Accrual Accounting

Recording earned revenues or incurred expenses regardless of whether cash is exchanged

What is Accrual Accounting?

In financial accounting, accruals refer to the recording of revenues a company has earned but has yet to receive payment for, and expenses that have been incurred but the company has yet to pay. This method also aligns with the matching principle, which says revenues should be recognized when earned and expenses should be matched at the same time as the recognition of revenue.

Accrual accounting differs from cash accounting. Under cash accounting, income and expenses are recorded when cash is received and paid. In contrast, accrual accounting does not directly consider when cash is received or paid.

What is an Accrual (in Plain English)?

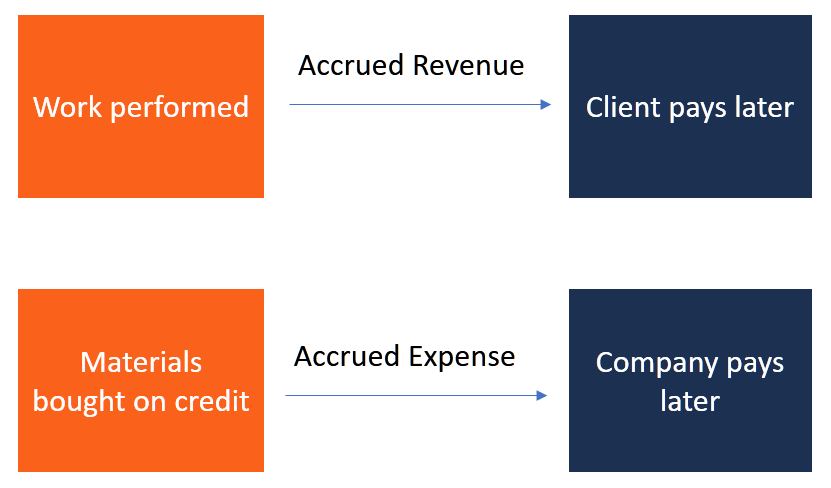

What exactly is an “accrual”? If companies received cash payments for all revenues at the same time those revenues were earned, there wouldn’t be a need for accruals. However, since most companies have some revenues in the year that were earned (i.e., good/services were delivered) but for which payment was not received, the companies need to account for those uncollected revenues.

The same applies to expenses. If companies incurred expenses (i.e., received goods/services) but didn’t pay for them with cash yet, then the expenses need to be accrued.

The purpose of accrual accounting is to match revenues and expenses to the time periods during which they were recognized and incurred, as opposed to the timing of the actual cash flows related to them.

Key Highlights

- Accruals refer to the recording of revenues a company has earned but has yet to receive payment for, and expenses that have been incurred but the company has yet to pay. This differs from cash accounting where income and expenses are recorded when cash is received and paid.

- Accruals help in demystifying accounting ambiguity relating to revenues and liabilities. As a result, businesses can often better anticipate revenues while tracking future liabilities.

- Accrual accounting is generally preferred to cash accounting. A potential flaw with cash accounting is that it can offer a misleading picture of an entity’s financial health, especially when transactions like unpaid expenses or outstanding receivables are not represented in the financial statements.

Categories in Accrual Accounting

In accounting, accruals broadly fall under either revenues (receivables) or expenses (payables).

1. Accrued revenues or assets

Accrued revenues are either income or assets (including non-cash assets) that are yet to be received but where an economic transaction has effectively taken place. In this case, a company may provide services or deliver goods, but does so on credit. Accrued capital expenditures is another example: a company may have received PP&E but has yet to pay for it.

Example: An example of accrued revenue is electricity consumption. An electricity company usually provides the utility to its consumer prior to receiving payment for it. The consumer uses the electricity, and the electricity meter counts the usage. The consumer is billed at the end of the billing period. During the month, the company pays its employees, fuels its generators, and incurs logistical costs and other overhead.

The electricity company needs to wait until the end of the month to receive its revenues, despite the in-month expenses it has incurred. Meanwhile, the electricity company must acknowledge that it expects future income. Accrual accounting gives the company a means of tracking its financial position more accurately.

At the end of the month, when the company receives payment from its customers, receivables go down, while the cash account increases.

2. Accrued expenses

An accrued expense refers to when a company makes purchases on credit and enters liabilities in its general ledger, acknowledging its obligations to its creditors. In accounting, it is an expense incurred but not yet paid. Common accrued expenses include:

- Interest expense accruals – interest expense that is owed but unpaid

- Supplier accruals – operating expenses for goods or services rendered by a third-party supplier

- Wage or salary accruals – salaries owed to employees who work for part of the month without having received their fully earned monthly salary

Example: Let’s take the example of a start-up company (Y) with an employee (Joe), who will receive a large cash bonus after five years with the company. Joe becomes faithful, hardworking and diligent while working for the company. Let’s assume he qualifies each year for a portion of his bonus.

However, during this period, Joe is not receiving his bonuses, as would be the case with cash received at the time of the transaction. Instead, Joe’s bonuses have been accruing. Parallel to that, Company Y’s liability to Joe has also been increasing.

In this case, it’s obvious that Company Y becomes a debtor to Joe for five years. Therefore, to carry an accurate recording of Joe’s bonuses, the company must make a bonus liability accrual to record these bonus expenses. When the company pays out Joe’s owed bonus, the transaction will be recorded by debiting its liability account and crediting its cash account.

Prepaid Expenses vs. Accrued Expenses

Prepaid expenses are the payment opposite of accrued expenses. Rather than delaying payment until some future date, a company pays upfront for services and goods, even if it does not receive the total goods or services all at once at the time of payment. For example, a company may pay for its monthly internet services upfront, at the start of the month, before it uses the services. Prepaid expenses are considered assets as they provide a future benefit to the company.

Impact of Accrual Accounting

In addition to accruals adding another layer of accounting information to existing information, they change the way accountants do their recording. In fact, accruals help in demystifying accounting ambiguity relating to revenues and liabilities. As a result, businesses can often better anticipate revenues while tracking future liabilities.

Accruals assist accountants in identifying and monitoring potential cash flow or profitability problems and in determining and delivering an adequate remedy for such problems.

Recording Accruals

An accountant enters, adjusts, and tracks “as-yet-unrecorded” earned revenues and incurred expenses. For the records to be usable in financial statement reports, the accountant must adjust journal entries systematically and accurately, and the journal entries must be verifiable.

The Relationship between Accrual Accounting and Cash Accounting

Accrual accounting is generally preferred to cash accounting. A potential flaw with cash accounting is that it can offer a misleading picture of an entity’s financial health, especially when transactions like unpaid expenses or outstanding receivables are not represented in the financial statements.

The accrual accounting method becomes valuable in large and complex business entities, given the more accurate picture it provides about a company’s true financial position. A typical example is a construction firm, which may win a long-term construction project without full cash payment until the completion of the project.

Under cash accounting, the company would record many expenses during construction, but not recognize any revenue until the completion of the project (assuming there are no milestone payments along the way). Therefore, the company’s financials would show losses until the cash payment is received. A lender, for example, might not consider the company creditworthy because of its expenses and lack of revenue.

Comparatively, under the accrual accounting method, the construction firm may realize a portion of revenue and expenses that correspond to the proportion of the work completed. It may present either a gain or loss in each financial period in which the project is still active. The method is called the percentage of completion method.

Regardless, the cash flow statement would give a true picture of the actual cash coming in, even if the company uses the accrual method. The accrual approach would show the prospective lender the true depiction of the company’s entire revenue stream.

Accounting Method and Taxation

Taxpayers are typically required by the appropriate taxation authority to consistently use the method of accounting that accurately captures the entity’s true income. Consistency is essential since the swapping of accounting methods can potentially create loopholes that a company can use to manipulate its revenue and reduce tax burdens. In general, cash accounting is allowed for sole proprietorships and small businesses, whereas large businesses will typically use accrual accounting when preparing its tax returns.

FASB and IFRS

The Financial Accounting Standards Boards (FASB) has set out Generally Accepted Accounting Principles (GAAP) in the U.S. dictating when and how companies should accrue for certain things. For example, “Accounting for Compensated Absences” requires employers to accrue a liability for future vacation days for employees. Learn more about this on FASB’s website. International companies outside the U.S. follow IFRS standards. Neither GAAP nor IFRS allows cash accounting.

Additional Resources

Create a free account to unlock this Template

Access and download collection of free Templates to help power your productivity and performance.

Already have an account? Log in

Supercharge your skills with Premium Templates

Take your learning and productivity to the next level with our Premium Templates.

Upgrading to a paid membership gives you access to our extensive collection of plug-and-play Templates designed to power your performance—as well as CFI's full course catalog and accredited Certification Programs.

Already have a Self-Study or Full-Immersion membership? Log in

Access Exclusive Templates

Gain unlimited access to more than 250 productivity Templates, CFI's full course catalog and accredited Certification Programs, hundreds of resources, expert reviews and support, the chance to work with real-world finance and research tools, and more.

Already have a Full-Immersion membership? Log in