Scenario Analysis vs Sensitivity Analysis

What is Scenario Analysis vs Sensitivity Analysis?

To understand scenario analysis vs sensitivity analysis, one should first understand that investment decisions are based on a set of assumptions and inputs. The lack of certainty in the premises and inputs brings about investment risk. Before making an investment, an individual assesses the magnitude of such risks and weighs it against potential benefits.

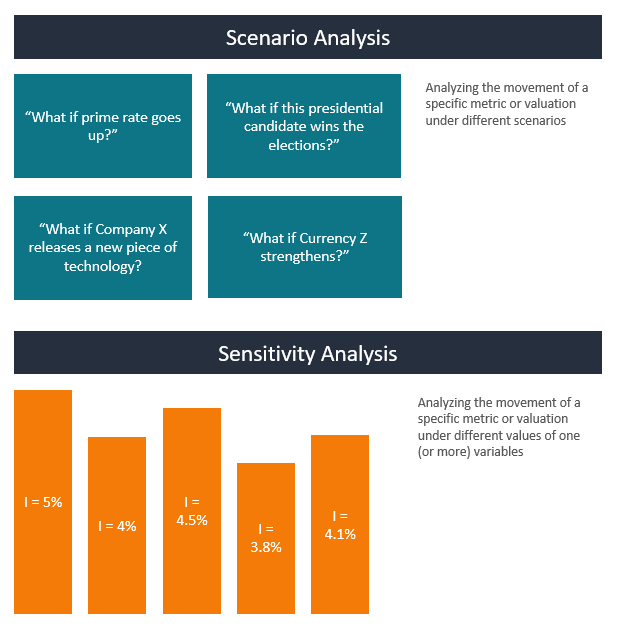

Scenario analysis is the process of predicting the future value of an investment depending on changes that may occur to existing variables. It requires one to explore the impact of different market conditions on the project or investment as a whole.

In contrast, sensitivity analysis is the study of how the outcome of a decision changes due to variations in input. It is used in situations that rely on one or more input variables. For example, bond prices can be affected by changes in inflation, interest rates, and credit ratings.

Investors use both techniques to determine the best possible investments.

Understanding Scenario Analysis vs Sensitivity Analysis

Investors use the two analytical methods to establish the amount of risk and potential benefits. The difference between the two methods is that sensitivity analysis examines the effect of changing just one variable at a time.

On the other hand, scenario analysis assesses the effect of changing all the input variables at the same time. With such an approach, an analyst comes up with different possible events that are likely to occur in the future.

Usually, scenario analysis requires the analyst or investor to create three possible scenarios:

- Base-case scenario – Refers to the ordinary/typical scenario. For example, to identify the net present value of an investment, one would likely use the discount rate and tax rate.

- Worst-case scenario – Refers to the most extreme situation that can happen if things don’t go as planned. In the earlier example, one would use the highest possible tax rate or the highest discount rate.

- Best-case scenario – Refers to the most favorable projected outcome. Still using the example above, it would entail using the lowest possible tax rate or the least possible discount rate.

Example of Scenario Analysis vs Sensitivity Analysis

The concepts of sensitivity and scenario analyses can better be understood by using an example. Imagine that an individual has invented a composite material that can not only be used in manufacturing mobile casings but also in charging phones. To determine the potential benefits of releasing his product into the market, the inventor can use scenario or sensitivity analysis.

Sensitivity analysis can help him determine how sensitive the dependent variable is (the quantity of composite material sold) if there’s a variation in the independent variable (the casing composite price).

As mentioned earlier, the sensitivity analysis model examines to what extent the outcome will change based on changes made to a single variable. However, one can also consider other factors apart from the outcome. For example, is the composite material compatible with the cases that are currently in the market?

In summary, sensitivity analysis is a prediction of how a specific percentage increase in price will lead to a subsequent percentage decrease in the quantity of products sold.

On the other hand, scenario analysis entails making several premises about different independent variables and then examining how the outcome changes. In the example above, the inventor would examine how other factors (other than price) would affect the sales of his revolutionary mobile case composite material.

What if there’s another company working on a similar technology, and it manages to release its product into the market first? What if the material makes the phone bulky? Will it still be as attractive as the current mobile cases?

Advantages of Sensitivity Analysis

1. Provides an in-depth assessment

Sensitivity analysis requires that every independent and dependent variable be studied in a detailed manner. It helps to determine the association between the variables. Even better, it facilitates more accurate forecasting.

2. Helps in fact-checking

Sensitivity analysis helps companies determine the likelihood of success/failure of given variables. Let’s say a company is looking for ways to increase the sales of its product. Sensitivity analysis can help them discover that a more refined packaging boosts their sales by a certain margin.

Advantages of Scenario Analysis

The beauty of using scenario analysis is that it doesn’t emphasize on accurately predicting the outcome. Instead, it generates several possible future events that are valid, although uncertain. There’s no question that companies benefit significantly from such an approach.

1. Improves systems thinking

Think of scenario analysis as chess where players think of multiple possible moves that will increase their likelihood of winning the game. In the case of a company, a manager can predict the likely positive and negative outcomes that will result from implementing certain policies and strategies.

2. Leads to an optimal allocation of resources

Since scenario analysis involves forecasting future events, it helps company owners to be aware of the external conditions that are likely to affect their operations. This, in turn, helps them to allocate resources more effectively in order to avoid negative consequences that may arise.

Summary

Sensitivity analysis is the process of tweaking just one input and investigating how it affects the overall model.

In contrast, scenario analysis requires one to list the whole set of variables and then change the value of each input for different scenarios. For example, the best-case scenario can help one predict the outcome when there’s a decrease in interest rates, an increase in the number of customers, and favorable exchange rates.

More Resources

Thank you for reading CFI’s guide to Scenario Analysis vs Sensitivity Analysis. To keep learning and advancing your career, the following CFI resources will be helpful:

Additional Resources

CFI is a global provider of financial modeling courses and of the FMVA Certification. CFI’s mission is to help all professionals improve their technical skills. If you are a student or looking for a career change, the CFI website has many free resources to help you jumpstart your Career in Finance. If you are seeking to improve your technical skills, check out some of our most popular courses. Below are some additional resources for you to further explore:

The Financial Modeling Certification

Excel Tutorial

CFI is a global provider of financial modeling courses and of the FMVA Certification. CFI’s mission is to help all professionals improve their technical skills. If you are a student or looking for a career change, the CFI website has many free resources to help you jumpstart your Career in Finance. If you are seeking to improve your technical skills, check out some of our most popular courses. Below are some additional resources for you to further explore:

The Financial Modeling Certification

to take your career to the next level and move up the ladder!

Create a free account to unlock this Template

Access and download collection of free Templates to help power your productivity and performance.

Already have an account? Log in

Supercharge your skills with Premium Templates

Take your learning and productivity to the next level with our Premium Templates.

Upgrading to a paid membership gives you access to our extensive collection of plug-and-play Templates designed to power your performance—as well as CFI's full course catalog and accredited Certification Programs.

Already have a Self-Study or Full-Immersion membership? Log in

Access Exclusive Templates

Gain unlimited access to more than 250 productivity Templates, CFI's full course catalog and accredited Certification Programs, hundreds of resources, expert reviews and support, the chance to work with real-world finance and research tools, and more.

Already have a Full-Immersion membership? Log in