How To Build A Merger Model

The key steps to building a merger model

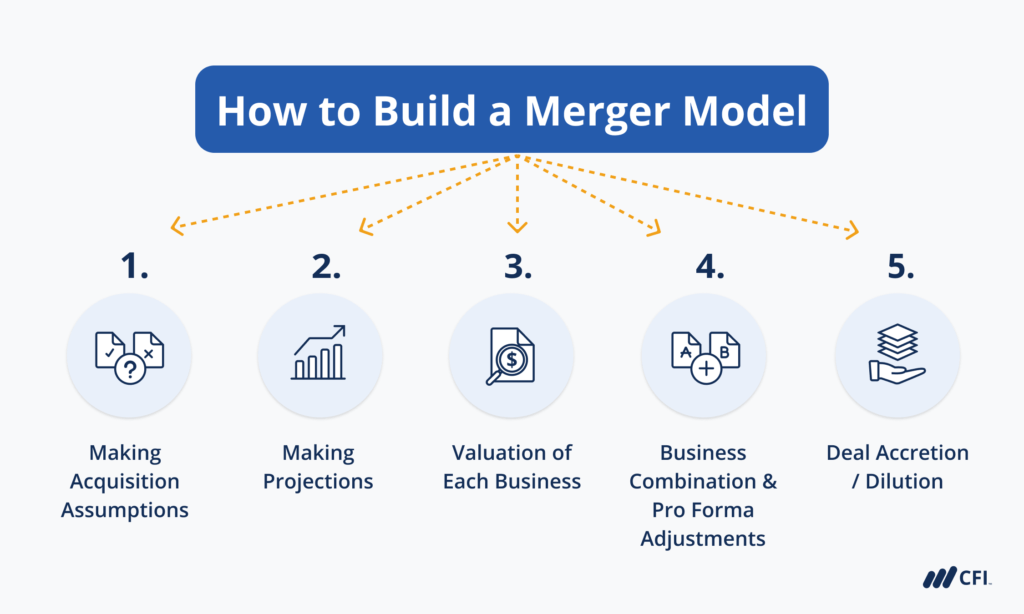

How to Build a Merger Model

A merger model is an analysis representing the combination of two companies that come together through an M&A process. A merger is the “combination” of two companies, under a mutual agreement, to form a consolidated entity. An acquisition occurs when one company proposes to offer cash or its shares to acquire another company.

In both cases, both companies merge to form one company, subject to the approval of the shareholders of both companies. Below are the steps of how to build a merger model.

To learn more, check out our Merger Modeling Course.

The mains steps for building a merger model are:

- Making Acquisition Assumptions

- Making Projections

- Valuation of Each Business

- Business Combination and Pro Forma Adjustments

- Deal Accretion/ Dilution

Each of these steps will be explored in more detail below.

1. Making Acquisition Assumptions

Where the buyer’s stock is undervalued, the buyer may decide to use cash instead of equity consideration since they would be forced to give up a significant number of shares to the target company.

In contrast, the target company may want to receive equity because it might be more valuable than cash. Finding a consideration agreeable to both parties is a crucial part of striking a deal.

In contrast, the target company may want to receive equity because it might be perceived as more valuable than cash. Finding a consideration agreeable to both parties is a crucial part of striking a deal.

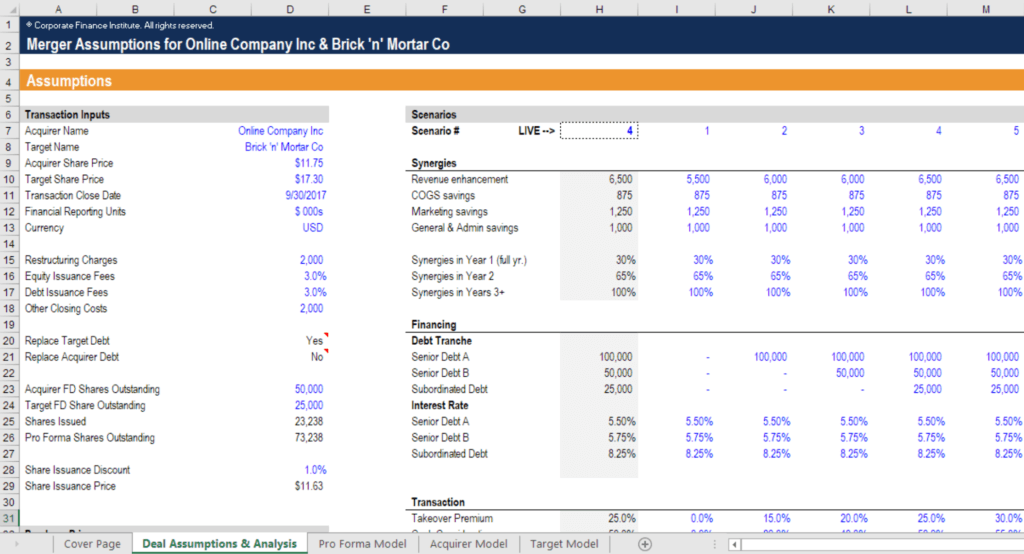

Key assumptions include:

- Purchase price of the target

- Number of new shares to be issued to the target (as consideration)

- Value of cash to be paid to the target (as consideration)

- Synergies from the combination of the two businesses (cost savings)

- Timing for those synergies to be realized

- Integration costs

- Adjustments to the financials (mostly accounting-related)

- Forecast/financial projections for target and acquirer

Screenshot from CFI’s M&A Modeling Course.

2. Making Projections

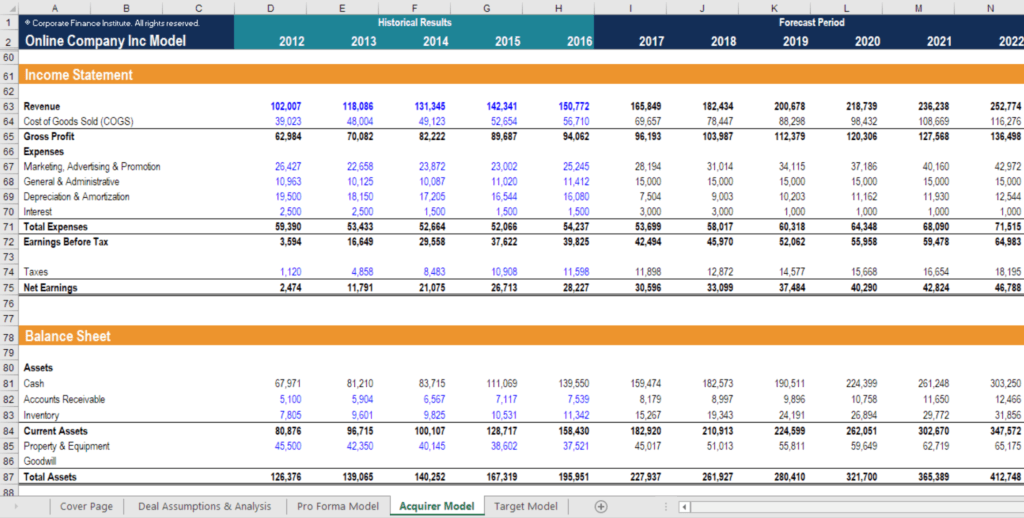

Making projections in a merger model is the same as in a regular DCF model or any other type of financial model. In order to forecast, an analyst will make assumptions about revenue growth, margins, fixed costs, variable costs, capital structure, capital expenditures, and all other accounts on the company’s financial statements. This process is known as building a 3-statement model and requires linking the income statement, balance sheet, and cash flow statement. Build this section just as you do with any other model, and repeat it twice: once for the target and once for the acquirer.

To learn more, launch CFI’s online financial modeling courses now!

3. Valuation of Each Business

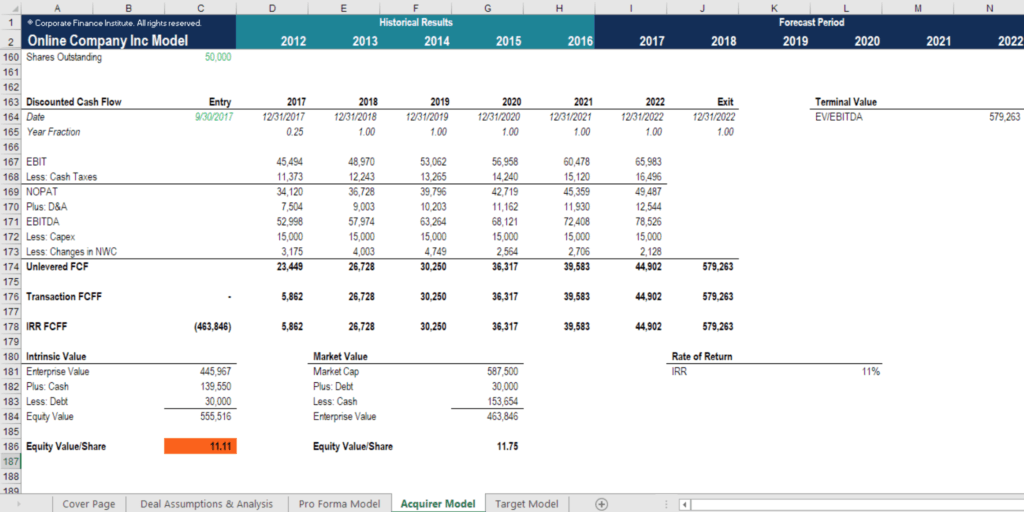

Step 3 of how to build a merger model is a DCF analysis of each business. Once the forecast is complete, then it’s time to perform a valuation of each business. The valuation will be a discounted cash flow (DCF) model that is also compared and contrasted against comparable company analysis and precedent transactions.

There will be many assumptions involved in this step, and it is probably the most subjective. Therefore, this is an area where having a highly-skilled financial analyst can really make a difference in terms of producing extremely accurate and reliable numbers.

The steps in performing the valuation include:

- Performing comparable company analysis

- Building the DCF model

- Determining the weighted average cost of capital (WACC)

- Calculating the terminal value of the business

Screenshot from CFI’s M&A Financial Modeling Course.

4. Business Combination and Pro Forma Adjustments

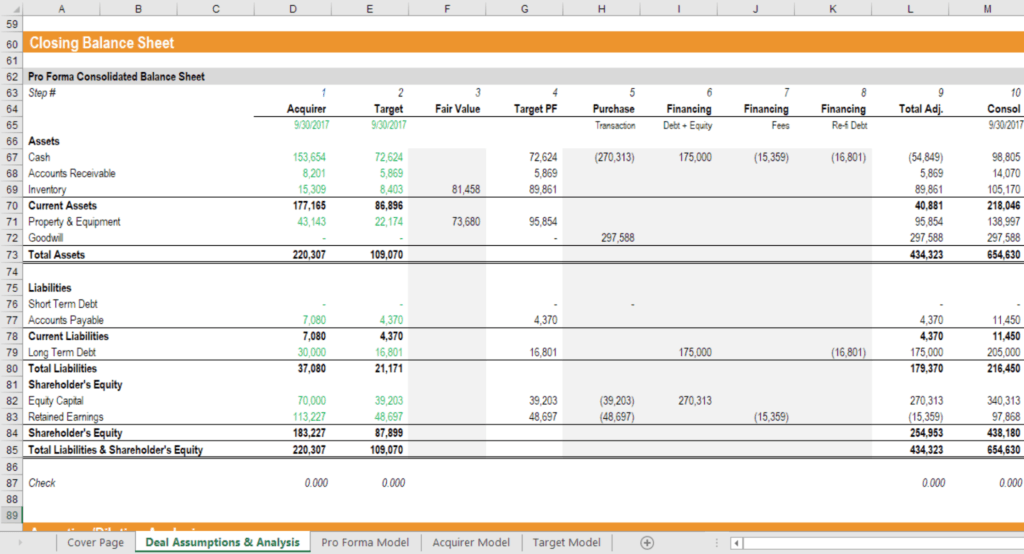

When company A acquires company B, the balance sheet items of company B will be added to the balance sheet of company A. Combining the two companies’ financials will require several accounting adjustments, such as determining the value of goodwill, value of stock shares, and options, and cash equivalents. This section is also where various types of synergies come into play.

Key assumptions include:

- The form of consideration (cash or shares)

- Purchase Price Allocation (PPA)

- Goodwill calculation

- Any changes in accounting practices between the companies

- Synergies calculation

An important step in building the merger model is determining the goodwill resulting from the acquisition of the assets of the target company. Goodwill arises when the buyer acquires the target for a price that is greater than the Fair Market Value of Net Tangible Assets on the seller’s balance sheet. If the book value of the acquired entity is lower than what the acquirer paid, then an impairment charge will arise. As a result, the acquired net assets will be written down in value equal to the consideration paid.

Read more: Merger Factors and Complexity

Learn more in CFI’s Mergers and Acquisitions Course.

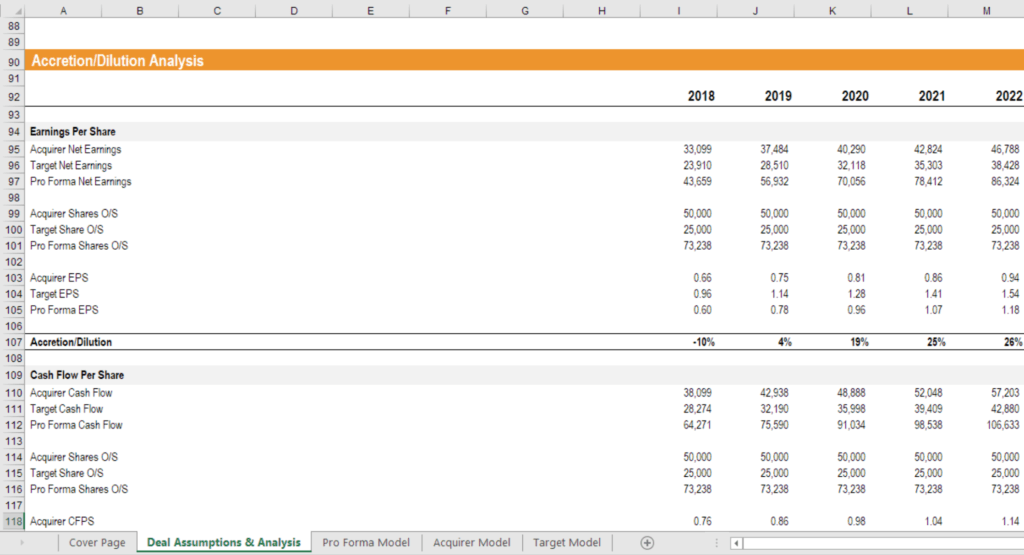

5. Deal Accretion/ Dilution

The purpose of accretion/dilution analysis is to determine the effect of the acquisition on the buyer’s Pro Forma Earnings per Share (EPS). A transaction is deemed accretive if the buyer’s EPS increases after acquiring the target company. Conversely, a transaction is viewed as dilutive if the buyer’s EPS declines as a result of the merger. The buyer should estimate the effect of the target’s financial performance on the company’s EPS before closing a deal.

Key assumptions include:

- Number of new shares issued

- Earnings acquired from the target

- Impact of synergies

Image from CFI’s Merger Modeling Course.

As you see in the example above, this deal is dilutive for the acquirer, meaning their Earnings Per Share is lower, as a result of doing the transaction, than their Earnings Per Share were before the deal. Such a situation – in isolation – would argue against the acquisition being a good deal for the acquirer but, of course, many other considerations factor into the final decision on whether or not to pursue a merger deal.

Read more: Accretion Dilution Analysis.

Learn More

Thank you for reading CFI’s guide to Building A Merger Model. To continue learning and advancing your career, these additional free CFI resources will be helpful:

Additional Resources

CFI is a global provider of financial modeling courses and of the FMVA Certification. CFI’s mission is to help all professionals improve their technical skills. If you are a student or looking for a career change, the CFI website has many free resources to help you jumpstart your Career in Finance. If you are seeking to improve your technical skills, check out some of our most popular courses. Below are some additional resources for you to further explore:

The Financial Modeling Certification

Analyst Certification FMVA® Program

CFI is a global provider of financial modeling courses and of the FMVA Certification. CFI’s mission is to help all professionals improve their technical skills. If you are a student or looking for a career change, the CFI website has many free resources to help you jumpstart your Career in Finance. If you are seeking to improve your technical skills, check out some of our most popular courses. Below are some additional resources for you to further explore:

The Financial Modeling Certification

Below is a break down of subject weightings in the FMVA® financial analyst program. As you can see there is a heavy focus on financial modeling, finance, Excel, business valuation, budgeting/forecasting, PowerPoint presentations, accounting and business strategy.

A well rounded financial analyst possesses all of the above skills!

Additional Questions & Answers

CFI is the global institution behind the financial modeling and valuation analyst FMVA® Designation. CFI is on a mission to enable anyone to be a great financial analyst and have a great career path. In order to help you advance your career, CFI has compiled many resources to assist you along the path.

In order to become a great financial analyst, here are some more questions and answers for you to discover:

- What is Financial Modeling?

- How Do You Build a DCF Model?

- What is Sensitivity Analysis?

- How Do You Value a Business?

Create a free account to unlock this Template

Access and download collection of free Templates to help power your productivity and performance.

Already have an account? Log in

Supercharge your skills with Premium Templates

Take your learning and productivity to the next level with our Premium Templates.

Upgrading to a paid membership gives you access to our extensive collection of plug-and-play Templates designed to power your performance—as well as CFI's full course catalog and accredited Certification Programs.

Already have a Self-Study or Full-Immersion membership? Log in

Access Exclusive Templates

Gain unlimited access to more than 250 productivity Templates, CFI's full course catalog and accredited Certification Programs, hundreds of resources, expert reviews and support, the chance to work with real-world finance and research tools, and more.

Already have a Full-Immersion membership? Log in