What Happened to Terra?

Over the course of a week’s time in 2022, the collapse of stablecoin Terra and its sister token, Luna, wiped out almost an estimated half-a-trillion USD from the cryptocurrency markets. So what is Terra and how did this happen

What is Terra?

Terraform Labs was founded in 2018 to use blockchain technology that aimed to create a decentralized finance network. The blockchain used TerraUSD and its sister token, Luna, to create an algorithmic stablecoin system.

Terraform Labs, or Terra for short, was founded by Stanford University-educated, ex-Apple and Google Engineer, Do Kwon. The TerraUSD stablecoin, known by its ticker UST, aimed to maintain a value of 1 USD by using a parallel floating rate cryptocurrency, Luna (LUNA), to back up the target peg.

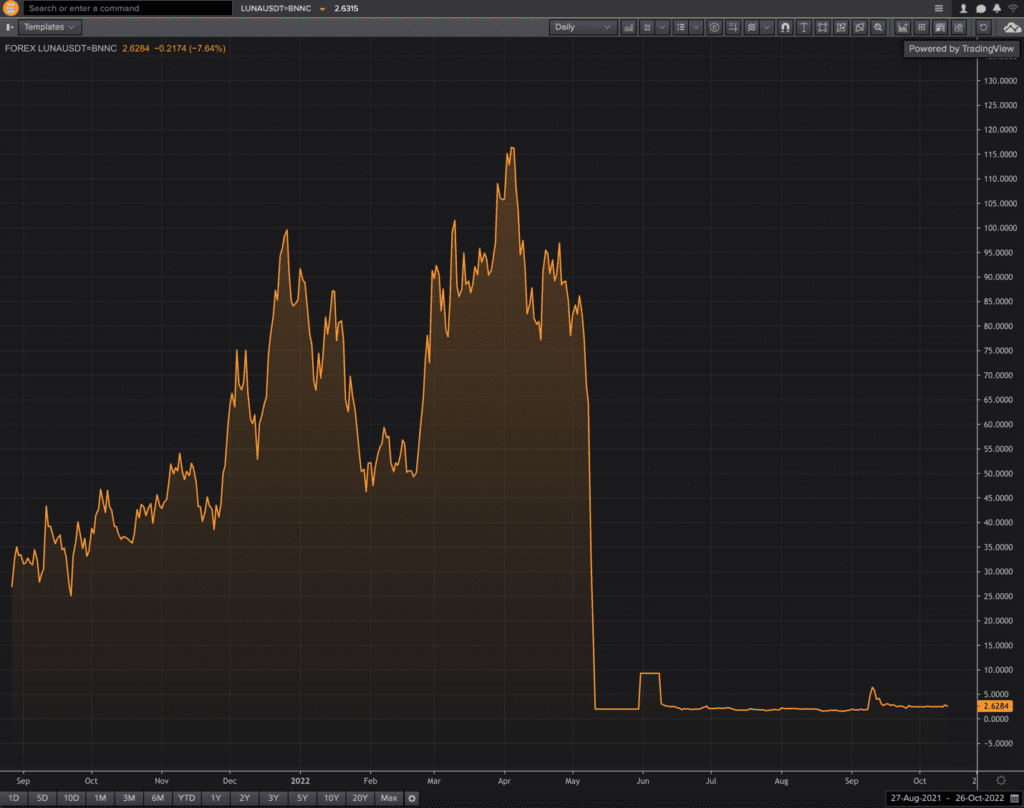

Based on the promise of the TerraUSD/Luna ecosystem and the massive crypto market run-up, LUNA achieved a high of almost $120 a token in March of 2022, spawning dedicated fans who called themselves ’Lunatics’ and Kwon was the “King of the Lunatics.”

However, in May of 2022, Terra experienced the cryptocurrency equivalent of a bank run, where depositors lost confidence in the tokens and all raced for the door at the same time. By May 16, the Terra stablecoin and Luna token were all but dead, with some media outlets calling it a Ponzi scheme while others were calling it a rug-pull scam.

Do Kwon still saw potential with blockchains and decentralization and chose to split the coin after the collapse. In its relaunch, Terra 2.0 focuses on using Luna to earn rewards for staking or purchasing digital art and paying fees. It is unclear what the future holds for this rebirth, but Do Kwon may face legal consequences.

Key Highlights

- Terra was a blockchain ecosystem with a stablecoin token called TerraUSD(USDT) and a sister token called Luna.

- The pair of coins together formed an algorithmic stablecoin that aimed to maintain a value of 1 USD for each USDT by using a parallel floating rate cryptocurrency, Luna (LUNA), to back up the target peg.

- In May 2022, the value of Luna collapsed from over $120 a coin to effectively zero, wiping out over $50bn in market capitalization of UST/LUNA and causing over $400bn in losses for the broader cryptocurrency markets.

What are Stablecoins?

Stablecoin refers to a range of cryptocurrencies that derive their market value from some external reference.

Stablecoins can be categorized on the bases of their working mechanisms – crypto-collateralized, algorithmic, and fiat-collateralized stablecoins.

What is an Algorithmic Stablecoin?

This category of stablecoins uses complex algorithms to keep their prices stable by balancing funds held on the blockchain using smart contracts to control supply and demand and maintain price stability.

An algorithmic stablecoin protocol achieves price stability by reducing the number of coins circulating when the market price goes down and increasing the number of coins circulating when it goes up, called “rebasing.” This is similar to how a Central Bank may act to defend the peg of their domestic currency in foreign exchange markets by buying or selling foreign assets.

In times of excess demand and the stablecoin might be expected to increase in price over the peg, the protocol releases more tokens to existing holders proportionately in order to bring prices down. In times of excess supply, the protocol will contract the number of coins that holders have in order to bring up the price of each of the remaining tokens.

There is one major concern with stablecoins; their value only remains stable if there is not much fluctuation of buying and selling, so major dumps can have drastic consequences which destabilize the coin.

How was the UST/LUNA Algorithmic Stablecoin Supposed to Work?

1. UST was pegged to LUNA

UST and Luna start with a link. In this case, one UST token would always be worth $1 USD of Luna and can be freely exchanged whenever you want. Whenever you exchange one for the other, smart contracts reduce the amount outstanding of the token that you are selling and increase the amount outstanding of the token that you are buying.

Using a numerical example, let’s start with a system of 100 UST. We also start with 20 Luna tokens. So, in this case, since one UST would always be worth $1 USD of Luna, you could sell 1 UST and redeem it for 1/5 of a Luna token. Hence, 1 whole Luna token would be worth $5.

If the price of UST falls below $1, say 90 cents, traders would buy 1 UST for less than a dollar and swap that for $1 worth of Luna tokens and sell that for $1 and lock in an instant profit of 10 cents. The smart contract would automatically reduce the amount of UST outstanding by one token and increase the amount of Luna tokens by 1/5 of a token. Traders would continue this arbitrage process until enough USTs have been taken out of circulation by the software to raise the price back to $1.

On the other hand, if UST rises above $1, say $1.10 a token, there is an incentive for traders to buy $1 worth of Luna tokens and exchange that token for 1 UST and sell the UST for $1.10 to lock in a profit of 10 cents. Again, smart contracts would do the opposite of the last example and would increase the amount of UST outstanding by one token and decrease the amount of Luna outstanding this time. Only when enough USTs have been added to circulation to bring the price of UST back to $1 would the swapping stop.

2. Anchor Protocol

Another way to keep UST’s price stable was to offer above-market interest rates through Anchor Protocol, a “decentralized lender” built on Terra’s blockchain. Anchor offered rates of around 20% on deposits of UST, which offered a significant demand for the token. In return, Anchor Protocol lends out the UST (as well as other cryptocurrencies) to users who need tokens in order to earn staking rewards.

3. Luna Foundation Guard (LFG)

Kwon started an organization called Luna Foundation Guard, which minted and sold Luna to famously buy Bitcoin. The LFG and its holdings of Bitcoin were meant to provide a sort of backing to the Terra and Luna ecosystems. Eventually, the LFG amassed $1.5bn in Bitcoin and other cryptos with plans to buy up to $10bn worth of BTC.

So How Did Terra Collapse?

UST is based on the value of LUNA, but what is the value of LUNA based on? And if someone loses confidence in Terraform Labs, won’t that mean that they would dump both UST and LUNA?

For example, using our earlier example of $1 UST and $5 Luna, let’s say that the price of UST falls to 80 cents. A trader would buy five UST tokens at 80 cents each for a total cost of $4 and swap it for 1 Luna token and immediately sell the Luna for $5 and pocket the $1 arbitrage profit.

However, if there are a lot of sellers of both USTs and Lunas, the next price for Luna won’t be at $5 anymore. It will logically go lower despite the supply balancing smart contracts. There is no natural stopping point because Luna (and, by extension, UST) isn’t worth anything – it was something made up as well.

Why Didn’t the LFG Stop the Collapse?

So if the price of UST and Luna were to plummet, you might also expect the LFG to come in and provide support by selling their Bitcoins in order to buy Luna. This does have two disadvantages, though: 1) if LFG were to sell Bitcoin, it might put pressure on the price of Bitcoin and other cryptocurrencies as well, and 2) the funds in the LFG war chest is limited – at some point, if LFG were to sell all its Bitcoin, it wouldn’t be able to support Luna and UST anymore.

What Happened in May 2022?

While it’s not clear what set off the sell-off in UST/Luna, there are some that blame a rate cut by Anchor from the ~20% interest it would pay for crypto deposits on May 2. Regardless of the cause, there were two large withdrawals from decentralized exchange, Curve Finance, totaling around $250mm dollars.

Many more UST depositors raced for the doors and knocked UST off its $1 USD peg. It led to more UST holders exiting and forced the UST/Luna exchange link to print a vast increase in Luna tokens, flooding the market and driving its value down even further. This caused what’s known as a ”death spiral,” and despite the LFG selling most of its Bitcoin to defend the UST/Luna tokens, by May 16, the Terra stablecoin and Luna token were essentially worthless.

The UST/LUNA crash caused thousands of investors to lose millions, with some losing their life savings.

The Rebirth of Terra – Terra 2.0

Do Kwon relaunched Terra as Terra 2.0 in late May 2022, but this time, without any links to the algorithmic stablecoin. Developers launched a new Terra blockchain called Terra 2.0 as a hard fork of the original Terra blockchain, now called Terra Classic, and the original LUNA token was renamed Luna Classic (LUNC).

The new LUNA 2.0 has a total locked supply of 1.0 billion, which is significantly better than the 6.5 trillion supply of the classic token. 35% of the new tokens were airdropped to previous and existing LUNC holders. 10% of LUNA 2.0 was sent to those who held the token before the UST crash, and 25% was sent to those who still own LUNC and UST, with 30% kept by the community pool with 10% going to the developers.

However, Do Kwon himself may still be in trouble with investors and law enforcement agencies. In September of 2022, Interpol placed him on the red notice list after authorities from his native South Korea issued an arrest warrant and revoked his passport. In March 2023, Kwon was arrested in Montenegro on charges of securities fraud, commodities fraud and conspiracy.

Learn More

Thank you for reading CFI’s guide to What Happened to Terra. To keep learning and developing your knowledge base, please explore the additional relevant resources below:

Related Articles

Introduction to Cryptocurrency

An introduction to cryptocurrencies and the blockchain technology behind them.

Create a free account to unlock this Template

Access and download collection of free Templates to help power your productivity and performance.

Already have an account? Log in

Supercharge your skills with Premium Templates

Take your learning and productivity to the next level with our Premium Templates.

Upgrading to a paid membership gives you access to our extensive collection of plug-and-play Templates designed to power your performance—as well as CFI's full course catalog and accredited Certification Programs.

Already have a Self-Study or Full-Immersion membership? Log in

Access Exclusive Templates

Gain unlimited access to more than 250 productivity Templates, CFI's full course catalog and accredited Certification Programs, hundreds of resources, expert reviews and support, the chance to work with real-world finance and research tools, and more.

Already have a Full-Immersion membership? Log in