- What is Accounting?

- What is Financial Planning and Analysis (FP&A)?

- FP&A vs. Accounting: Key Differences

- Why FP&A and Accounting are Both Important

- Do You Need to Be an Accountant to Work in FP&A?

- How to Transition From Accounting to FP&A

- 1. Expand Your Education and Skills

- 2. Build Technical Proficiency with a Certification

- 3. Gain Relevant Experience

- 4. Develop Strategic Thinking

- 5. Emphasize Transferable Skills

- Strong Career Prospects

Accounting vs. Financial Planning and Analysis (FP&A)

When it comes to managing a company’s financial activities, the accounting and financial planning and analysis (FP&A) teams each play distinct yet interdependent roles. While accounting ensures accuracy and compliance in financial statements and reporting, FP&A leverages this information to develop budgets, identify business trends, analyze data, create financial forecasts, and advise the Chief Financial Officer (CFO) and other senior executives on critical business decisions.

This comprehensive guide breaks down the unique characteristics, key differences, and interplay between accounting and FP&A.

Key Highlights

- Accounting ensures accurate financial records and compliant financial reports, while FP&A uses this financial data to build budgets, variance analysis, forecasts, and scenario analysis.

- Accounting experience is beneficial but not mandatory for a career in FP&A. Analytical skills, attention to detail, and understanding of financial statements are transferable between the two fields.

- For a career transition from accounting to FP&A, consider an advanced degree or professional certification, develop your business acumen, and volunteer for cross-functional projects to gain practical experience.

What is Accounting?

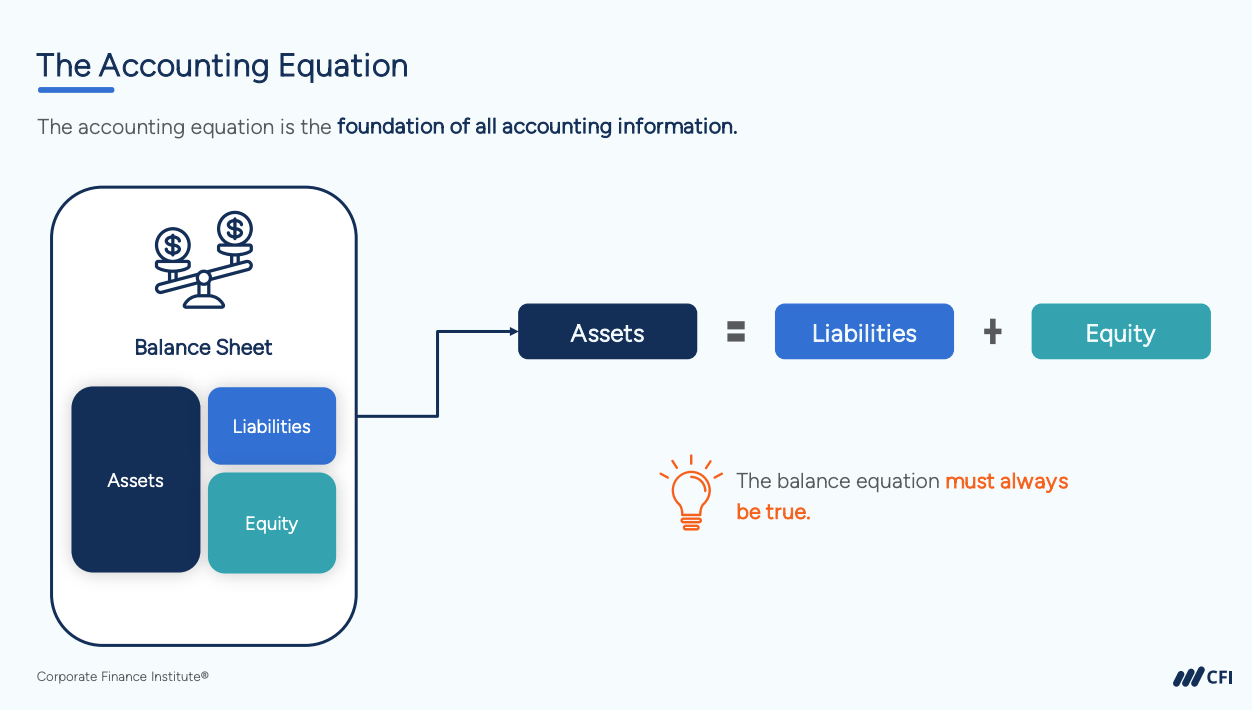

Accounting is the systematic process of recording, analyzing, and interpreting a company’s financial transactions, serving as the backbone of financial controls and stewardship in businesses. This discipline is essential for maintaining accurate financial records, compliance with accepted accounting principles and providing stakeholders with detailed and accurate financial reports.

Key Accounting Functions

Accountants take on various roles and responsibilities, depending on the size and nature of the business. The key responsibilities of an accounting team include:

- Ledger Management: Accountants are responsible for maintaining and reviewing the general ledger, a complete record of financial transactions over the life of a company.

- Reporting and Compliance: Accounting managers ensure that financial reports comply with domestic and international accounting standards and laws.

- Financial Statements: Preparing accurate financial statements (balance sheets, income statements, and cash flow statements) that summarize the financial status of the organization.

- Tax Preparation: Calculating and filing tax returns and ensuring that the company pays accurate taxes on time to avoid legal issues.

- Audit and Assurance: Providing audit services for internal or external purposes to affirm the accuracy of financial records, operations, and reporting.

Image: CFI’s Accounting Fundamentals Course

What is Financial Planning and Analysis (FP&A)?

Like accounting, Financial Planning and Analysis (FP&A) professionals perform a variety of functions. FP&A activities include budgeting, forecasting, quantitative and qualitative analysis, tracking progress against its goals, and providing strategic and financial insights to company executives and business partners.

This discipline involves data gathering, financial forecasting, and analyzing “what-if” scenarios to aid in strategic planning and decision-making. Financial analysts in FP&A must have a deep understanding of their company’s three financial statements and the bigger picture of economic trends and the company’s financial health.

Key FP&A Functions

FP&A’s core activities include:

- Forecasting: Financial analysts build detailed forecasts of future performance using key financial metrics such as revenue, cash flow, profit margins, capital expenditures, and headcount, based on historical data and expected growth.

- Budgeting: They are integral in the budgeting process, setting financial targets and allocating resources to support strategic goals. This function includes the creation of annual budgets and continuous adjustments and scenario planning throughout the year.

- Financial Planning: In addition to budgeting, the FP&A team typically takes the lead in corporate financial planning, ensuring the following year’s plan aligns with budgets and supports strategic objectives.

- Scenario Planning: They conduct scenario and sensitivity analysis using past performance and market trends to project future financial conditions, growth scenarios, and business performance.

- Variance Analysis and Performance Monitoring: FP&A conducts ongoing assessments of financial performance against key performance indicators (KPIs). They perform variance analysis for metrics like revenue and expenses to understand what’s driving deviations from forecasts. Analyzing financial performance on an ongoing basis helps to ensure that financial targets are met, and operational adjustments are made in a timely manner.

- Supporting Executive Decision-Making: By providing in-depth analysis and actionable insights, FP&A helps business leaders understand the drivers of the company’s financial performance and implications of critical financial decisions.

Tools and Technologies

FP&A professionals rely on a variety of activities and tools to perform their duties effectively:

- Financial Modeling: Building financial models that simulate the financial impact of strategic decisions under different scenarios.

- Data Visualization and Business Intelligence (BI) Tools: Software such as Tableau and Power BI help in visualizing data trends and delivering insights through interactive dashboards and reports.

- ERP Systems: Enterprise resource planning (ERP) systems integrate various financial functions and provide a unified source of truth for financial data, which is crucial for accurate forecasting and analysis.

- Advanced Analytics: Leveraging statistical tools and machine learning algorithms to predict future trends and model complex financial scenarios.

By harnessing these tools, FP&A professionals can enhance their analytical capabilities, providing more precise and timely data analysis to support strategic business decisions and financial outcomes.

FP&A vs. Accounting: Key Differences

Both FP&A and accounting are essential to the financial management of business units within a company, but they focus on different aspects of financial oversight and support. Here, we clarify these differences through distinct comparisons:

Nature of Work

- FP&A: Both proactive and reactive, combining forward-looking forecasting with the analysis of current financial performance. Financial analysts in FP&A use historical and current data to forecast future trends, support strategic planning, and manage present realities such as budget variance. Their role is to provide predictive insights while also ensuring that current operations align with strategic financial targets.

- Accounting: Predominantly reactive and historical, focusing on accurately recording past and present financial transactions. Accounting managers ensure compliance with accounting principles and regulations, providing a detailed and accurate reflection of the company’s financial state at any given moment.

Why FP&A and Accounting are Both Important

Accounting and Financial Planning and Analysis (FP&A) aren’t isolated functions within a corporation; rather, they are interconnected disciplines that significantly enhance each other and the overall financial health of the organization. Understanding the synergies between these two areas can illuminate how they collectively contribute to a company’s own financial health and stability and its strategic plan and execution.

Interdependency

- Data Foundation: Accounting provides a reliable foundation of accurate financial data, which is critical for FP&A activities. Without the precise and compliant data provided by accounting, the forecasts and strategic insights generated by FP&A would lack accuracy and reliability.

- Informed Decision-Making: FP&A utilizes the data curated by accounting to identify trends, prepare forecasts, and advise on future business strategies.

- Regulatory Compliance: Accounting ensures that all financial practices and financial reporting comply with laws and regulations. Meanwhile, FP&A helps to develop strategies based on financial capabilities and constraints identified through compliance requirements.

- Performance Feedback Loop: Accounting reports on financial results by comparing actual results to historical data, while FP&A assesses these results against forecasts and budgets. This cycle creates a feedback loop where both departments work together to refine financial strategies and operational adjustments, ensuring ongoing alignment with corporate goals.

- Resource Allocation and Utilization: Effective resource management requires the meticulous record-keeping of accounting combined with the strategic oversight of FP&A. Accounting tracks how resources are currently being used, while FP&A develops plans to optimize future resource allocation based on strategic goals and market conditions.

- Risk Management: Both disciplines play a pivotal role in managing financial and regulatory risks. Accounting focuses on identifying and mitigating risks through stringent financial controls and compliance monitoring, while FP&A uses financial models to assess potential risks in business strategies and forecasts. Together, they enable the organization to foresee, evaluate, and respond proactively to financial uncertainties and risks.

Do You Need to Be an Accountant to Work in FP&A?

A common question among accountants and other professionals considering a career in corporate finance is whether a background in accounting is necessary or beneficial for transitioning into Financial Planning and Analysis (FP&A). Understanding the skill overlaps and the unique aspects of each field can clarify this path.

Skills Transfer

The skills developed in accounting are not only transferable but often form a strong foundation for roles in FP&A. Here are several key areas where accounting skills align well with FP&A requirements:

- Analytical Skills: Both accountants and FP&A professionals must possess strong analytical capabilities. Accountants analyze financial statements and transactions to ensure accuracy and compliance, while FP&A professionals analyze financial data to forecast trends and support strategic decisions.

- Attention to Detail: The precision required in accounting is beneficial in FP&A, where detailed financial analysis, budgeting, forecasting, and variance analysis require meticulously working with numbers.

- Understanding of Financial Statements: A deep understanding of three financial statements — the balance sheet, income statement, and cash flow statement — is required in accounting and directly applicable to FP&A. These three statements are foundational to building financial models.

- Technology Proficiency: Accountants often use advanced accounting software and ERP systems, skills that are easily transferable to the sophisticated modeling and data analysis tools used in FP&A.

- Risk Management: Accountants’ expertise in spotting discrepancies and potential financial risks can be incredibly valuable in FP&A, where risk assessment forms a part of strategic planning.

- Integrated Perspective: Having an accounting background allows FP&A professionals to appreciate the nuances of financial data more deeply, facilitating more integrated and realistic financial models and forecasts.

While a background in accounting is advantageous, it is not strictly necessary for a career in FP&A. Many FP&A professionals come from varied backgrounds, including finance, economics, and even fields such as engineering or data science, where they have developed strong quantitative and analytical skills.

How to Transition From Accounting to FP&A

Transitioning from accounting to Financial Planning and Analysis (FP&A) can be a rewarding career move that allows professionals to apply their analytical skills in a more strategic role. Here are practical steps for making this transition:

1. Expand Your Education and Skills

- Advanced Education: Consider pursuing further education, such as a Master’s in Business Administration (MBA) or a finance-related postgraduate degree. These programs often include coursework that aligns well with FP&A functions, such as modeling, business strategy, and advanced data analysis.

2. Build Technical Proficiency with a Certification

- Financial Modeling: Familiarity with financial modeling is crucial for developing strategic forecasts and conducting scenario analysis. CFI’s Financial Modeling & Valuation Analyst (FMVA®) certification program teaches its participants everything they need to know about advanced modeling, budgeting, and forecasting in Excel.

Image: CFI’s Introduction to 3-Statement Modeling Course

- Business Intelligence Tools: Gain proficiency with business intelligence (BI) tools, which are widely used in FP&A to analyze data and generate actionable insights. CFI’s Business Intelligence & Data Analyst (BIDA®) Certification teaches best practices and hands-on skills with industry-standard tools like Power BI, Tableau, SQL, and more.

Image: CFI’s Introduction to Business Intelligence Course

3. Gain Relevant Experience

- Cross-Functional Projects: Seek opportunities to work on projects that require collaboration between accounting and FP&A teams. This experience can help you understand the strategic aspects of budgeting, forecasting, and performance monitoring.

- Budgeting and Forecasting: Volunteer to assist with budgeting, forecasting, or financial modeling tasks in your current accounting role, or participate in cross-departmental financial planning initiatives.

4. Develop Strategic Thinking

- Business Strategy: Study how FP&A professionals influence business strategy by reading industry reports, articles, or case studies. Understanding market trends and strategic decision-making will help you adopt a more forward-looking mindset.

- Networking: Connect with FP&A professionals through networking events, seminars, or mentorships to learn about best practices and develop a clearer understanding of what the role requires.

5. Emphasize Transferable Skills

- Highlight Accounting Experience: When seeking FP&A opportunities, emphasize how your accounting experience has given you a strong foundation in financial reporting, data accuracy, and compliance — all of which are highly valued in FP&A.

- Adaptable Mindset: Demonstrate your ability to adapt to new analytical challenges, especially in forecasting and budgeting, variance analysis, performance monitoring, and supporting senior management decision-making.

Strong Career Prospects

Whether one is considering a career transition from accounting to FP&A or exploring potential career paths, both professions are in high demand with positive growth outlooks. The skills and insights from both fields are integral to a corporation’s financial health and strategic agility. Together, they form a comprehensive framework that enables companies to navigate current challenges while anticipating and preparing for future opportunities.

Additional Resources

Accounting Crash Courses

Learn accounting fundamentals and how to read financial statements with CFI’s online accounting classes.

These courses will give you the confidence to perform world-class financial analyst work. Start now!

Boost your confidence and master accounting skills effortlessly with CFI’s expert-led courses! Choose CFI for unparalleled industry expertise and hands-on learning that prepares you for real-world success.

Create a free account to unlock this Template

Access and download collection of free Templates to help power your productivity and performance.

Already have an account? Log in

Supercharge your skills with Premium Templates

Take your learning and productivity to the next level with our Premium Templates.

Upgrading to a paid membership gives you access to our extensive collection of plug-and-play Templates designed to power your performance—as well as CFI's full course catalog and accredited Certification Programs.

Already have a Self-Study or Full-Immersion membership? Log in

Access Exclusive Templates

Gain unlimited access to more than 250 productivity Templates, CFI's full course catalog and accredited Certification Programs, hundreds of resources, expert reviews and support, the chance to work with real-world finance and research tools, and more.

Already have a Full-Immersion membership? Log in