- Private Equity vs. Venture Capital vs. Angel/Seed Investors

- Comparison Table: Private Equity vs. Venture Capital vs. Angel and Seed Investors

- Stage of Business - Private Equity vs. Venture Capital vs. Seed Investors

- Size of Investment – Private Equity vs. Venture Capital / Seed Investors

- Type of Investment – Private Equity vs. Venture Capital and Seed

- Investment Team – Private Equity vs. Venture Capital vs. Angel Investors

- Level of Risk

- Return Targets

- Industry Focus

- Investment Screening

- Examples of PE, VC, and Angel/Seed Firms

- Financial Modeling in Private Equity vs. Venture Capital vs. Angel/Seed Investors

- More Resources

Private Equity vs Venture Capital, Angel/Seed Investors

A detailed comparison of the three investor classes

Private Equity vs. Venture Capital vs. Angel/Seed Investors

This guide provides a detailed comparison of private equity vs. venture capital vs. angel and seed investors. It’s easy to confuse the three classes of investors, especially because they overlap a lot and the distinctions are not always super clear. Below are the most important things you need to know about private equity, venture capital, and angel/seed investors.

Comparison Table: Private Equity vs. Venture Capital vs. Angel and Seed Investors

The easiest way to compare the three classes of investors is by viewing the table below. It provides a breakdown based on the stage of businesses they invest in, size and type of investment, risk/return profiles, their management teams, and more.

| Seed/Angel | Venture Capital | Private Equity | |

|---|---|---|---|

| Stage of Business | Founding, startup, pre-revenue | Early stage, pre-profitability | Mid to later stage, profitable, cash flow |

| Size of Investment ($) | $10,000's to a few million | A few million to tens of millions | Wide range: a few million to billions |

| Type of Investment | Equity, SAFE | Equity, convertible debt | Equity with leverage |

| Investment Team | Entrepreneurs/past founders | Mix of entrepreneurs and bankers/finance | Mostly bankers/finance professionals |

| Level of Risk | Extreme risk, high chance of losing all money | High risk, moderate chance of losing all money | Moderate risk, low chance of losing all money |

| Return Profile | >100x return targets | >10x return targets | >15% IRR |

| Industry Focus | Varies firm to firm | Varies firm to firm | Varies firm to firm |

| Investment Screening | Founders, TAM, market share potential, virality, # users, etc. | Founders, market share potential, revenue, margins, growth rate | EBITDA, cash flow, IRR, financial engineering |

| Examples | Paul Buchheit / Y Combinator, AngelList, Techstars, Jeff Clavier | Andreessen Horowitz, Sequoia Capital, VantagePoint, Highland | KKR, Carlyle Group, Blackstone, Apollo |

Stage of Business – Private Equity vs. Venture Capital vs. Seed Investors

As the names imply, “seed” or “angel” investors are usually the first investors in a business, followed by venture capital firms (think “new venture”), and finally, private equity firms.

Angel or seed investors participate in businesses that are so early-stage they may be pre-revenue with few to no customers at all. They could simply have a well-developed business plan, prototype, beta test, minimum viable product (MVP), or be at a similar level of development. Some of the businesses, however, may have revenue or even cash flow (it’s not to say that they can’t have those things – it’s just that they frequently don’t).

Venture capital (VC) firms typically invest in businesses that have proven their revenue model, or if not, at least have a sizable and rapidly-growing customer base with a revenue strategy in clear sight.

Private equity (PE) firms invest when a company has gone beyond generating revenue and developed profitable margins, stable cash flow, and is able to service a significant amount of debt. To learn more about the various types of cash flow, read our ultimate cash flow guide.

Size of Investment – Private Equity vs. Venture Capital / Seed Investors

Seed and angel investors really have no minimum size, but typically it’s at least $10,000 to $100,000 and can be as high as a few million in some cases. Y Combinator, for example, typically invests $120,000 for a 7% ownership stake in companies accepted into its accelerator program.

Venture capital firms can invest a wide range of values depending on the industry, company, and various other factors. As a rule of thumb, you can assume venture capital deals are, on average, anywhere between $1 million and $20 million.

Private equity firms, being later-stage investors, typically do larger deals and the range can be enormous depending on the types of business. There are boutique, mid-market private equity firms that will do $5 million deals, while massive global firms such as Blackstone and KKR do billion-dollar deals. The range is so wide it’s almost meaningless to put an average on it.

Type of Investment – Private Equity vs. Venture Capital and Seed

Angel/seed investors can only invest equity, as the businesses they are targeting are so early-stage that they’re not suitable for debt. In extremely early-stage deals they may use an instrument called a SAFE, which stands for Simple Agreement for Future Equity. This is an alternative to a convertible note. In exchange for money, the company gives the investor the right to buy shares in a future equity round (with specific price parameters). Most deals, however, are simply done as straight-up cash for shares.

VC firms invest common equity, preferred shares, and convertible debt securities in companies. Their focus is on equity upside, so even if they invest in a convertible debt security, their goal is to eventually own equity. Preferred shares can have all sorts of special rights and privileges to protect investors by limiting their downside (first out) and protecting them from future dilution of equity interest (rights/warrants/ratchets).

PE firms typically invest equity, but also borrow a significant amount of money to enhance their levered rate of return (internal rate of return IRR). They may undertake a transaction known as a leveraged buyout LBO where they maximize the amount of debt they can use in the deal.

Investment Team – Private Equity vs. Venture Capital vs. Angel Investors

Seed or angel investors are typically entrepreneurs who founded their own companies and had successful exits. Their main skillset is understanding the role of the entrepreneur in the business, and they often have very specific product knowledge.

Venture capital investment teams are often a mix of entrepreneurs and ex-investment bankers or other types of finance professionals. For example, A16Z hires a wide range of entrepreneurs and professionals, as you can see in their a16z team profiles.

Private equity firms are typically more weighted towards ex-investment bankers and corporate development types, or experienced corporate operators.

Level of Risk

This part is fairly straightforward. The earlier the stage the business is in, the higher the risk (as a generalization – there are exceptions, of course).

One thing that can skew the level of risk is leverage and financial engineering. While Top Private Equity firms may typically invest in lower-risk enterprises, if they use excessive leverage in acquiring a sizeable equity interest, then the investments can become very high-risk.

Return Targets

All three classes of investors are trying to earn the highest possible risk-adjusted rates of return. That goes without saying.

Given the different risk profiles though, we can observe that, on average, seed investments can return 100x or more when they work (they often go to zero), while later-stage VC returns may be more like 10x (fewer of them go to zero). PE firms seek 20% or higher IRRs (only a very small number of investments go to zero).

Industry Focus

There is no real, identifiable industry distinction between the three classes of investors.

Private equity vs. venture capital vs. angel/seed investors vary so widely by industry that they can only be assessed on a firm by firm basis.

Investment Screening

Angels and seed investors focus more on qualitative factors such as who the founders are, high-level reasons why the business should be a big success, and ideas about product-market fit.

VCs are also very focused on who the founders are, but usually by this stage, more concrete metrics are available to consider, such as revenue run rate, average revenue per user, customer lifetime value, margins, etc. To learn more, see our list of internet startup valuation metrics.

PE firms look at key financial metrics, including EBITDA, cash flow, free cash flow, and, ultimately, what IRR they believe they can achieve.

To learn more, see our business valuation fundamentals course now!

Examples of PE, VC, and Angel/Seed Firms

Let’s take a look at firms that operate in private equity vs. venture capital vs. angel and seed investing.

Seed stage:

- Y Combinator

- Techstars

- Boom Startup

- Maven Ventures

- Individuals such as Jeff Bezos and Marissa Mayer

Venture Captial firms:

- Oak Investment Partners

- VantagePoint

- Highland Capital Partners

- Greylock Partners

- Google Ventures

- Andreessen Horowitz

Private Equity firms:

- The Carlyle Group

- Kohlberg Kravis Roberts (KKR)

- The Blackstone Group

- Apollo Global Management

Financial Modeling in Private Equity vs. Venture Capital vs. Angel/Seed Investors

As you can see, there are many differences between private equity vs. venture capital vs. angel investors. The primary identifiable difference really comes down to the stage of businesses they invest in. Everything else tends to blur across the three categories.

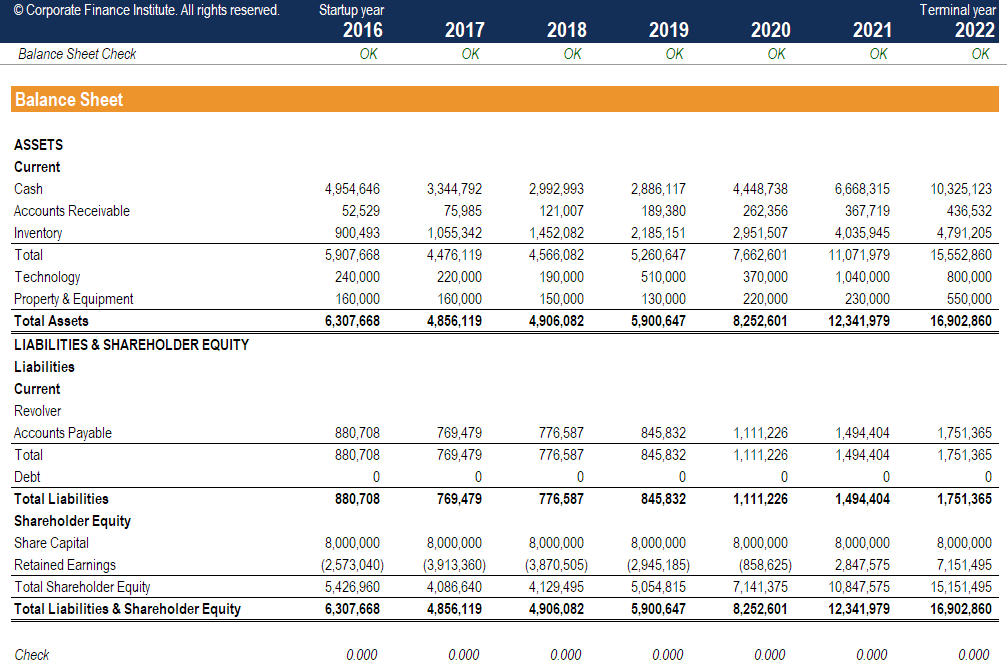

When it comes to skill sets and career paths in all three types of firms, expertise is required in extensive financial modeling and valuation methods.

If you’re looking for an edge in the job marketplace at investor firms, be sure to check out our online financial modeling courses, where you learn to build models like the one below from scratch.

More Resources

Thank you for reading CFI’s guide on Private Equity vs Venture Capital, Angel/Seed Investors. You may find these additional resources helpful:

Create a free account to unlock this Template

Access and download collection of free Templates to help power your productivity and performance.

Already have an account? Log in

Supercharge your skills with Premium Templates

Take your learning and productivity to the next level with our Premium Templates.

Upgrading to a paid membership gives you access to our extensive collection of plug-and-play Templates designed to power your performance—as well as CFI's full course catalog and accredited Certification Programs.

Already have a Self-Study or Full-Immersion membership? Log in

Access Exclusive Templates

Gain unlimited access to more than 250 productivity Templates, CFI's full course catalog and accredited Certification Programs, hundreds of resources, expert reviews and support, the chance to work with real-world finance and research tools, and more.

Already have a Full-Immersion membership? Log in