- What is an Intercreditor Agreement?

- Significance of an Intercreditor Agreement

- Negotiating an Intercreditor Agreement

- Key Provisions in an Intercreditor Agreement

- Seniority

- Repayment & Prepayment

- Subordination & Collateral

- Dispute Resolution, Default, and Voting Rights

- Information Sharing

- Release and Termination Rights

- Who Drafts an Intercreditor Agreement?

- Practical Example of an Intercreditor Agreement

Intercreditor Agreement

A contract between two or more creditors that governs their financing relationships with a joint borrower

What is an Intercreditor Agreement?

An Intercreditor Agreement documents the rights and obligations of two or more creditors when working with a shared borrower; these include priority of claims on loans and collateral.

By coordinating their mutual (and competing) interests in advance, the Agreement governs their relationship with each other and the borrower, providing legal certainty. Cooperation can reduce costs, risks, and inefficiencies when working in tandem to service a common borrower.

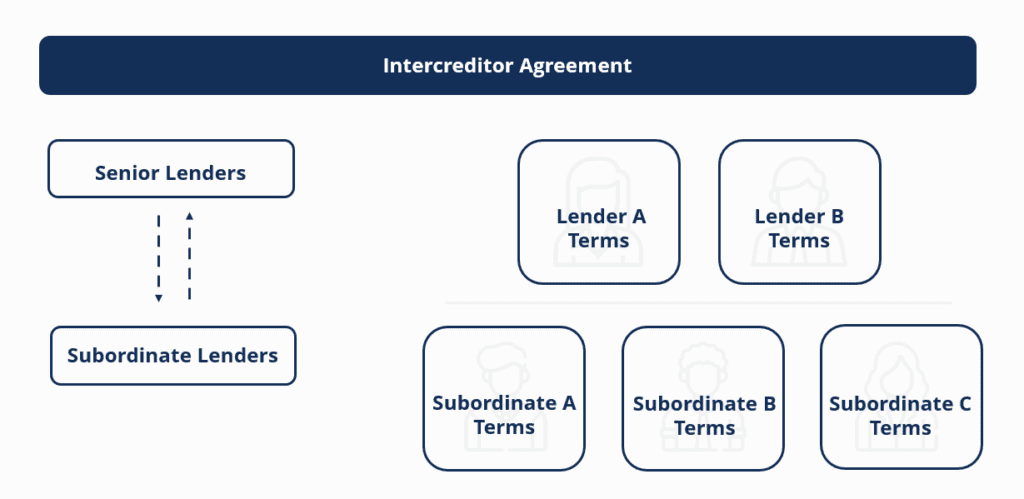

In a typical scenario, there are multiple loans and creditors, such as senior and subordinate (junior) lenders. The Agreement defines the claims of each creditor. In other circumstances, two or more senior lenders may require multiple Agreements defined amongst each other.

Instead of multiple Agreements, a group of lenders (found in project financing or syndications) may use a Common Terms Agreement (CTA), combining the borrower’s loan terms with specific terms between the creditors.

Key Highlights

- An Intercreditor Agreement stipulates creditor rights and priorities, which are critical if a borrower’s financial capabilities erode and the borrower defaults.

- Creditors use the Agreement to reduce risks and provide certainty whenever they work with a common borrower.

- An Agreement often includes provisions such as seniority, payment priority, subordination, dispute resolution, information sharing, and other rights and remedies.

Significance of an Intercreditor Agreement

An Intercreditor Agreement plays a pivotal role in the right to lien. It builds a foundation of creditor rights and priorities in case a borrower’s financial position erodes and the borrower triggers an event of default.

Conflicts can occur if each party exercises its rights simultaneously without such a document. When a credit event occurs, if there are insufficient assets to settle all liabilities, there will always be a competition of creditors’ interests. The intercreditor agreement thus defines and protects the interests of each creditor in advance of any such scenario.

Negotiating an Intercreditor Agreement

In many Agreements, the senior lender dictates the terms of the lien because there is often an imbalance of power. If the junior lender fails to negotiate the deed strongly, they may be at a disadvantage in a downside scenario.

For example, a junior lender may have fewer resources and need more time to seek approval to finalize an agreement or claim. It may be used as a tactic for senior lenders to frustrate a junior lender enough that they capitulate to the stated terms.

In the case of project financing, the junior lender may consider adding terms for taking over if the borrower defaults, as their loss on default is naturally higher than the senior lender.

Under such a circumstance, the junior lender has two options: inject additional funds to cure monetary defaults to the senior lender, or pay off the senior lender and terminate the Agreement. The latter, in effect, means the junior lender assumes the role of senior lender and increases their exposure to the project.

Take-out financing can prove challenging when the dynamic between lenders is highly unbalanced; for example, when the senior financing exceeds the junior’s capacity or the terms from the senior lender are “non-negotiable”.

Key Provisions in an Intercreditor Agreement

Seniority

Describes the relative legal ranking of various debts (i.e., in order from senior to subordinated, etc.). It gives one creditor preference over another and may also cover interest, fees, costs, and indemnity payments, along with any limitation on the amount of debt issued by each.

Repayment & Prepayment

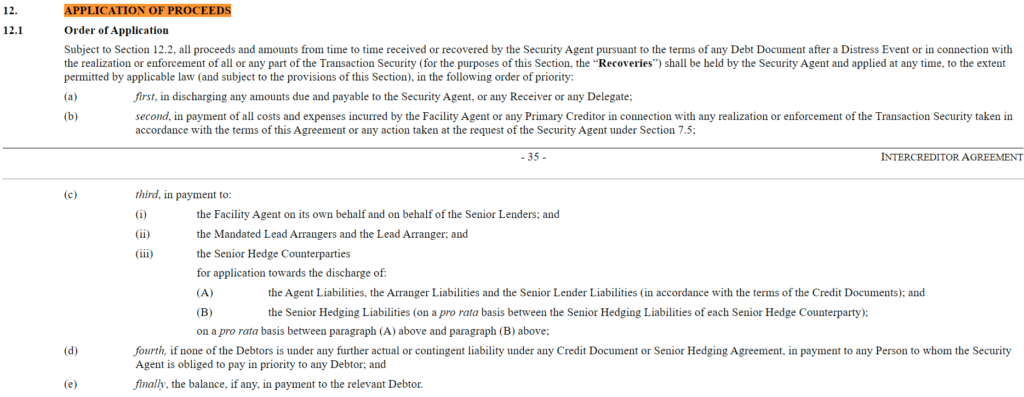

Define the priority when applying the borrower’s cash flow to debt; for example, the senior lender receives principal and interest payments first. The sequence (sometimes known as a waterfall) may also address the proceeds of collateral disposal and other recovery efforts available to support repayment.

It may describe how repayments to junior lenders can be blocked, for example, if a borrower defaults. Other protections include the acceleration of debt repayment and other traditional legal remedies.

Subordination & Collateral

Describe the granting of rights (such as repayment priority) from one creditor to another over pledged collateral. In some instances, specific rights may take precedence over debt seniority.

For example, a senior creditor may agree to subordinate their recovery rights to some specific collateral (or a class of collateral) to a junior lender. The result restricts the senior lender from exercising repayment priority rights until the junior lender’s claim is satisfied.

Dispute Resolution, Default, and Voting Rights

Structure the enforcement framework governing creditors, such as the dispute resolution process. It may include standstill clauses (i.e., refraining from taking enforcement actions) and other decision-making powers. Another example of enforcement power is the ability to reorganize the borrower and its capital structure.

The allocation of voting rights varies significantly. Recent US case law[1] suggests the enforceability of the voting rights provision remains in flux.

Information Sharing

Outlines how financial performance and other details are disclosed in a data room or other methods, so creditors do not act uncoordinated or without material, non-public information. Sharing clauses may stipulate the notification of potential prescribed events between the creditors.

Release and Termination Rights

Define the circumstances whereby creditors can be changed and released from the Agreement, for example, upon the discharge of a priority obligation. Clauses may also include shifting rights and obligations among the parties.

Who Drafts an Intercreditor Agreement?

The lead arranger or agent of the financing transaction is typically responsible for working with legal counsel to draft the Agreement, as they coordinate the overall financing process between creditors. For less complex transactions, the lead arranger is also usually the senior lender. A borrower may be involved if the financing relationship is complex or if they have a close relationship with the lenders.

Drafts are circulated for further negotiation and approval by the individual creditors. The complexity of this effort expands with the number of creditors involved in an agreement. Each must follow their policies and process, including any vetting by their (separate) legal counsel, so the lead arranger’s role is paramount.

Practical Example of an Intercreditor Agreement

Homes Inn & Hotels Management Inc. required a $240MM senior secured credit facility for general corporate purposes[2].

Due to the size of the deal, the financing was provided by a syndicate with multiple senior creditors. The facility agent and security agent were both BNP Paribas.

The company (and its subsidiaries) also have obligations owed to it by others, not unique in the corporate world. Thus, it acts as a secondary lender in this transaction. Another example is when a company acts as a lender and finances shareholder loans to its owners.

In clause 1, the Intercreditor Agreement defines the ranking and priority. The Senior creditors all rank pari passu, meaning they are treated equally.

In this case, as the company is a secondary lender, it agrees to subordinate and make junior its repayment rights of obligations owed to it by others.

In clause 12, “Application of proceeds,” the Agreement states that the Security Agent distributes the recoveries from realization or enforcement in a specific order of priority after a Distress Event.

As the above examples illustrate, the seniors enter into an intercreditor agreement to protect their interests and unnecessary conflict amongst themselves when they jointly finance a common borrower.

Related Resources

CFI is a leading provider of financial analysis programs, including the Commercial Banking & Credit Analyst (CBCA)™ certification for finance professionals looking to take their careers to the next level.

Thank you for reading CFI’s guide on Intercreditor Agreement. To keep learning and advancing your career, the additional CFI resources below will be helpful:

Fundamentals of Credit

Learn what credit is, compare important loan characteristics, and cover the qualitative and quantitative techniques used in the analysis and underwriting process.

Create a free account to unlock this Template

Access and download collection of free Templates to help power your productivity and performance.

Already have an account? Log in

Supercharge your skills with Premium Templates

Take your learning and productivity to the next level with our Premium Templates.

Upgrading to a paid membership gives you access to our extensive collection of plug-and-play Templates designed to power your performance—as well as CFI's full course catalog and accredited Certification Programs.

Already have a Self-Study or Full-Immersion membership? Log in

Access Exclusive Templates

Gain unlimited access to more than 250 productivity Templates, CFI's full course catalog and accredited Certification Programs, hundreds of resources, expert reviews and support, the chance to work with real-world finance and research tools, and more.

Already have a Full-Immersion membership? Log in