responsibilities, demonstrating your value to your employer — leading to promising career advancement opportunities, promotions, and more diverse career experiences.

Which Degree is Right for You?

If you’re deciding between an accounting or finance degree, there’s a lot to consider and compare. The major things you’ll want to think about include:

Your Personal Interests and Strengths

If you enjoy detailed analysis and have a knack for numbers, you might prefer accounting over finance. If you’re more interested in the big picture of financial management and investment strategies, finance could be the right choice.

When comparing the two degrees side by side, remember that accounting focuses on the detailed recording and reporting of financial transactions, where the key skills include financial statement preparation, tax knowledge, and auditing. Finance focuses on managing money and growing money and assets for clients, where the key skills include investment analysis, risk management, and financial modeling.

Your Career Goals

Understanding the typical career paths for each degree and considering which aligns better with your long-term professional aspirations is essential to deciding which one to pursue. Remember that many roles in corporate finance benefit from knowledge in both areas and if you want to have more versatility and diversification within the job market, you may want to consider pursuing both. You’ll also want to consider future opportunities and the skills you’ll need to unlock those opportunities.

Your Next Steps

Choosing between an accounting and finance degree depends on your personal interests, strengths, and career goals. Both degrees offer valuable skills and diverse career opportunities within the financial sector. Whether you lean towards the more precise and detailed world of accounting or the strategic ins and outs of finance, both paths can lead to rewarding careers in corporate finance.

To further explore each field and enhance your skills in both accounting and finance, check out CFI’s selection of finance and accounting courses and start preparing for a successful career in corporate finance and beyond.

Additional Resources

Asset Management vs. Wealth Management: What’s the Difference?

Data Analyst vs. Data Scientist: A Comparative Guide

Create a free account to unlock this Template

Access and download collection of free Templates to help power your productivity and performance.

Already have an account? Log in

Supercharge your skills with Premium Templates

Take your learning and productivity to the next level with our Premium Templates.

Upgrading to a paid membership gives you access to our extensive collection of plug-and-play Templates designed to power your performance—as well as CFI's full course catalog and accredited Certification Programs.

Already have a Self-Study or Full-Immersion membership? Log in

Access Exclusive Templates

Gain unlimited access to more than 250 productivity Templates, CFI's full course catalog and accredited Certification Programs, hundreds of resources, expert reviews and support, the chance to work with real-world finance and research tools, and more.

Already have a Full-Immersion membership? Log in